Money may make the world go round, but at what cost?

- Published

More than $5tn is traded on the global foreign exchange markets every day

Banks once had a near monopoly on moving money around the world, and they charged a pretty penny for it.

But since the 2008 financial crisis, their reputations have taken an almighty battering, and a growing number of technology-focused start-ups are intent on getting a slice of the action.

Cost has become the battleground and technology the weapon in this huge business: people send more than $500bn (£334bn) abroad each year.

TransferWise, for example, says banks and independent money transfer giants such as Western Union and MoneyGram, charge about 5-8% in fees when transferring money abroad, and these fees are often concealed within the exchange rate.

It charges just 0.5% of the amount being converted. This can equate to a £100-£150 saving on a £5,000 international money transfer.

Peer-to-peer

TransferWise co-founder Taavet Hinrikus thinks banks charge too much for money transfers

Founded by Estonians Taavet Hinrikus and Kristo Kaarman, the firm achieves this by matching people transferring money in one direction with people transferring it in the other - so called peer-to-peer transfers.

In other words, you are in effect buying your currency from other individuals, thereby cutting out a big chunk of exchange rate and "foreign transaction" charges normally levied by banks.

"We didn't understand why transferring money had to be so expensive," says Mr Hinrikus, who was one of the first employees of Skype, the online communications company.

"With us, it's all about transparency - that's really important. We choose the mid-market rate when we transfer money."

Easy by design

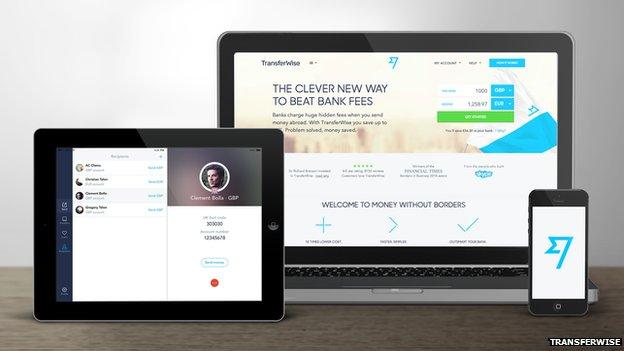

Another key to their success - TransferWise has shifted more than £3bn of customers' money since 2011 - is the simplicity of design, he says.

"Banks are really bad when it comes to building consumer-centred products. People expect systems to be as simple as Skype, which we had experiencing building. We've been working on this system for four years - it's quite a piece of art."

TransferWise supports more than 300 currency routes, recently launched in the US, and is in the process of adding other destinations like India and Nigeria.

But it does not support transfers into cash at the other end, as do many rivals, such as leader-of-the-pack Western Union with its 490,000 agent locations.

"We're a technology company at heart, not a bank," he says. "We believe that the future of money is digital."

TransferWise has sent more than £3bn of customers' money so far

The company is hoping that even in developing economies, the majority of recipients will move online or go mobile.

Muscling in

With $91m (£61m) of backing from PayPal co-founder Peter Thiel, and support from Virgin entrepreneur Sir Richard Branson, TransferWise may be forgiven for appearing bullish.

But there are others muscling in to this lucrative market, such as Azimo and CurrencyFair.

Both offer simple-to-use services, focusing on a wide range of markets and charging very low fees.

"We saw how customers' usage of technology was changing," says Azimo founder and chief executive Michael Kent. "They were starting to use smartphones and keep in touch via Skype and Facebook. We knew the High Street model would go the same way as the traditional travel agent."

Ex-pat Somalis send about $1.3bn (£872m) home to relatives each year using money transfer services like Juba

Azimo focuses on markets such as Poland, Eastern Europe and the Philippines, but is now expanding into Africa and Latin America, he says.

But the way people like to receive money depends on the culture.

"In Africa, we send money to M-Pesa [the mobile payments system], whereas most orders to the Philippines are picked up as cash. Latin America is also keen on cash. But we we also pay straight into bank accounts."

Better deal

Azimo enables money transfers to 198 countries and offers 270,000-plus cash pick up locations, as well as home delivery.

The peer-to-peer lending operated by TransferWise is only useful for those countries where money is flowing fairly evenly in both directions, says Mr Kent.

When it's foreign workers mostly sending money home, the direction tends to be one way, so "peer-to-peer is less useful in those circumstances", he says.

Azimo offers eye-catchingly low transaction fees - from £1 - but the key is in the exchange rate these online companies offer, and this can make it difficult to compare costs on a like-for-like basis.

But on any measure, you are likely to get a better deal using one of these companies than a High Street bank.

Mobile money

WorldRemit boss Ismail Ahmed believes mobile-to-mobile money transfers are the future

WorldRemit, another tech company attracting a lot of money from financial backers, sees itself competing with the major offline services, Western Union and MoneyGram, and focuses on mobile-to-mobile payments.

Ismail Ahmed, its founder and chief executive, says: "We send more transfers than anyone else to mobile money services - sometimes known as digital wallets.

"Although uncommon in the West, there are currently 259 of these services across the world, with more than half of them in Africa."

In many countries, there are more mobile wallets than bank accounts, says Mr Ahmed, with more than 100 million people estimated to use them worldwide.

Like TransferWise, WorldRemit believes the future of money is digital, given the continued rapid rise of mobile phone adoption.

Tech transfer

So what are the key technologies enabling such companies to undercut the banks and big operators?

The most obvious is the internet itself, allowing money transfer firms to offer their services efficiently and directly to consumers without having to maintain an expensive branch or office network.

"The internet gives new players a chance, although the barrier to entry is still high in our industry because of the tough regulatory standards that we have to meet," says Mr Ahmed.

Western Union transfers more than $80bn of client money a year

Then there's the plumbing behind the scenes, provided by the likes of Currency Cloud, that gives smaller companies easy access to the colossal, mostly speculative, global foreign exchange markets that handle more than $5tn of transactions every day.

And the rise of the all-conquering smartphone app has proved to be the cherry on the cake.

Crypto-currencies, such as Bitcoin and Ripple, could further threaten the dominance of the banks, enabling almost instant digital money transfers. But money-laundering concerns remain a barrier to their widespread acceptance.

Whether such tech-focused upstarts can really challenge the likes of Western Union, which transfers more than $80bn a year, must remain in doubt.

But even a small slice of a very large pie is better than nothing at all.

- Published13 March 2015

- Published6 March 2015