The tech helping investors ignore their emotions

- Published

Investors are only human - but what if you could take emotion out of the equation?

For decades "passive" tracker funds that mirror stock market indexes have been shown to outperform ones actively managed by humans.

And now so-called 'robo investors' - algorithm-based systems that manage investments on our behalf - are soaring in popularity with the public.

A key advantage to automated funds is that they bypass human emotions like fear and greed, which often lead to poor investment decisions.

However, a new wave of tech start-ups say they can redress the balance - by helping fund managers overcome their deepest cognitive biases.

Using big data and behavioural finance techniques, they say they can help you invest more wisely and ethically - as well as outflank the automatons eating your lunch.

Fear and loathing

Clare Flynn Levy was a hedge fund manager for 10 years before she set up Essentia Analytics, a forerunner in the space. Its clients include the likes of Man Group, Union Investment and Artemis Fund Managers.

"Fear and greed drive us to do irrational things, but a lot of it is subconscious. We're driven by our wiring to avoid losses, to be afraid of missing out and to follow the herd but it's just what humans do," she says.

As a result fund managers often deviate from preset strategies, holding stocks too long, getting out too early when they're winning, or being overconfident and ignoring risks.

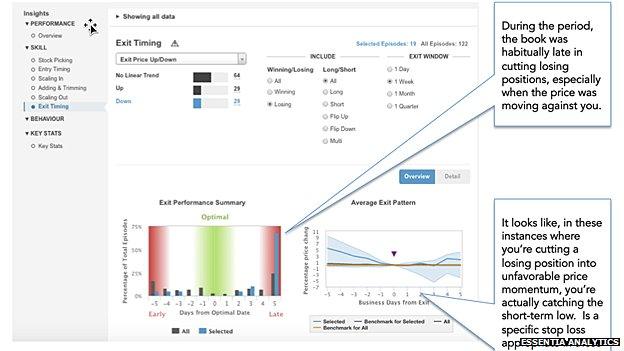

Essentia, however, says it can combat such blind spots by monitoring your trading performance, the context in which you made investment decisions, and then correlating the two.

Put simply, you tell the system about your investment plans, price targets, risks you're looking out for - even how many hours' sleep you had last night or whether you woke up in a bad mood.

Algorithms start to recognise your behavioural ticks and alert you.

"It might send you a message to say, 'FYI, here are two stocks you hold that are starting to show the same characteristics that have got you into trouble before, so you might want to have a look,'" says Mrs Levy.

"You make the ultimate decision. It just helps you to stay the course and do what you'd said you would do and not get side-tracked by your own emotions."

Essentia Analytics' software analyses your investments looking for where emotions are influencing your decisions

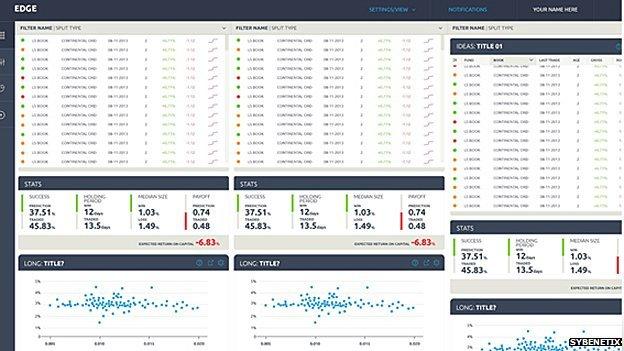

Sybenetix, another start-up in the field, says that users of its software can see the cost of a biased decision immediately after they make a trade - and in some cases it's as high as 3% of profits.

However the impact of such technology could go much deeper than profit, having the potential to reduce market speculation in times of boom and bust, or root out misconduct.

"Since the financial crash, all of these investment management companies are being hit by government regulations about conduct and market abuse," says Taras Chaban, chief executive of Sybenetix.

"But our system can look for outliers in normal trading patterns and flag them up right after the trading activity happens so clients can investigate them."

According to Dr Thomas Oberlechner, chief science officer at Immatchative, transparency is key in a system where huge amounts of capital are at stake.

His firm uses financial and behavioural data to match institutional investors with hedge funds that manage money, the idea being to forge a happy and long-lasting partnership.

"It's analogous to online dating. The basic currency of the investment relationship is trust, so making sure early on that you're aligned in terms of your values, goals and risk appetite is vital," says Dr Oberlechner.

Sybenetix says the cost of a biased decision can be as high as 3% of profits

Speculation mounts

Prof Raghavendra Rau, director of the Behavioural Finance programme at Cambridge Judge Business School, is not convinced by the new wave of behavioural tech, however.

He says that systems still can't predict the vagaries of the stock market and he's yet to see a "strategy that consistently makes money".

"A big issue is that they have no way of predicting turning points in markets. Human beings can't do it, and if we can't do it we can't programme it effectively either."

Greg Davies, head of behavioural finance and investment philosophy at Barclays, says that while today's systems show promise, they need to be better tailored.

"An enormous amount depends on the specific objectives, environment and context of the investor. For example, the role played by 'in-the-moment intuition' is completely different for an investor with a five-year time horizon, versus one trading stocks with an average holding period of a week."

Where both agree is that behavioural finance technology can and does lead to wiser, more situation-specific investment decisions. Still, will that be enough to stop the onward march of automated investment funds?

According to the Investment Management Association, between 2004 and 2014, assets under management in UK tracker funds grew from £17bn to some £80.6bn - about 10% of the market.

And PwC has forecast that passively managed assets globally will double in value by 2020, amounting to about 20% of the market.

Where fund managers do seem to still have an edge is in their ability to navigate volatile markets - for example, where large drops in share prices are followed by swift recoveries.

Up or down: Could technology complement human instinct when it comes to deciding which way the market is going?

"Automated models still don't really know what to do when markets go haywire," Essentia's Mrs Levy says, "but what humans bring to the situation is their natural skill, intuition and emotional intelligence which technology can't replicate."

Barlclays' Mr Davies believes technology can, however, accentuate our human aptitudes, which in turn should narrow the gap with automated funds.

"An interesting parallel is in the world of chess," he says.

"It took a long while for machines to beat humans, and yet there is now a form of chess which combines the power of humans and machines, which is actually far more powerful than either humans or computers can achieve alone."

There is a frightening caveat here, though, that artificial intelligence (AI) could one day enable robo-investors to harness aspects of human intuition and edge humans out of the picture.

But while Sybenetix's Mr Chaban thinks it is possible, it's thankfully still a long way off.

"There's no way it'll happen soon; we're talking about hundreds and hundred of years for technology to reach that point," he says.

The job of a fund manager is getting tougher, and not just because you're expected to make regular returns in unpredictable markets.