Etsy: Can craft and capitalism coexist?

- Published

Etsy sellers, like scratchcraft, are known for their unique, handmade items

More than a century ago, English artist and activist William Morris argued "nothing should be made by man's labour which is not worth making, or which must be made by labour degrading to the makers".

Morris, external and the followers of the Arts and Crafts movement, external, which spanned Britain, the United States and Japan in the late 19th century, argued that mass manufactured products devalued labour and led to cheap and ugly surroundings.

It's not too big a stretch to argue that the 21st century version of that argument is "buy good things from real people" - the motto of online crafts marketplace Etsy.

Founded a decade ago in Brooklyn, New York - the epicentre of the do-it-yourself (DIY) movement - Etsy is billed as the "artisanal" eBay, a place where crafters can sell their wares to like-minded buyers.

The site has capitalised on a generational shift, where younger consumers value knowing where and how their purchases are made - and are willing to spend more for that knowledge.

Now, according to a filing, external with US regulators, there are nearly 1.4 million Etsians - as Etsy sellers are known - who together sold a combined $1.9bn (£1.3bn) worth of knit caps, tables, and other handmade and antique goods to almost 20 million buyers globally.

Etsy's motto is "buy good things from real people"

But as the company prepares to make its stock market debut later this week, with an estimated value of $1bn, the question is whether its DIY spirit can survive the pressures of shareholders that are often ruthless in their demand for growth and profits.

'Only good'

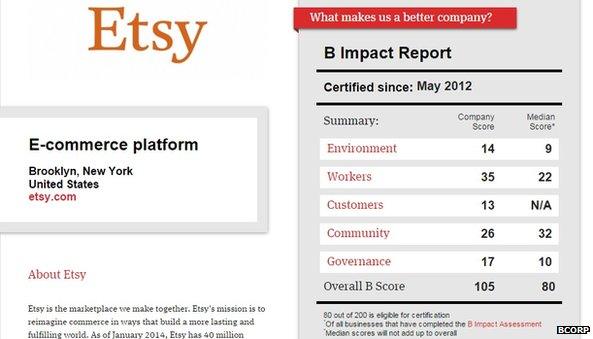

In 2012, Etsy chief executive Chad Dickerson wrote in a blog post that the company had sought a "B corporation" certification. That is a private label granted to firms that audit their business, grading their efforts on such criteria as workplace diversity to sustainability.

"We believe that business has a higher social purpose beyond simply profit," he wrote, external.

Etsy is based in the Dumbo neighbourhood of Brooklyn

While the certification was lauded at the time by Etsy's sellers and buyers, the company's commitment to putting ethics about profit is now about to be tested in the marketplace.

News of the company's decision to list on the Nasdaq met with a mixed reaction from Etsy sellers, who posted hundreds of notes in forums on the site.

"[I] went thru this with eBay. It will now be all about the shareholders and how much money they can make for them and no one else," wrote one, external seller of vintage jewellery.

Many users said they viewed the decision to go public as part of a larger trend away from the company's small DIY ethos - particularly after Etsy decided to amend its rules to allow sellers to let outside manufacturers make their goods.

But Lisa Yen, who runs the Etsy shop Moss+Twig, external from her one-bedroom apartment in Flatbush, Brooklyn, where she makes terrariums filled with moss and whimsical accoutrements such as coral and figurines that cost between $26 and $75, says she is optimistic.

Lisa Yen started her Etsy, Moss & Twig, store nearly two years ago

"I think actually once they start offering shares the company will start growing [and] it will just expand the programmes they can offer their sellers," says Ms Yen, who has benefitted from Etsy programmes that link sellers with large retailers such as Nordstrom.

"There's still a lot of people who don't know what Etsy is, so it's going to get a lot of traction and I can only see good coming out of this."

Ms Yen makes moss terariums, which she sells for between $26 and $75 a piece

Ms Yen says she sells about $1,000 worth of goods a month on Etsy

Don't forget

While there is nothing illegal in prioritising social good over profits, according to Brooklyn Law School professor Dana Brakman Reiser, the problem for Etsy is that there are very few other firms who have signed on to the B corporation platform that have also attempted to appeal to outside investors.

"Etsy is going to have to be persuasive to a much larger and more diverse group of shareholders now," says Prof Brakman Reiser.

"Many people think is going to scare investors off, who think 'why would I invest in a company that's going to trade my profits for social good? I'll just get the profits and buy my own social good by making a donation?'."

The challenge for Etsy will be to maintain a high enough share price and a sufficiently diverse investor base who will see value in the company's more expensive decisions.

If it fails to do so, the company could become a target for a takeover by a larger rival such as eBay.

What is a B Corp?

Created in 2006 by the non-profit B Labs, external, a B Corporation, external (or B Corp) is one that has audited itself to evaluate its performance on a series of metrics including the company's commitment to sustainability and diversity.

If the firm gets a score above 80 (out of a possible 200) it can call itself a B Corp and advertise its commitment to social good.

The label is like those given to organic or Fairtrade food - a private certification "intended to demonstrate that this is a company that is using its business to also achieve some kind of social good", according to Prof Brakman Reiser.

B Corps are different, although related, to Benefit Corporations, which are legal entities. Some, but not all, US states allow companies to register as Benefit Corporations, which is a legal category different than that of a Limited Liability Corporation (LLC), for instance.

Etsy, which is registered in the US state of Delaware, is technically supposed to register as a Benefit Corporation as part of its adherence to the B Corp programme, which it has not yet done.

DIY IPO

That is why Prof Brakman Reiser and others have said that Etsy is making a canny move in prioritising its sellers - and other smaller investors - in its public share sale.

Unlike the public stock offerings of other technology companies such as Facebook or Twitter, in which smaller investors were largely excluded from buying shares ahead of the listing, Etsy has specifically advertised its offering to the sellers on its site.

The company has set aside 5% of its shares to allow smaller investors to purchase between $100 and $2,500 worth of Etsy stock.

Kenneth Manger, who runs a new Etsy store, printswonderful, external, is one of the hopeful buyers.

"I was surprised when I clicked on the little IPO thing that they had on the website that they actually would make shares available to small investors," he says.

Kenneth Manger runs an Etsy store called printswonderful

He says that while he cannot claim to be an Etsy expert, he appreciates the company's commitment to creativity. That is why he is willing to take a risk investing in a company that is yet to turn a profit.

If Etsy is successful - and success, in this instance, will be more than just whether shares in the firm "pop", or rise significantly in their first day of trading, which is expected to be Thursday - it could serve as a model for other like-minded firms.

"If Etsy demonstrates continued growth stable or rising share price and a lot of liquidity for investors, that's proof of concept that this kind of company can get funding on the public markets," says Prof Brakman Reiser.

- Published23 September 2013

- Published26 September 2012

- Published8 November 2012