Will Wonga and other payday lenders survive?

- Published

Wonga's adverts featuring puppets were controversial and eventually cut

The rags to riches to rags story of payday lender Wonga has made it a household name but left it with a sullied image.

News that the company, which provides short-term loans, has itself fallen into the red was met with glee by some, while others point out it remains a huge player in a strictly regulated market.

With the company reporting a loss of £37.3m for 2014 and predicting more losses in 2015, many on social media were quick to jokingly offer the company a loan at an interest rate of 5,000%.

So what happened to the company that made a pre-tax profit of £84.5m in 2012, and what does this say about the wider health of the payday lending industry?

What caused the slump?

Wonga's new management team has been highly critical of the "problems of the past".

Chairman Andy Haste, who arrived last summer, says that the company needs to repair its reputation and only lend to those who can afford to repay loans.

Scandals, including letters from fake legal firms when chasing debts, and advancing a host of unsuitable loans, have caused such damage to the brand that a name change is not off the cards.

But key data that explain the big shift into the red include a 36% fall in lending volumes and a fall in customer numbers from a million in 2013 to 575,000 last year.

This restriction in lending came as the regulator, the Financial Conduct Authority (FCA), squeezed the life out of some lenders in a bid to stop vulnerable borrowers being pulled into spiralling debt.

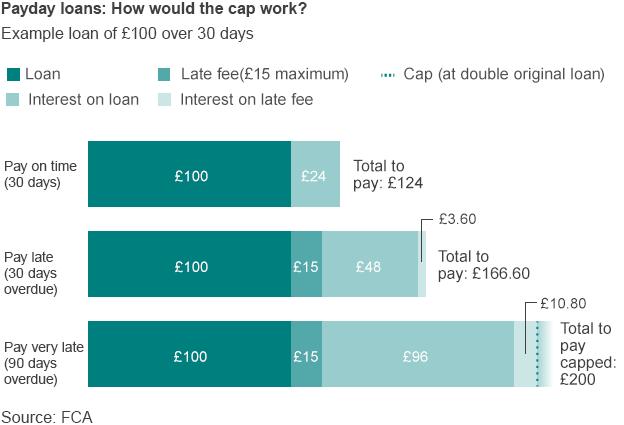

The regulator's main weapon is a cap on the cost of payday loans of 0.8% of the amount borrowed per day, which came into force in January.

In addition, there is a £15 cap on default charges. No borrower has to pay back more than twice the amount they initially borrowed, lenders can no longer roll over a loan more than twice, nor can they attempt to reclaim payment from a borrower's account more than twice.

It is not only Wonga that has been affected, according to trade body the Consumer Financial Association (CFA). It claims that stricter regulation has changed the face of the High Street.

Its analysis suggests there has been a 58% fall in the number of stores offering short-term loans since 2013.

Even more striking is its estimate that the volume of payday loan approvals has shrunk by 75% from its 2013 peak.

What does this mean for the future?

The attention of the regulator has resulted in some big names slashing their workforce or exiting the market altogether.

The Cheque Centre, which had 451 branches, announced that it would stop selling loans that needed to be paid back in one lump sum. Meanwhile, The Money Shop, a payday lender owned by US firm Dollar Financial, axed a host of stores.

The FCA says that there have been about 400 short-term lenders with permission to operate in the UK, but nobody is in any doubt that the total will plummet.

Now all payday lenders need to pass strict FCA assessments in order to get permission to carry on.

The deadline for applications for those licences was the end of February. The FCA has yet to say how many applications were made and processing those applications will take many months. So the scale of any exodus is not yet clear.

Richard Griffiths, of the CFA, says many of the smallest payday lenders will not have bothered putting in an application and so will stop lending. He estimates that only around 30 lenders are actively making loans subject to the new cap on the cost.

Still, that is many more than the three or four that the regulator itself believed would eventually get through the tough assessment process.

Wonga has put in a "good application", according to its chairman, who pointed to the strengthening of its lending criteria and introduction of the new price cap.

Asked if it is still possible to run a profitable payday loan business under the new industry regime, he says it is, but his company is suffering from "legacy issues".

"Could you start a payday business today within the cap and be profitable? Yes," he says.

But he predicts that Wonga will no longer rely solely on "one product and one price", although he did not spell out what the new products might be.

Mr Griffiths argues that many lenders have already moved away from the one month, short-term, high-interest loan to tide borrowers over until the next payday. Instead, many now offer mini personal loans for six months or so.

Where will all the borrowers go?

Some payday lenders may have given the industry a "tarnished image" in the words of its own trade body, but there is no doubt that payday loans have been popular.

In its results, Wonga makes an unusual estimate - claiming that its research suggests around 13 million people across the UK are "cash and credit constrained" and are under-served by mainstream financial services.

These are people who may have defaulted on loans, overdrafts and credit cards in the past and so struggle to secure more credit from banks or building societies.

So, if the payday lending industry starts turning them away or providers disappear entirely, where can these borrowers go?

A recovering economy and rising wages might reduce demand and increase the supply of loans from traditional lenders.

If not the regulator says many people will find a way to tighten their belts, or turn to family and friends for help.

Some, it is feared, might turn to illegal loan sharks.

Consumer groups and charities argue that loans are the cause, not the cure, of financial stress.

"More loans are not always the answer," says Mike O'Connor, chief executive of the StepChange debt charity.

"We must do more to help people on low incomes to save for a rainy day so that they are less likely to need to borrow in emergencies."