Australia's economy grows faster than expected

- Published

Consumer spending and home construction only just offset an ongoing slump in Australia's mining investment, said economist Shane Oliver from AMP Capital.

Australia's economy grew at a better-than-expected 0.9% in the first quarter of 2015, compared to the previous quarter, boosted by mining together with financial and insurance services.

Forecasts were for quarterly growth of between 0.5% and 0.7%.

Official statistics, external also showed that household consumption expenditure boosted the quarterly growth numbers.

But economist Shane Oliver told the BBC the numbers were "well below potential".

On an annual basis the economy expanded 2.3%, beating expectations for 2.1%.

Economic growth in the March quarter of 2014 was 2.9%.

'Not out of the woods'

"The March quarter GDP [gross domestic product] growth was far better than feared just a few days ago," said Mr Oliver, who is chief economist with AMP Capital in Sydney.

"However, Australia is still not out of the woods, as annual growth at 2.3% is well below potential, and a full 0.8% percentage points of the 0.9% growth came from higher inventories and trade."

He said domestic demand remained "very weak with consumer spending and home construction only just offsetting the ongoing slump in mining investment".

"So the Australian economy has not crashed - as many had feared would happen after the end of the mining boom - but it is continuing to grow at a sub par pace," he added.

Under pressure

A rising Australian dollar has been a cause for concern for Australia's big exporters

Australia's economy has been adjusting to a post mining-boom landscape. It saw its economy grow 0.5% in the October to December 2014 period from the quarter before, when growth was 0.4%.

On Tuesday, the country's central bank, the Reserve Bank of Australia (RBA), did not cut its lending rates further to help boost the economy, despite pressure from businesses to do so.

The decision saw Australian stocks fall 1.72% as investors saw little hope of a further cut in the near future.

However, Evan Lucas from IG Markets in Melbourne said "the collapse of [Australian stocks] on the back of the RBA not having an explicit easing bias... was a bit of an overreaction".

In May, the RBA cut its benchmark lending rate by 25 basis points to an all-time low of 2%.

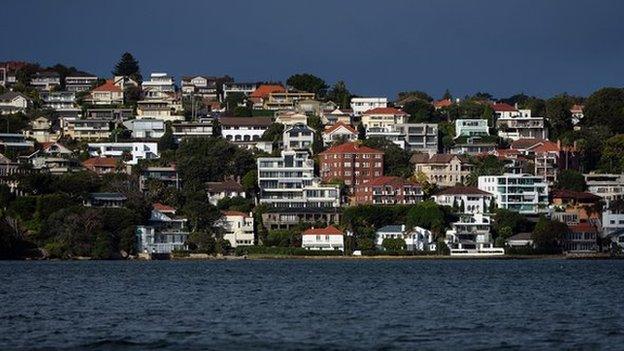

Rising property prices in Australia's biggest city, Sydney, a strong currency and a drop in iron ore prices were among the reasons for the RBA's rate cut last month

Rising property prices in Australia's biggest city, Sydney, a strong currency and a drop in iron ore prices were among the reasons for the cut.

The May rate cut was the second this year, following a previous 25 basis point cut in February and followed similar action from central banks in China, Canada, Singapore, Korea and India.

A rising Australian dollar had also been cause for concern, particularly for Australia's big mining and energy exporters.

Mr Oliver said more help would likely to be required "in the form of an even lower Australian dollar - and to ensure this happens the RBA may yet still have to cut interest rates further into record low territory."

- Published12 May 2015

- Published8 May 2015

- Published5 May 2015

- Published29 March 2015

- Published4 March 2015

- Published3 February 2015