Australia's budget offers small businesses a boost

- Published

Australian Treasurer Joe Hockey said the budget was "responsible, measured and fair"

Australian Treasurer Joe Hockey has delivered the country's budget, promising to help small businesses and ensure parents can join the workforce.

The budget also included a boost in national security spending.

It has largely been seen as attempt to win back public support in the lead-up to the 2016 election.

Last year's budget was criticised for being too severe in its public spending cuts as the government tried "to end the days of borrow and spend".

Several of those measures, such as pension cuts and fees to visit the doctor, have since been dropped or have been blocked in the Senate.

Difficult transition

Australia's economy has been slowing amid a downturn in the mining industry.

Mr Hockey described the country's transition away from mining to one of "broader-based growth" as difficult.

The latest budget papers, external showed Australia's deficit for the 2015-16 financial year is estimated to reach 35.1bn Australian dollars ($27.96bn; £17.82bn).

The market had expected a deficit of some A$41bn for the period.

The country was nevertheless still on "a credible path to surplus", despite the price of iron ore almost halving since the previous budget and an A$52bn write‑down in tax receipts.

The budget papers also showed the deficit was projected to fall to A$7bn by the end of the 2018-19 financial year.

In his budget speech, external, Mr Hockey pledged A$5.5bn for small businesses.

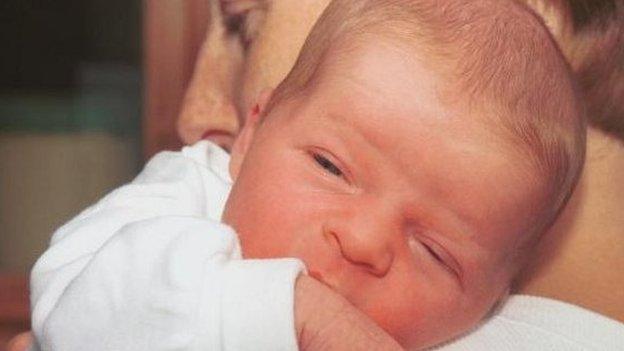

A $4.4bn family package to "reform the child care system" and help parents join the workforce was also unveiled.

Analysis: Wendy Frew, Australia editor, Sydney

Australia's next election is likely to be held in the second half of 2016, leaving Prime Minister Tony Abbott and his team a year to improve their weak standing in the opinion polls.

The budget's centre piece is a A$4.4bn ($3.5bn, £2.4bn) families package that will be funded by a cut in the country's existing family tax benefits. Childcare assistance will be increased for families with parents who are both in the workforce, although stay-at-home parents will lose childcare subsidies. There are also new subsidies for nannies.

Winners and losers have been created also among pensioners, one of Australia's most vocal and powerful lobby groups. Those living on modest incomes will get more money, but wealthier retired people who own a home and other assets will lose some of their government benefits.

"This budget is responsible, measured and fair," said Mr Hockey.

"We are creating opportunities for job seekers, young and old. We are caring for our most vulnerable. We are keeping the country safe and secure," he said.

"This is a budget for small business people who want to innovate and grow."

Credibility questioned

Some economists questioned the budget's credibility

"The good news is it's not as scary as last year's budget," Sydney-based economist Shane Oliver told the BBC.

"There are some measures in there to save money, but they're nowhere near as onerous as they were last year.

"And there are some positive moves, such as the spending on child care and the small business tax cuts - more positives in this one than negatives," he said.

But Mr Oliver, who is head of investment strategy and chief economist with AMP Capital Investors, said he questioned the budget's credibility.

"The government still has the budget going back to surplus by 2020, but that almost looks dodgy in a way," he said.

"That return to surplus will be very dependent on a big pick-up in revenue growth, and there's a danger that the government's growth forecast of a return to 3.5% in 2017-18 is too optimistic."

He said the numbers could see a "bounce in consumer confidence", but warned there could be another disappointment in the next 12 months.

Lower taxes

A major focus of this year's budget was on the country's more than two million small businesses and their contribution to the Australian economy.

The $A5.5bn small business package would include a tax cut starting in July for companies with an annual turnover of less than A$2m.

They would have their tax rate lowered to 28.5% from 30%, which Mr Hockey said was the lowest small business company tax rate in almost 50 years.

He also said he would allow small businesses to claim a deduction for "each and every item they purchase up to A$20,000", effective immediately.

Small businesses in Australia will be able to claim a deduction for "each and every item they purchase up to A$20,000", effective immediately, Mr Hockey said

Jennifer Westacott, chief executive of the Business Council of Australia, said the budget was a strong package for small businesses which she said were an important part of the economy.

"We hope small business will use [the tax deduction] to grow their productivity capacity and invest in innovation so they can start to get on a growth plan," she told the BBC.

"It's a very sensible initiative."

However, Ms Westacott said she would have liked to have seen an "across the board" tax cut for all businesses. "But the simple reality is the government was not in a position to provide that tax relief," she said.

"We are hoping to see the government pick up the urgent need for broader corporate tax relief [in the future]."

Ms Westacott agreed the budget would likely be good for consumer confidence and that "on balance" businesses would see this budget as a good one.

The government's 2015-16 budget papers set out its proposed revenue and expenditure in the following financial year, and its fiscal policy for several years after that.

In December, the government said it expected the nation's deficit to grow to A$40.4bn in the 12 months to June.

At the time, it said falling prices for key export commodities had hurt the economy.

- Published12 May 2015

- Published11 May 2015

- Published10 May 2015

- Published11 May 2015

- Published4 May 2015

- Published14 April 2015

- Published13 April 2015

- Published15 December 2014