Questions over Osborne's Victorian-era budget plans

- Published

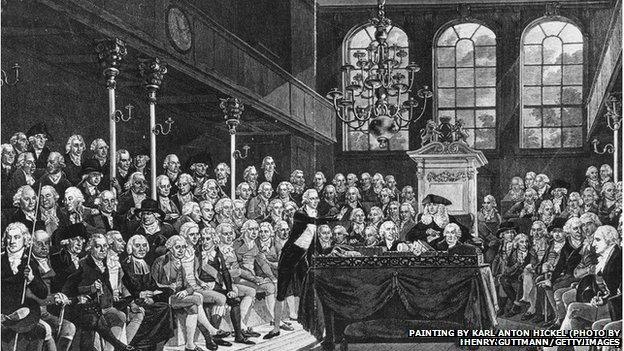

Former Prime Minister William Pitt the Younger speaks in the House of Commons

George Osborne is expected to look to the past to achieve a novelty in the modern-day UK - an economic surplus.

Under proposed new rules, the UK would be required to run a budget surplus when the economy is growing.

He is expected to revive a committee that last met more than 150 years ago to help balance the nation's books.

William Pitt the Younger convened the Committee of the Commissioners for the Reduction of the National Debt to repair the UK's finances after the Napoleonic Wars.

Mr Osborne will also take inspiration from other countries' more recent fiscal triumphs - the chancellor will say he is following the lead of Canada and Sweden in the late 1990s.

Their balanced budget rules helped them to withstand the financial crisis, he will say.

But economic watchers are waiting to hear how - and if - the plan will work.

'Laudable aim'

Some experts have some misgivings about how the potential new rules would work.

John Longworth, director general of the British Chambers of Commerce, said: "While running a budget surplus is a laudable aim, economic history shows that the national interest sometimes requires fiscal flexibility.

"It is impossible to predict global economic conditions with any certainty, so no government should put itself into a fiscal straitjacket that limits its scope to respond.

"Any move to constrain future spending should explicitly exclude infrastructure, which is an investment rather than just a cost.

"Roads, railways, energy grids and broadband drive productivity and job creation - and it is time for government's contributions to national infrastructure to be removed from the debate on the deficit and the national debt.

"Far too often, Britain's infrastructure needs have been sacrificed to short-term spending considerations. This must stop."

'Constraint'

Chris Williamson, chief economist at Markit, says governments should be trusted to manage public finances, with the ability to run a deficit if necessary to stimulate the economy.

"It's almost unnecessarily putting a constraint on policy making," he says.

Mr Williamson also asks what the implications would be if the government broke the deficit rule.

"Is it more of a PR stunt than a piece of policy making?" he asks.

Another economist asks how the new constraints will actually be implemented.

"You can put down as many rules as you want, but the responsibility lies with policymakers to actually deliver it," says Ross Walker, senior UK economist at RBS.

He points out that he UK has one of the largest structural deficits in the developed world.

However, David Gauke, the Financial Secretary to the Treasury, said the proposed new measures would not limit the government's ability to stimulate growth.

"The idea that there is a contradiction between taking a fiscally conservative approach and getting to grips with public finances and growing the economy is simply not true.

"In 2014 we were the fastest growing major economy in the western world whilst pursuing measures to reduce our deficit."

- Published10 June 2015