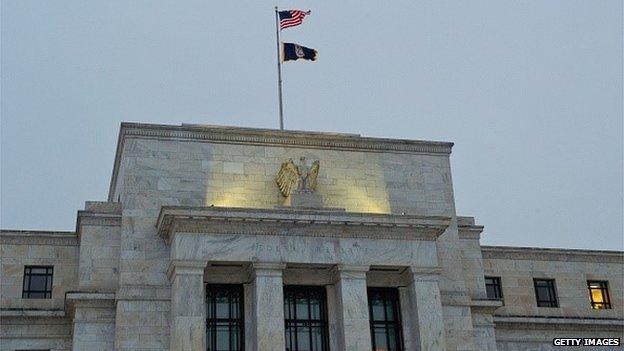

The Federal Reserve moves towards a rate rise this year

- Published

The US Federal Reserve is moving towards an interest rate rise later this year.

It would be the first increase since the rate was cut to near zero during the 2008 financial crisis.

However, the bank said conditions in the labour market and inflation did not yet warrant an increase.

In a press conference the Fed chair Janet Yellen said that "most [policy-makers] are anticipating a rate increase this year".

She added that once rates started to rise, any increases would be gradual.

The US central bank is trying to find a balance between giving clear guidance to the markets about what will prompt a rise, while not restricting its freedom to react to new economic data.

The bank said, external it would raise rates when it had "seen further improvement in the labour market" and was "reasonably confident" that inflation would reach its target of 2% in the "medium term".

Many economists expect the first rate rise to come in September, though the projections released by the Fed today show less certainty about how far rates will rise before the end of this year.

Policy makers are equally split between one, two or three rate increases this year, according to the bank's "dot plot", which shows where individual policy makers think the economy is heading.

Ms Yellen said that "sometimes too much attention" was placed on the timing of the first increase - and that the entire trajectory should be considered.

"It seems likely that some cyclical weakness in the labour market remains," she continued, "although progress clearly has been achieved, room for further improvement remains".

The jobless rate is currently at 5.5%, close to where the policy makers said it needed to be to consider raising rates.

But it is thought that this number does not reflect the full picture with many people not being counted because they are not looking for work, but would still like a job.

'Sticking to the script'

Ms Yellen said that, although the Federal Reserve saw the factors behind the disappointing first quarter as transitory, they "would like to see more decisive evidence that a moderate economic growth will be sustained".

"In the grand scheme things doesn't mark a big shift in their thinking," said Charles Seville, North America director at the ratings firm Fitch.

"They're sticking to their script. We expect a rate rise in September."

Mr Seville added that the emphasis on the slow and gradual rate rises was also reassuring.

- Published17 June 2015

- Published5 June 2015

- Published3 June 2015