Investing in Iran after the lifting of sanctions

- Published

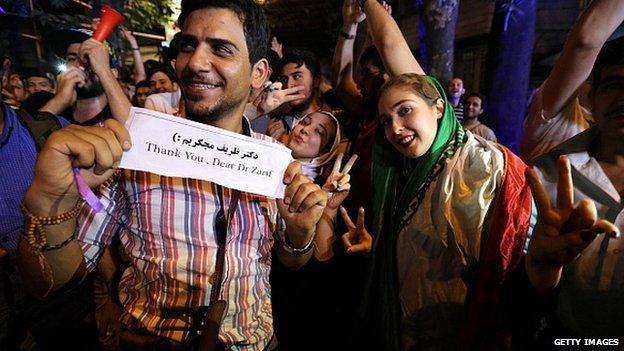

Iranians celebrate after Iran's nuclear negotiating team struck a deal with world powers in Vienna

Just a few days after hosting a historic deal between Iran and the world powers on Tehran's nuclear programme and lifting international sanctions, Vienna has been the venue for deals of a different kind.

For the first time in many years, an army of Iranian government officials descended on a business conference in the Austrian capital in a bid to attract foreign investors to Iran after the lifting of sanctions.

In a small side room on top of a conference hall at the Austrian chamber of commerce, a few men in suits - some with ties but most without - gathered around a small table in the middle. Two thick files of bundled paper represented a deal worth around $130m.

The contract, for a joint venture between a few Iranian private sector firms and an Austro-German company is to design, manufacture and test car engines in Iran, compatible with the latest European emissions and efficiency standards.

"Thanks to the imminent lifting of sanctions, Iranians can burn less fuel and enjoy cleaner air," said Mojtaba Mirsoheil, president of Pars Raisen Co, one of the Iranian partners of the joint venture.

"We have been working on this deal for almost two years, but it was signed only after the nuclear deal was signed."

Investment hopes

Full implementation of the 14 July nuclear deal - reached between Iran and the United States, Russia, China, United Kingdom, France and Germany - could take at least six months. Furthermore, economic sanctions on Iran's energy, trade and financial sectors will be removed only after Tehran delivers its end of the bargain.

Iran is planning to treble the number of cars it manufactures, says Industry Minister Mohammad Nematzadeh

But Iran, with a population of 80 million and a $400bn economy, is already flirting with European businesses that are in a rush to secure "first-mover" advantage.

"We are no longer interested in unidirectional importation of goods and machinery from Europe," Iran's inudstry minister, Mohammad Reza Nematzadeh, told a packed room of some 400 business delegates at the Iran-EU trade and investment conference.

"We are looking for two-way trade, as well as cooperation in development, design, engineering and joint investment for production and export."

According to Mr Nematzadeh, the manufacturing sector is leading Iran's economic recovery, experiencing a growth of 6.7% last year, while the mining sector has had an even higher growth rate of 9.8%.

He said he planned to triple the number of cars Iran manufactured to three million a year by 2025, saying that besides European and Japanese carmakers, General Motors had also "indirectly" shown interest in talking about joint production.

"In mining too, we need a further $20bn of investment by 2025 for the exploration and development of mines," said Mr Nematzadeh's deputy, Mehdi Karbasian, adding that most of the investment would have to come from abroad.

Higher growth prospects

As part of the nuclear deal reached in Vienna, a huge kitty of Iranian assets and oil money, currently blocked in accounts around the world, will be unfrozen. The amount was estimated at between $100bn and $150bn, but Iran's central bank officials have rushed to dampen expectations of a hard-currency tsunami.

Iran wants to invest $185bn in its oil and gas sector over the next five years

"The foreign asset position of the central bank is around $100bn, but we are bringing back only $29bn to the country," Akbar Komijani, deputy-governor of Iran's central bank told the conference.

Mr Komijani said the money would mainly be spent in petrochemical, gas, mining, road and construction sectors to create jobs. He declined to comment if any cash would end up with Iran's military.

He believes access to these reserves as well as increased oil proceeds will mean higher-than-expected GDP growth in the year to March 2016.

"Prior to lifting of sanctions, we had estimated a growth rate of 1.6-2% for this (Iranian) year," he said.

"In some scenarios, we now are estimating the growth to reach 3-4%."

'The deal is done'

No Iranian business conference is complete without speakers flaunting Iran's oil and gas reserves, with BP now estimating the latter to be the largest in the world.

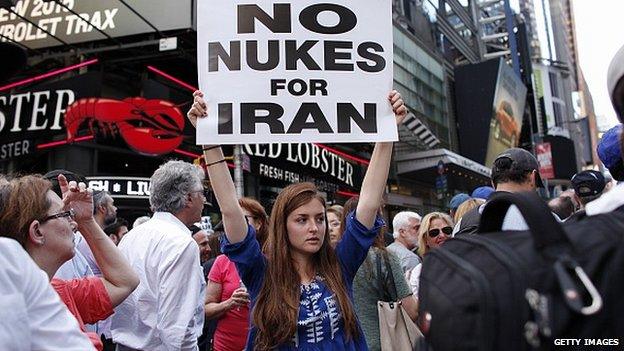

Iran's nuclear deal has provoked strong opposition - not just in the United States

An Iranian deputy oil minister told investors if Europe wanted to get rid of its dependence on Russian gas, and instead import from Iran, his country needed their money to develop the gas fields.

The investment required in oil and gas in the next five years amounts to $185bn, according to the Iranian officials. Tehran is also promising energy companies contracts with better terms.

"Do not doubt - the deal is done," said Amir Hossein Zamaninia who was himself a member of the nuclear negotiating team before joining the Iranian ministry of petroleum in December.

Mr Zamaninia was speaking to investors in Vienna while US Secretary of State John Kerry and his team were grilled for four-and-a-half hours at a hearing by US senators who oppose the nuclear deal with Iran.

"Leave the doubt to some quarters in Washington and Tehran," he added.