Northern Rock loan decision reversed

- Published

A court has reversed a decision that would have led to compensation being paid to 43,000 borrowers with the former bank Northern Rock.

A High Court ruling in December over the wording of documents sent out by the bank meant £261m would have been paid in refunded interest.

But the decision has now been reversed by the Court of Appeal.

The case related to Northern Rock's "Together Mortgage", and questioned the wording in past loan documents.

The Together Mortgage allowed unsecured loans of up to £30,000 alongside mortgages, to be repaid at the same rate as the mortgage.

In 2012, Northern Rock Asset Management had to pay out £270m in refunded interest after the bank failed to make mandatory disclosures in customer letters from 2008.

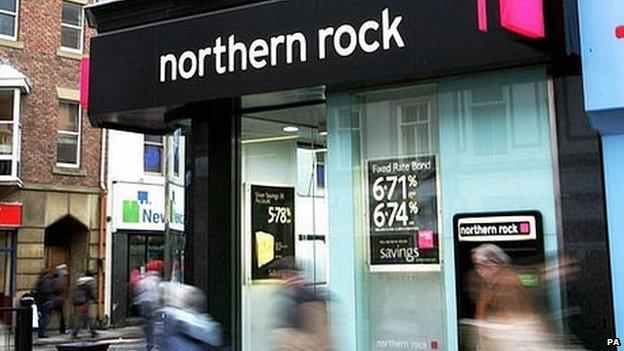

Newcastle-based Northern Rock was nationalised in 2008 following its near collapse at the onset of the global credit crunch.

Two years later it was split into a "good" and a "bad' bank, with the Northern Rock name transferred to the good bank.

In late 2011 Virgin Money bought the good part of the business, and discontinued the Northern Rock name.