How China is raining on Glencore's parade

- Published

Last month China temporarily closed 10,000 factories around Beijing. The aim was to limit pollution and ensure blue skies for the country's World War Two celebrations at the start of September.

But if the sun was shining for Beijing, the event cast a shadow across the fortunes of some surprising onlookers at the event - among them the mining giant, Glencore.

While the mining giant's problems began long before China moved its serried ranks of polished missile carriers onto the parade ground, it's a measure of just how powerful Chinese demand can be.

Even a temporary shutdown, added to the wider shudders of doubt over China's growth, helped to undermine the prices of commodities.

And commodities are Glencore's lifeblood.

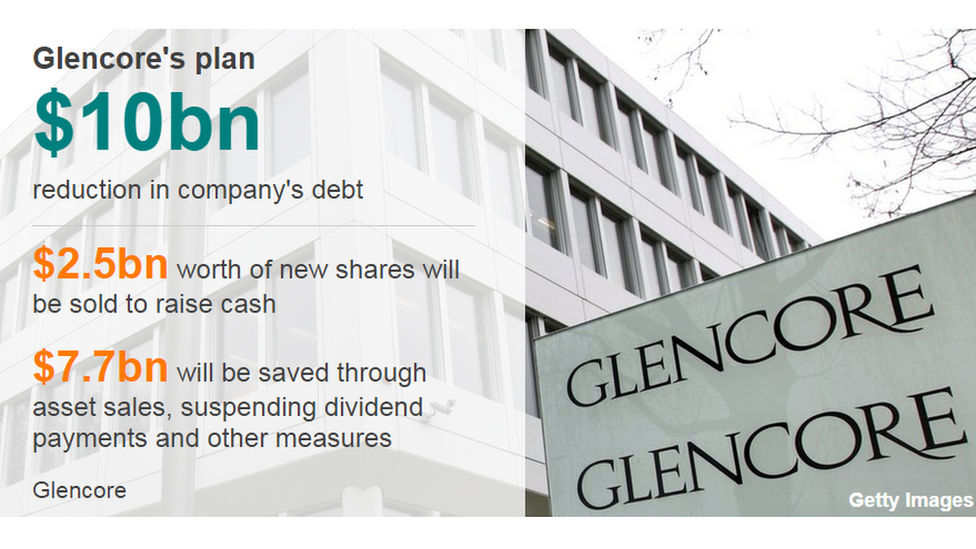

This week the company decided to smash the glass on an emergency rescue package worth $10.2bn (£6.7bn) - made up of $2bn in asset sales, new shares worth $2.5bn and a dividend suspension, a move which marks a sharp reversal of fortunes for its audacious deal-making chief executive Ivan Glasenberg.

Copper bottom

Just four years ago news bulletins featured trains being delayed because thieves had stolen the metal wiring in the signal boxes. Copper fetched such a high price criminal gangs emerged to harvest and sell what they'd pilfered. Those stories have since vanished.

Glencore's plan

$10bn

reduction in company's debt

-

$2.5bn worth of new shares will be sold to raise cash

-

$7.7bn will be saved through asset sales, suspending dividend payments and other measures

Copper is now worth a quarter of what it was in 2011. Other commodities have also plummeted in price as China's rapid growth has slowed.

China currently consumes more than 70% of the world's iron ore, more than 50% of the world's nickel and aluminium and just over 45% of the world's copper. Even small changes in demand from China's vast economy can have a knock-on effect on prices.

As Glencore has found out to its cost.

On their mettle

Mr Glasenberg, a former Olympic-standard race walker and South African Army veteran, raised $60bn in a stock market flotation in 2011, and acquired mining company Xstrata in 2013, at a time of still buoyant demand for commodities.

At the time the deal was portrayed as a merger of equals, but Mr Glasenberg soon ousted Xstrata boss Mick Davis in what became in effect a hostile takeover, creating a $90bn agriculture and commodities giant with operations in Africa, North and South America and Australasia.

Glencore's chief executive, Ivan Glasenberg, has a background in commodity trading rather than mining

The company's biggest problem at the time was defending its reputation against campaigners criticising its record in countries where it extracted raw materials, from Colombia to Zambia.

But by this year, Mr Glasenberg's ambitious plans had taken a battering. Glencore was the worst performer on the FTSE 100 index in the first half of 2015, with its shares plummeting by more than 50%. Ratings downgrades followed and the company reported a 29% drop in its first-half earnings.

Debt relief

Mr Glasenberg's latest move will cut Glencore's debt by a third to just over $20bn by the end of next year, a level the company believes investors will find more tolerable.

"After listening to shareholders we decided to make our balance sheet bulletproof," he told analysts, although he added that he did not believe the current low commodity prices would continue.

The company is also cutting copper production by 400,000 tonnes over 18 months, by mothballing lossmaking mines in Zambia and the Democratic Republic of Congo, an announcement that produced a filip in the copper price.

But what happens next depends as much on China as it does on decisions in Glencore's boardroom.

Production will be halted at Zambia's Mopani mine for 18 months to save money

According to John Meyer, partner at investment advisors SP Angel, Glencore has had to contend with more on the China front than just slackening demand. Earlier this summer a corporate raid by Chinese hedge funds attempted to drive copper prices down by massive short-selling in the market

"[China] flooded the market by selling copper futures contracts and they sold it at illiquid times of the day when people weren't around and they hammered the market down," Meyer said. "It was a classic bear raid."

He said the event was damaging enough for Glencore to mention it in its interim report.

"They didn't use the term state-sponsored price manipulation but they intimated the Chinese had manipulated prices lower in an orchestrated action."

Ups and downs

Now that Glencore has cut copper production, however, this again changes the landscape, forcing prices higher. Mr Meyer cautions that China may have overplayed its hand.

"This could quite easily swing the market from a copper surplus to a deficit," he says."China used the paper market to push the price down, now Glencore will use the physical market to lift the price up.

"That's the strength of Glencore; they have a mixture of low-cost production which they would never cut and high-cost production which they can use to balance out the market."

Glencore has faced controversy in the past over its environmental record in countries such as Colombia.

Marc Elliott, a mining analyst at Investec, agrees that Glencore's future will hinge on what China does to boost its economy.

"I think [Glencore] has taken the right course of action," he says. "I guess the question is, if things are equally as challenging in a year from now, will it be enough?"

Glencore, he stressed, is not alone among mining companies in feeling the pain from the slump in Chinese demand but the company's unusually high debt has left it more vulnerable.

Market jitters

What makes Glencore unusual though is that the company is both a mining company and a commodities trading company.

"These guys are financiers who very successfully used leverage over the years to grow a very large trading business and those financial skills then allowed them to get into mining," says Deutsche Bank mining and metals analyst Rob Clifford.

But it's that reliance on debt that has proven the riskiest part of Glencore's strategy, says Mr Clifford, as the market has grown more jittery in recent months.

Ultimately, he says, Glencore may have more to fear from a skittish market than a slump in Chinese consumption.

"China's deceleration is a trigger but the main cause is the market's perception of what that really means."

In other words, if commodity prices fail to recover, Glencore's plan to cut back its debts may not be enough to help it weather the storm.

- Published4 September 2015

- Published25 August 2015

- Published7 September 2015

- Published25 August 2015