The two Estonians taking on the banks at currency exchange

- Published

"Whenever you move money around the world, banks take a cut, it's a big cut and it's unfair," says Kristo Kaarmann, co-founder of Transferwise.

"In most of the successful disruption cases the industry doesn't see what has hit them."

Kristo Kaarmann, one of the founders of peer-to-peer money sending firm TransferWise, has a glint in his eye as he recounts how the business he created with his friend Taavet Hinrikus has grown.

The firm, founded just four years ago, has already moved more than $4.5bn (£3bn) of customers' money across the world and employs 400 people in five offices globally.

Banks once had a near monopoly on this lucrative sector, where people send more than $500bn (£334bn) abroad each year.

But not anymore, according to Mr Hinrikus who says the banks "have fallen asleep".

"They have been quick to adopt modern technology to optimise the way things work internally, but when it comes to services for customers their processes haven't really changed for many decades."

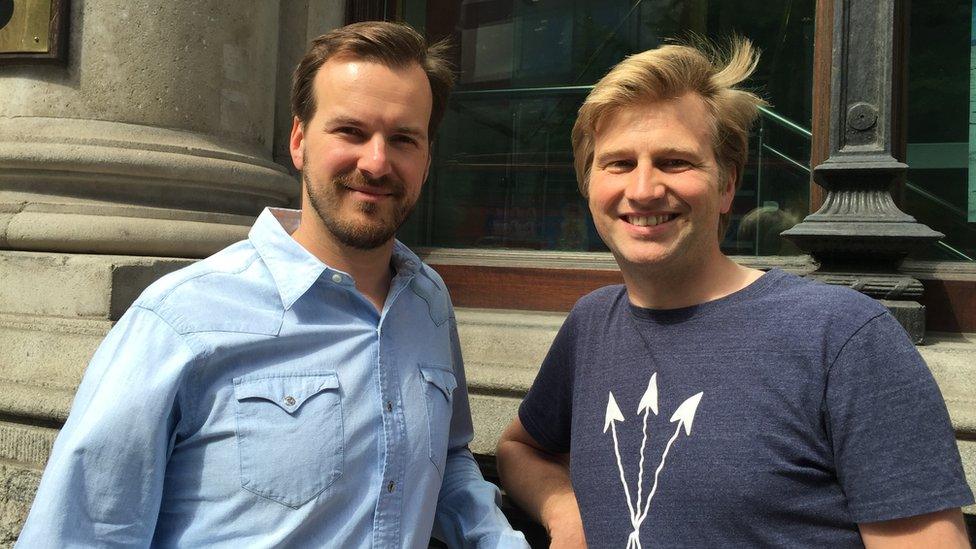

Kristo Kaarmann (far left) and Taavet Hinrikus (far right) launched TransferWise in 2011

The two Estonians started TransferWise in 2011 when they were both living in London. Mr Kaarmann was being paid in pounds but had bills to pay in Estonia, and Mr Hinrikus was being paid in euros but need pounds for his living costs.

They came up with a way of sending money into each other's account which meant they did not have to pay banks extra fees for the transfer.

"Banks are very slow to move.

"While all the other sectors that are driven by technology like media, newspapers, music have all been disrupted, nothing exciting has been happening in banking for the last twenty years," says Mr Kaarmann.

Mr Kaarmann should know. He founded the business after working at PwC and Deloitte advising banks on how to improve their systems.

Meanwhile, his business partner Mr Hinrikus had already disrupted an industry as a key player in the rise of Skype - the internet telecoms pioneer - where he was the company's first ever employee.

Do it yourself

The friends were originally from the Soviet Union. Mr Hinrikus was ten-years-old when Estonia became independent and he believes the experience of living under communism has made Estonians more entrepreneurial.

Taavet Hinrikus believes that growing up in the Soviet Union made his generation more entrepreneurial

"We had to build the country from scratch," he says.

"We had no legacy systems, processes or procedures. Finland offered us their old phone exchange and we were bold enough to say no we don't want it, we can live without one for another year or two until we can afford something modern."

"If you had to fix your washing machines you had to use parts from your car, if you wanted something you had to build it yourself and that has given people an attitude of not being afraid of rolling up their sleeves and getting their hands dirty."

He says that more people should start a business.

"For some reason people are afraid, they're afraid of failing. The most you will lose is a few months of your life and in return you will get a fantastic experience that will help you in the future."

Bubble trouble?

The business has an impressive roster of investors such as Virgin Group founder Sir Richard Branson, PayPal co-founder and early Facebook investor Peter Thiel and David Yu, one of the founders of Betfair.

In January, newspapers reported that some Silicon Valley funds were valuing TransferWise at $1bn, a sum that Mr Hinrikus will not comment on.

Taavet Hinrikus and Kristo Kaarmann will not comment on reports of a $1bn valuation of their company

But do these rumoured amounts suggest a return to the dotcom bubble which led to technology shares crashing at the turn of the millennium?

"Fundamentally this is very different" Mr Hinrikus says.

"If you look at how many people have access to the internet and at how fast businesses are growing and generating profits.

"It is very different to 1999 when the world got a bit ahead of itself, but we are reaping the benefits of that time. Everything people thought would happen then is actually being done now."

The way TransferWise works is that instead of sending money across borders, the company matches people transferring money in one direction with people transferring it in the other - so called peer-to-peer transfers.

Effectively, you are buying your currency from other individuals.

The "mid-market" rate the site gives is taken from the rate published by Reuters and it is often significantly less than the rates offered by traditional currency exchange businesses.

The firm charges a fee of £1 on all transactions up to £200, and 0.5% thereafter.

Competitive pressures

Since TransferWise's launch other competitors have come into the market with a similar model, but the Estonians believe they are ahead of the game.

It's an issue that technology investor, Eileen Burbidge thinks TransferWise can deal with.

"There's nothing stopping somebody else mimicking what TransferWise does from their website to their user interface to their customer support," she says. But, she believes that TransferWise's advantage lies in the men behind the business.

"We have been building TransferWise for four years. It will be hard to copy as they will have to catch up and we're still innovating and moving on," says Mr Hinrikus.

A business built on immigration

In January, TransferWise set up in the US and they say the business has grown quickly, at a rate of 40 to 50% a month.

"The USA is a huge market which has a large immigrant population from Europe, India, from all around the world, lots of them have still strong ties to home so move lots of money," Mr Hinrikus says.

"I do believe the world is becoming much smaller, people are moving around much more than ever before, we are immigrants ourselves, we employ people from about 20 different nationalities so we are big fans of a small global world."