The way we buy cars today - the rise of personal contracts

- Published

Tuesday 6 October 2015 will be a big day for the UK's car industry.

We will learn how many cars were sold in September.

Figures from the the Society of Motor Manufacturers and Traders (SMMT), external will be broken down by manufacturer, model and type of engine.

So they should give us the first indication of whether or not the Volkswagen emissions scandal has dented sales of its diesel engine cars in the UK.

If sales have fallen, the data will be sure to provoke suggestions that the German company, and maybe even the entire car industry, is suddenly staring into the proverbial abyss.

For several years now the industry has in fact been in rude health.

New car sales in the UK have risen steadily since the beginning of 2012, external, following the huge slump caused by the great banking crisis a few years before.

Purchases reached a 10-year high of just under 2.5 million in 2014 and, Volkswagen possibly aside, they seem to be on course to grow even further this year.

There is a good reason for that.

The car industry has shown itself to be quite innovative when it comes to ways of luring members of the public to open their wallets, or at least hand over their bank details, to buy a new car.

Making cars more affordable?

The main innovation has been a type of deal known as a personal contract purchase (PCP), external.

If you have not been interested in shelling out £15,000 to £30,000 for a new car in the past five or six years you may not have noticed this.

Once upon a time these sorts of arrangements, structured as rental or leasing agreements, were targeted just at businesses, especially the buyers of huge fleets of cars who wanted new cars they could offload easily after just two to three years.

But the new variation on this theme, the PCP, has been targeted at small businesses and individuals.

It has become very popular, especially with those who want to buy a more expensive or up-market car.

Apparently more than 80% of Mercedes sales in the UK now take place via this sort of deal.

Toby Poston of the BVRLA, a trade body for rental and leasing firms, says two things have driven this.

One is that the banking crisis forced manufacturers to find new ways to stimulate car sales.

And then came the availability of very cheap finance, courtesy of the Bank of England's policy of keeping interest rates very low.

"It's all to do with the availability of cheap finance," he says.

"These deals make cars more affordable for those who don't have the cash or can't take a loan... and give access to new, high quality vehicles."

How they work

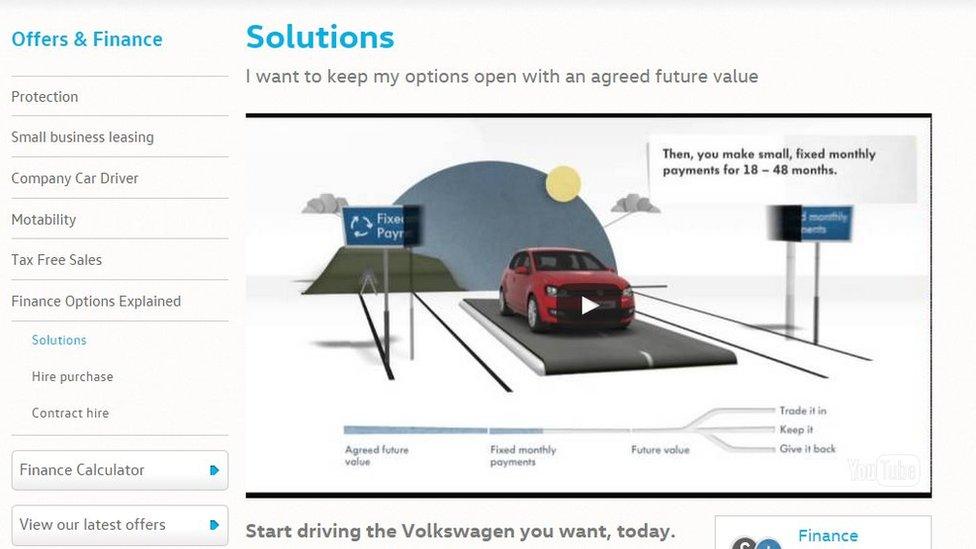

Although the terminology can vary from manufacturer to manufacturer, the PCP deals generally work like this.

There are plenty of these on the UK's road these days, thanks to personal contract deals

You pay a deposit, make monthly payments for three or four years, and at the end of that you have a choice.

You can either buy the car outright with a final "balloon" payment, or you can hand the car back to the dealer.

There is nothing very cheap about this though, and you can easily be paying £300, £400, or even more each month, depending on the starting cost of the car and the length of the deal.

The industry argues that these plans can work out cheaper than the more traditional form of borrowing to buy a car, called hire purchase.

Under that arrangement, the car manufacturer or someone else in the finance industry lends you the money.

You pay for the car in monthly instalments over several years, along with a hefty slug of interest, and at the end of the process the car is all yours.

'A very good deal'

So popular have the new PCP deals become that, in the twelve months to July 2015, 705,000 people used them to buy new cars.

That was nearly 59% of all private new cars sold in the UK during that period.

So what is the advantage, real or perceived?

One big attraction is that while you are driving around in your swanky, unblemished new car, the cost of servicing, maintenance and even accident repairs may still be borne by the manufacturer as part of the arrangement.

In other words, hassle-free driving; albeit you have to pay for it.

Breakdown costs, and even new tyres and windows, may be covered too, though generally not the cost of your car insurance premiums.

And then after three or four years you can roll over the deal and pay for another new car in a similar fashion.

Garel Rhys, Emeritus Professor of Motor Industry Economics at Cardiff Business School, says: "Leasing plans present a very good deal for both companies and buyers."

"It is very difficult to see what is wrong for the customer in this sort of thing.

"A C-class Mercedes can cost just the same as a Mondeo in terms of monthly repayments," he adds.