Madoff victims bring auditor to trial

- Published

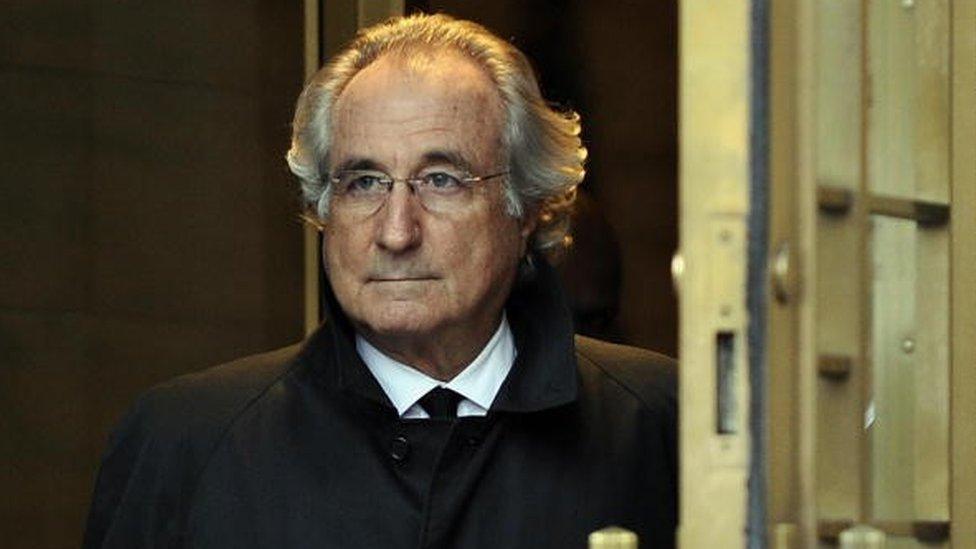

In 2009, Bernie Madoff was sentenced to 150 years in prison for defrauding investors

The trial has begun between victims of Bernie Madoff's "Ponzi" scheme and Ernst & Young, the auditors they allege should have revealed the fraud.

FutureSelect Portfolio Management, which lost $129m (£84m), is seeking to recoup £65m in a Seattle, Washington court.

It claimed Ernst & Young should have taken more steps to verify that Madoff's funds were real.

Ernst & Young said they are not responsible for the losses.

Ernst & Young told the BBC that they were among several auditors used by funds that chose Madoff as their investment adviser, none of whom detected the fraud.

The trial comes nearly seven years after Madoff's scheme to defraud investors, which resulted in £11.4bn in losses, was revealed. Madoff was sentenced to 150 years in prison.

FutureSelect's claims that as an auditor, Ernst & Young should have confirmed that the funds and returns were legitimate.

Steven Thomas, FutureSelect lawyer's told the Associated Press: "Because Ernst & Young said the numbers were good, FutureSelect invested."

In a statement to the BBC, Ernst & Young called the Madoff scheme a "sophisticated fraud" that went undetected even by government regulators.

"While we regret the investors' losses, no audit of a Madoff-advised fund could have detected this Ponzi scheme," a spokesperson wrote.

FutureSelect invested money in a collection of funds managed by Tremont Partners, which in turn invested with Madoff. Ernst & Young was Tremont's auditing firm between 2000-2003.

FutureSelect filed suits against Tremont, its parent company, and the other auditors. Those have all reached private out of court settlements.

A New York trustee has so far recovered or made agreements to recover £7.1bn of the lost principal amount.

The trial is scheduled to last about one month.

- Published6 August 2015