The Old Lady of Threadneedle Street lifts her skirts

- Published

Mark Carney opens the Bank of England Open Forum at the Guildhall in London on Wednesday

Central banks are not famous for their openness - rather, secrecy and closed doors remain the norm.

They might now publish the minutes of meetings where decisions about interest rates are made, hold regular media conferences - and even have Twitter accounts.

But in many respects the Bank of England remains cocooned from the real world behind its fortress-like facade on Threadneedle Street in the heart of the City of London.

An event organised by the Bank this week, however, was an attempt to lower the drawbridge just a little. Open Forum 2015, external is thought to be the first time that a central bank has invited the public to a debate about the role financial markets play in society.

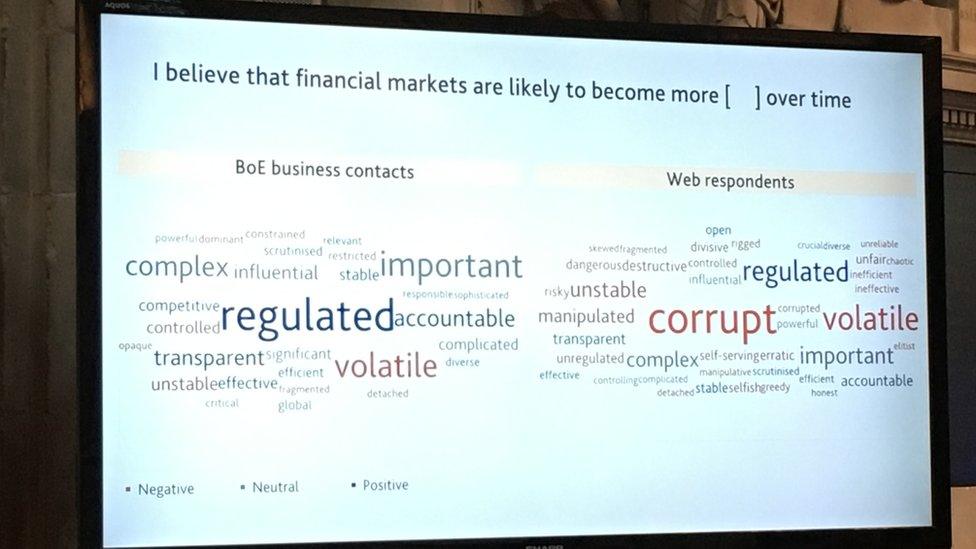

Andy Haldane, the Bank's chief economist, says the words used by the public to describe financial markets - "corrupt; unreliable; rigged" - underline why this event was worth holding.

He describes the forum as the start of a process to close that yawning gap between those who work in the financial sector - and the rest of us on the outside.

One of the "word clouds" shown at the Open Forum

About half the 400 people who attended Open Forum 2015 were those working in the financial sector, as well as businesspeople from other industries, academics, politicians and clergy. The remainder had applied for a place in a public ballot and Mohini Patel, a fixed income dealer at Hermes Investment Management, was one of those who did so.

"The opportunity to engage with central banks in this kind of forum doesn't come about very often," she says during the lunch break at the Guildhall, just around the corner from the Bank - 400 people couldn't fit in Threadneedle Street, apparently.

Ms Patel says she wanted to hear what the speakers, who included Chancellor George Osborne, European Central Bank president Mario Draghi, Mark Carney, the Bank's governor, and his deputy Nemat Shafik had to say.

Putting aside a reservation that the event was more a conversation than one aimed at producing "outcomes", Ms Patel says: "It's a positive thing, definitely - it's quite impressive that the dialogue is open."

Bank of England deputy governor Nemat Shafik at Open Forum 2015

John Hearn, a senior economics lecturer at IFS University College that offers professional education for the financial services and dates back to the Institute of Bankers that was founded in 1879, says he attended Wednesday's function with the aim of "asking some awkward questions" and the hope of increasing the public's financial literacy.

"We'll only solve financial problems if people understand what the issues are - and an event like this throws it out much more widely."

As the Bank was given far wider powers over the financial system in the wake of the crash some eight years ago, it's only right that it should try to be more transparent, says BBC Economics editor Robert Peston.

ECB president Mario Draghi, Chancellor George Osborne and Bank of England governor Mark Carney at the forum

"Given that the governor of the Bank of England is not elected, there is a fear that the Bank is super-powerful but not answerable to the people - having this sort of public consultation is a step in the right direction," he comments.

"If it's just a PR exercise it's worthless, but if the Bank can demonstrate that it's listening to what people are saying then that would be a good thing."

But back to the cheerleaders for a moment. Xavier Rolet, chief executive of the London Stock Exchange Group, was a panel member for one of the morning's breakout sessions, snappily-titled, "Improving the effectiveness of market finance in serving the economy".

He describes the forum as "pretty visionary and very ambitious" given that no central bank has staged an event like this before.

To be fair, it tried to be as inclusive as possible, with parallel events in Birmingham and Edinburgh, a Twitter hashtag, external that attracted more than 3,000 tweets, a webcast of the whole event and an online seminar in which 5,000 school students took part. (You can catch up on the Bank's YouTube channel, external - some 10,000 people have logged on so far.)

Mr Rolet believes the event is part of the drive to ensure the financial sector is "at the service of the real economy" and help create high-quality jobs.

London Stock Exchange Group chief executive Xavier Rolet says the meeting was "pretty visionary"

When so many people still associate financial markets with corruption and nefarious activities, there remains a need to hold up a mirror to it, says Michael Salib, a Bank of England employee currently studying for a Master's degree at the London School of Economics.

The poor perception that the public have of the industry should be a wake-up call, he argues.

"The job is not done - although a lot of regulation has been put in place, communicating to the public what that means clearly hasn't worked for that lack of confidence to be there still."

So what will Open Forum 2015 achieve? Mr Haldane who helped shape the event, he calls himself the "party planner", says: "I hope today has moved us on a step in the debate about finance. And it wasn't scripted to within an inch of its life."

The grand hall at the Guildhall, where Open Forum 2015 was held

He feels it also underlines the Bank's drive to be more open.

"This is the most 'One Bank' thing we've done in my 26 years at the Bank by a mile - it involved absolutely everyone. It's a risky thing - in the business of central banking it's quite out there."

It seems the Old Lady of Threadneedle Street has lifted her skirts just a touch - and the hemline may remain just a little bit higher.

- Published11 November 2015

- Published11 November 2015

- Published29 September 2015

- Published25 February 2015