UK economy 'losing speed' warns BoE economist Haldane

- Published

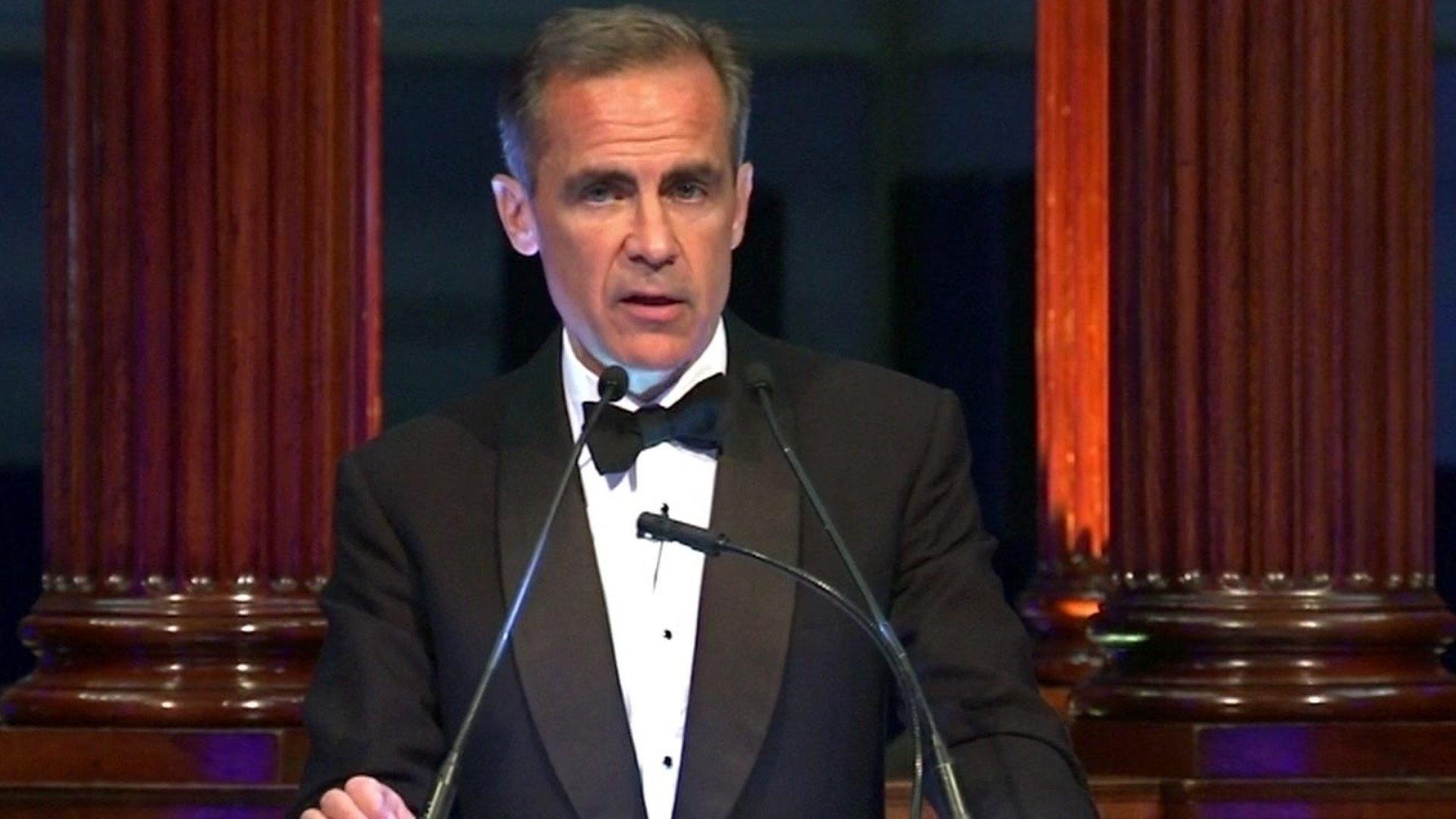

The Bank of England's chief economist, Andy Haldane, has warned that the UK's "economic aircraft appears to be losing speed on the runway".

Mr Haldane, added that any rate rise would "increase unnecessarily the chances of the economy falling below critical velocity".

He is considered to be the most cautious policy-maker when it comes to raising interest rates.

Interest rates have been at 0.5% since 2009 and the financial crisis.

The first increase is now expected in late 2016. Forecasts were put back after the Bank of England's last inflation report in which the Bank said the outlook for global growth had weakened.

In a speech to trade union body the TUC, Mr Haldane also indicated that the next rate move could equally be a cut rather than a rise.

'Awkward'

"Now more than ever in the UK, policy needs to be poised to move off either foot depending on which way the data break," he said in his speech.

Mr Haldane said that because wage growth could be weaker than currently expected, inflation may undershoot the Bank's November predictions, when it estimated that inflation would rise above its 2% target in two years.

The Consumer Price Index currently stands at 0.1%.

"Against that backdrop, my view is that the case for raising interest rates is still some way from being made," Mr Haldane said.

"Whatever the reason, the economic aircraft appears to be losing speed on the runway. That is an awkward, indeed risky, time to be contemplating take-off.

'Housing market broken'

"Meanwhile, inflationary trends do not at present give me sufficient confidence that inflation will be back at target, even two years hence."

Mr Haldane also had strong words on the UK's increasingly expensive housing market.

"The UK housing market is broken," he told the TUC meeting.

"There is a chronic and accumulated imbalance between demand and supply, and it is that which is sending skyward - and has sent skyward - house prices."

- Published12 November 2015

- Published11 November 2015

- Published24 July 2015

- Published18 September 2015