Iran banks unprepared for post-sanctions world

- Published

Iran knows full well that the end of international sanctions will only translate to more foreign trade and investment if major global banks re-connect with the Islamic republic.

But of all foreign companies, banks are the most reluctant to resume relations with Iran.

Tasked with courting prospective suitors, Iran's central bank governor Valiollah Seif and a battalion of Iranian bankers arrived in Frankfurt this week to meet with European counterparts.

"Short-term relationships between Iran and global partners will not be beneficial - having a long-term perspective for investment in Iran's banking sector is essential," Mr Seif told an open session on Iran at EuroFinance Week.

But most talks between Iranian bankers and their potential partners were held in private on the side-lines of the event. International sanctions on Iran's trade, energy and banking sectors are not yet officially lifted and foreign banks fear breaching them.

Lifting sanctions

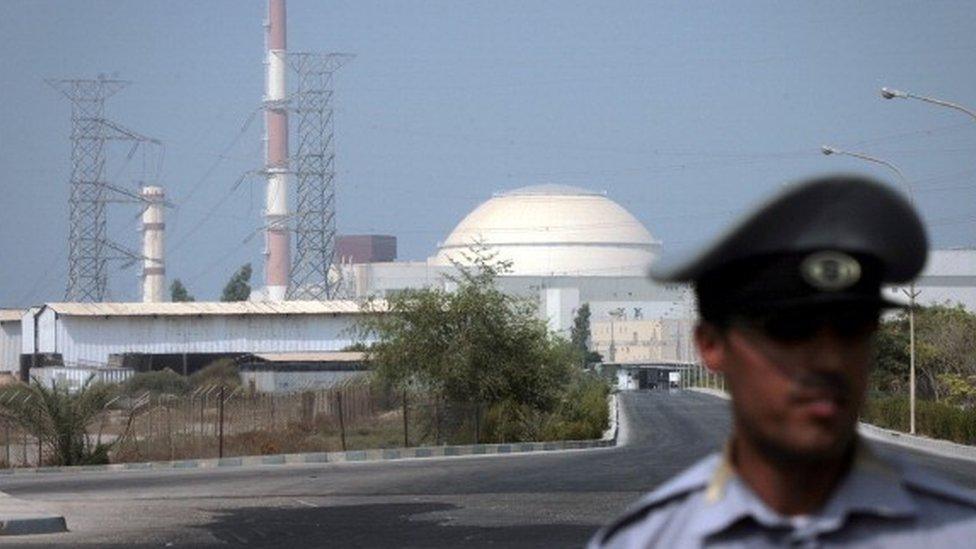

Iran and world powers reached a deal on 14 July to limit the Islamic republic's nuclear ambitions in return for lifting international sanctions that have crippled the Iranian economy by cutting it off completely from the global banking system.

Once both sides complete their commitments of the deal, sanctions will be lifted - possibly early next year. But a number of banks have jumped the gun.

Iran's central bank governor Valiollah Seif stressed the importance of long-term relationships

US financial and judicial authorities have slapped hefty penalties on two dozen European banks for by-passing US sanctions on Iran, Sudan and Cuba. A total of $14bn have been paid, either in fines or settlements out of court, in the last ten years. French bank BNP Paribas's bill alone amounted to $9bn.

"We don't expect the 'bitten banks' to resume relations immediately, but we had very good negotiations with others," said Rasoul Dorri, senior advisor to the central bank governor.

Another banker said the Iranian delegation had this week held "advanced talks" with German counterparts to resume so-called Hermes Cover, an export credit guarantee provided to German exporters by the Federal government.

The cover was halted once sanctions intensified.

Stricter standards

But dating in secret is not the biggest challenge in bringing Iranian and European partners back together.

The problem is having a healthy relationship after a decade of separation, and that depends on healthy balance sheets and sound policies.

"Iran's central bank has already started reforms for financial stability, sound monetary policy and effective allocation of resources in the banking system," Mr Seif said.

Iran's return to the global banking system also means the country has to meet international standards, for example those on money laundering and minimum reserve requirements that guard banks against major global shocks.

Consumer spending is slowing down, acting as a drag on economic growth

The problem is, Iranian banks are on life-support at home.

A total of $26bn of non-performing loans have crippled the banking system. These were cheap credits splashed mostly at corporations or individuals who enjoyed close ties with the government of former president Mahmoud Ahmadinejad (2005-2013).

Some recipients used their cosy relations with that government to constantly delay repayments. Others, hit by the country's recession, simply could not afford to pay the money back.

Iran's central bank says non-performing loans, on average, amount to 20% of some bank's assets.

Higher growth

At the same time, lengthy delays in lifting sanctions are weighing heavily on the economy, and there is a genuine fear that the recession is back.

Iranian consumers are holding back from spending, expecting prices to fall after sanctions are removed. Economists say this will not necessarily be the case.

After a recent visit to Iran, a delegation from the International Monetary Fund (IMF) said it expected the country's GDP growth to be between -0.5% and 0.5% in the year to March 2016. The IMF says the Iranian economy grew 3% in the previous year and could grow up to 5% a year after sanctions are lifted.

President Rouhani has loosened the tight monetary policy used to bring inflation down

In a sharp U-turn from its previous policy, last week Iran's central bank introduced a package of measures to stimulate spending by providing cheap credit and injecting money into the economy.

President Hassan Rouhani's government had previously tightened monetary policy to bring down inflation, which has fallen to 15% from 40% just two years ago.

Iran's central bank package to stimulate the economy:

•Cheap loans for purchase of homes and Iranian-made cars

•Household credit of $3,000 with low interest rates to buy Iranian-made home appliances

•Injecting some $2.5bn into mega projects

•Cutting bank reserve requirements from 13% to 10%

•Cutting interbank lending rates from 29% to 26%.

Iranian carmakers sold some 100,000 cars in just six days this week thanks to low-interest loans of $8,000 provided by banks to each buyer. These cars had been parked in depots for months due to faltering demand.

"This is monetary expansion, though controlled," said Ali Sanginian, chief executive of Iran's Amin Investment Bank.

"A proper expansionary policy has to come with fiscal expansion too."

"The government may soon have to follow the footsteps of its predecessor, by printing money or by devaluating the currency," Mr Sanginian said.

President Rouhani had promised not to do either.

Iranian bankers may paint a rosy picture of the huge potential of doing business with Iran, but their foreign partners will look at the policies and balance sheets and not the words, to see where the country's economy is heading.

- Published2 November 2015

- Published5 June 2015