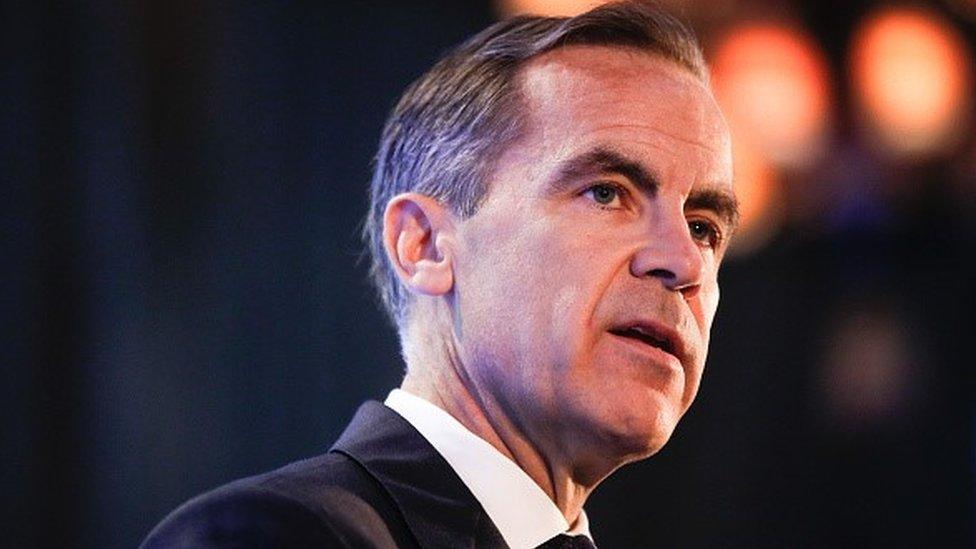

Mark Carney: UK rates to remain low 'for some time'

- Published

Bank of England governor Mark Carney has said that UK interest rates are likely to remain low "for some time".

His comments came as he spoke to MPs on the Treasury Committee.

UK rates have been held at 0.5% since March 2009. Most economists are not expecting the Bank to raise rates until mid-2016 at the earliest.

Mr Carney said that "even with limited and gradual rate increases it still will be a relatively low interest rate environment".

'Solid recovery'

He remained vague on when a rate rise might be coming, and added: "The question in my mind is when the appropriate time for interests to increase and that is strongly consistent with the strength of the domestic economy."

Mr Carney also said that he did not see any need for negative interest rates.

Meanwhile, he said the Bank was monitoring groups of households to find out what impact any rate hike would have.

Kirstin Forbes, an external member of the Bank of England's Monetary Policy Committee, who was also giving evidence at the same hearing, said that the next interest rate move would be upwards.

"Given the state of the UK economy, a solid recovery, I still believe certainly the next move in interest rates will be up, we will not require loosening," she said.

'Balance of risks'

Mr Carney also said productivity was more likely to exceed than undershoot the Bank's latest forecasts, reducing the pressure on inflation.

Meanwhile, sterling fell after the Bank's chief economist Andy Haldane said he saw more downside risks to growth and inflation than had been indicated by the Bank's latest economic outlook.

He also reiterated his view that the Bank's next move might actually be a rate cut.

"I see the balance of risks around UK GDP growth and inflation as skewed materially to the downside, more so than embodied in the November 2015 Inflation Report," he told the Treasury Committee.

In late morning trade sterling fell by 0.03% against the US dollar, to $1.5120, and by 0.15% against the euro, to 1.4198 euros.

- Published17 November 2015

- Published5 November 2015