Oil price to remain low in 2016, says Total boss

- Published

The oil price is unlikely to recover next year, according to the boss of the French energy giant, Total.

The price of Brent crude is currently under $43 a barrel, down more than 60% since last summer, while US light crude is trading below $40 a barrel.

US prices have not been this low for more than 10 years.

And Total's Patrick Pouyanne "doesn't anticipate a recovery in 2016". In fact, he thinks supply will grow faster than demand next year.

He is not alone. Last Friday, Goldman Sachs put out a note suggesting prices could fall a lot further.

"While [we are] forecasting oil prices over the next few months to be near $40 a barrel, or roughly where they are trading today, there could be another 50% to fall," the investment bank said.

Renewed concerns about supply and demand imbalances pushed the oil price sharply lower on Monday, with Brent down more than $1 a barrel and US crude $1.30 lower.

Asset sales

Oversupply is the reason for the slump in prices over the past 18 months, largely due to US shale oil flooding the market. At the same time, demand has fallen due to a slowdown in economic growth in China and Europe.

This has hit not just the oil industry, but also oil-exporting countries. Many big oil producers such as Libya, Algeria, Nigeria and Venezuela need an oil price well above $100 a barrel to balance their budgets. With the price down near $40, they are having to sell assets to make up the difference.

Indeed a recent report from US data provider eVestment showed that sovereign wealth funds in the oil-rich Gulf are pulling money out of global fund management houses at the fastest pace on record.

Many of these Gulf states are members of Opec, the group that controls about 30% of the world's oil supply.

Understandably, many are furious that the oil price has been allowed to drop so low.

Iranian oil

Historically, Opec has cut production to support prices but, led by Saudi Arabia, the group has resolutely refused to trim supply this time.

Saudi's motivation is simple - to drive US shale producers out of business, believing that they will fall victim to lower prices long before the traditional oil producers of Opec.

The group met last Friday, and agreed again to maintain supply at about 31.5 million barrels a day.

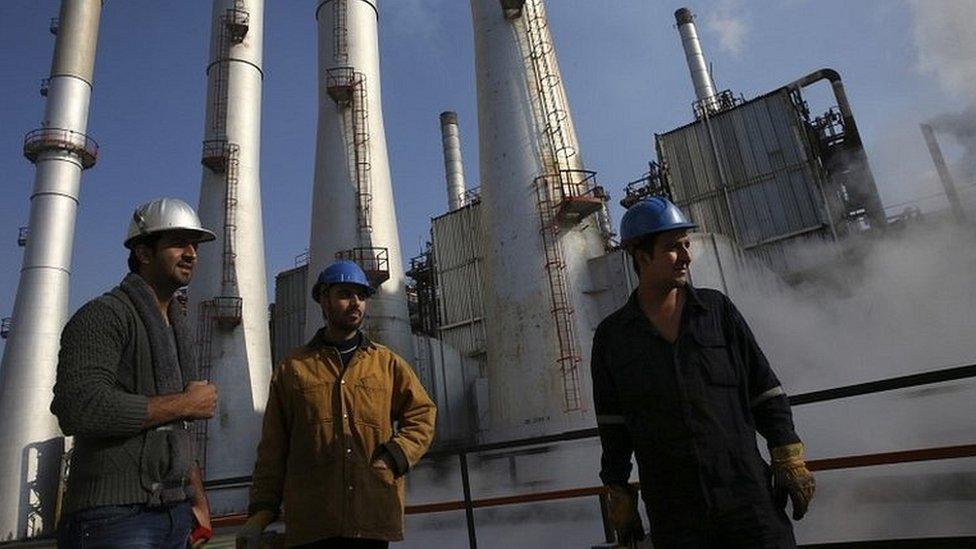

Iran is planning to increase oil production substantially

It could go even higher. Following a nuclear deal with six world powers in July and the imminent lifting of sanctions, Iran has big plans to increase oil production in the coming years, from about three million barrels a day now, to five million by the end of the decade.

At the end of last month, Iran overhauled the way in which it offers contracts to foreign energy companies in a bid to attract up to $30bn (£20bn) of new investment, with a view to increasing output by 500,000 barrels a day once sanctions are lifted.

And Opec believes its strategy is beginning to work, as small US shale producers, many of which are heavily indebted, struggle to cope with low oil prices.

Indeed the International Energy Agency has forecast that US shale production will begin to fall next year.

Mr Pouyanne agrees.

"Non-Opec supply will contract... by mid-2016 we should see contraction in US production," he says.

Presumably not fast enough to have any material impact on oil prices, according to his own predictions.

- Published13 November 2015

- Published5 June 2015