Fed up: Asia reacts to the US interest rate rise

- Published

The last time the US Federal Reserve raised interest rates was nearly a decade ago in 2006

Life, it has been said, is 10% what happens to you and 90% how you react to it.

The same could be said of the US Federal Reserve's highly anticipated decision, and the ensuing markets and currency reactions in Asia.

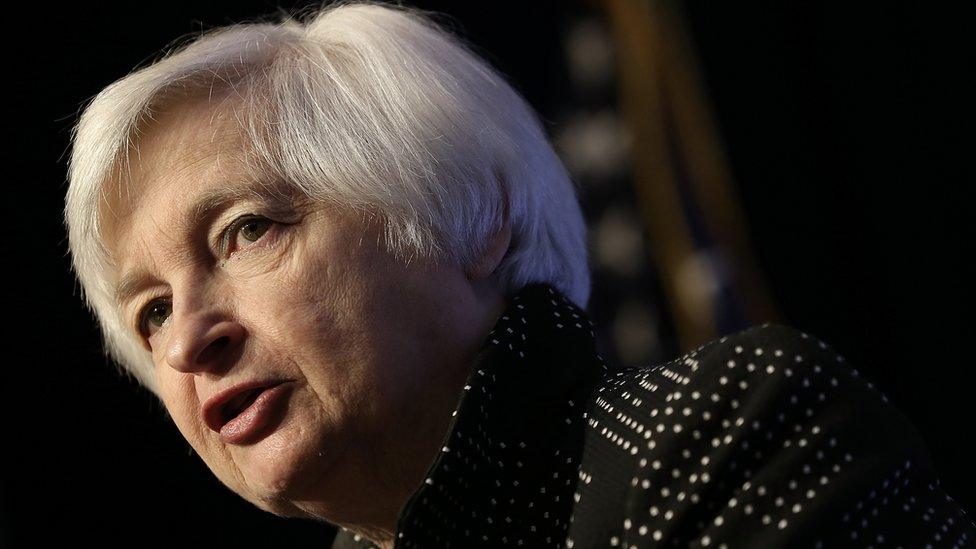

When Janet Yellen failed to raise rates in September, pointing the finger at China's economic instability, markets in Asia went beserk.

But this time around don't expect a meltdown on regional stock markets.

Asian investors are, frankly, fed up with waiting for the Fed.

This was a decision that everyone has been expecting. In fact, according to a Reuters poll, the probability that the Fed was going to raise rates stood at 90% before the meeting.

So investors in Asia are prepared - and have been for the last couple of years.

And they've been reacting - we've seen money being pulled out of equities in emerging markets in preparation for this move.

Capital outflows from emerging markets are on track to exceed the amount that went into them this year for the first time since 1988, external, according to the Institute of International Finance.

So if immediate reaction isn't the concern - then what are the longer-term consequences of this rate rise for Asia?

Here are the three things you should watch out for:

Currencies

When the US raises rates, the US dollar tends to rise which means other currencies depreciate against it. And that's going to hurt some emerging markets.

Moody's has already highlighted the issues for emerging markets: the ones where domestic challenges have added to exchange rate problems will be the worst off.

The Indonesian rupiah fell to a four-week low last week because of worries over outflows in the event of the Fed raising interest rates

So in Asia - that's Indonesia, Malaysia and possibly India.

Debt

Then there's debt - or what some are calling the "perfect storm" for emerging markets.

RBC Capital Markets says emerging markets currencies will be weaker in 2016 and that Asia's debt levels as a percentage of GDP have converged to those of the developed world.

That's worrying for Asian companies who have a lot of their debt in US dollars, but make their profits in local currencies - especially if there are more rate rises to come.

And that's what many in the market are betting on, as Shang Jin-Wei, chief economist at the Asian Development Bank told me.

US rate rises tend to be followed by a series of rate rises so "from that point of view, even though we're very prepared, there can be some elements of surprises."

Central bank dilemma

So what's an Asian central bank to do?

Raising rates like the US means that you risk stifling growth and hitting consumption. Cutting rates means more capital outflow and a weaker currency - which could lead to more emerging market debt.

But it's not all doom and gloom. Capital Economics says that Asian economies are much less vulnerable now than they've been in the past to deal with all of this and believe the economic environment in Asia should improve next year.

So until then Asian central banks - and Asian investors - are likely going to have a tread a fine balance, preparing themselves for the worst, and ready to react when the timing is right.

- Published16 December 2015

- Published16 December 2015

- Published15 December 2015