What will happen to the property market in 2016?

- Published

The property market will have rather more on its plate in 2016 than the perennial issue of whether house prices will go up or down.

The recent decision of the US central bank, the Federal Reserve, to raise interest rates for the first time since the summer of 2006, has opened the door for the Bank of England finally to follow suit.

And one thing that will certainly happen in England and Wales is that from next April, stamp duty rates will be jacked up for anyone buying a home that is not their main residence.

A similar change will happen in Scotland.

That will make things more expensive for second-home buyers and buy-to-let landlords, and deter some potential buyers altogether.

So, after a few years in which the the mortgage tap has been turned back on and sales have revived, the property market is in line to receive some jolts.

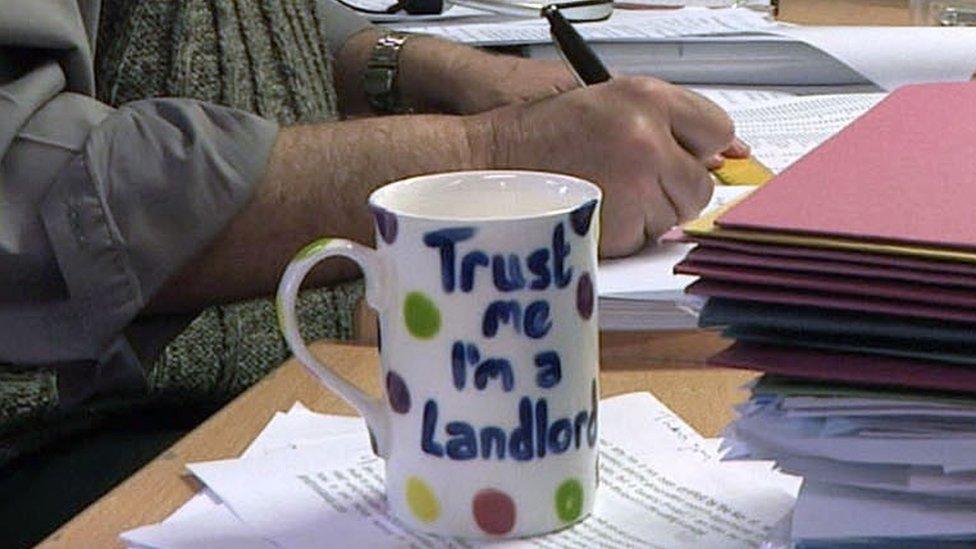

Hard times for landlords

Who would have guessed that a Conservative government would take a dim view of buy-to-let landlords, just the sort of people supposed to be staunch Tory voters?

But that is exactly what has happened.

Not only will their stamp duty rates rise, but an erosion of some of their tax privileges is now in the pipeline for 2017, after an announcement in the Chancellor's summer Budget.

Also, the Bank of England wants the power to limit overall lending to buy-to-let borrowers, something to which the Chancellor will almost certainly agree.

The economic and political problem, as the government sees it, is that the rise of private landlordism has crowded out home owners, especially the fabled first-time buyers.

"The government is very motivated to reverse the trend in owner-occupation - this is now a very important part of the government's housing strategy," says Simon Rubinsohn, chief economist at the Royal Institution of Chartered Surveyors (Rics).

"Buy-to-let landlords have had a very good run - holding property has been a very lucrative investment, so if the government has to squeeze the buy-to-let landlord it will take that in its stride."

'Frightening prospect'

Not surprisingly, current and would-be landlords are now feeling a bit beleaguered.

"It's an extraordinary about-turn for landlords," says property commentator Henry Pryor.

"And because rents are unlikely to rise to compensate for the increase in stamp duty, capital values are likely to fall - which is the government's intention."

He also points out that some landlords will be driven out of the business altogether, once they start having to obey the new regulations on 1 February which are aimed at illegal immigrants.

Under these rules, landlords will have to check, on pain of a £3,000 fine, that their tenants have the right to rent in the UK.

"Many landlords are finding this is a rather frightening prospect and are talking of giving up as a result," he says.

The Council of Mortgage Lenders (CML) forecasts that the number of new loans made to landlords will now fall sharply, from 116,000 in 2015 to just 90,000 in 2017.

Will mortgage rates rise at last?

It is almost seven years since the Bank of England slashed interest rates to a record low of just 0.5%.

That was the end point of a series of emergency cuts, designed to stave off financial Armageddon in the wake of the great banking crisis.

Since then, most economists have persistently forecast that rates would start rising again, probably within 18 months.

Every year these forecasts have been wrong, so will 2016 be any different?

For its part, the Bank of England continues to sit on the fence, effectively saying "wait and see".

Most independent economists think the first UK rate rises since July 2007 will at last happen this coming year, and by two increments of 0.25% each., external

One forecaster, Ed Stansfield at Capital Economics, explains why: "The economy is probably a little bit healthier than the collective wisdom of the Bank's Monetary Policy Committee thinks."

"We think that one of the things that will convince the Bank to act is continued signs that incomes are recovering."

And that growth in incomes will help avoid a collective shudder going through the country if rates do indeed rise by, say, 0.5%.

As a ready-reckoner from the CML points out, external, such an increase in mortgage rates, for someone with a £100,000 loan currently charged at 3.22%, would add just £26 to their monthly outgoings.

Choppy times ahead

For several years now, the low Bank rate has translated into historically very low mortgage rates, making even very large mortgages appear affordable.

More recently, house prices and sales have been buoyed up by the government's Help-to-Buy schemes.

These have meant that tens of thousands of people, mainly first-time buyers, have been lent money to buy a home when they might otherwise have been locked out.

And the steady growth of the economy, with rising employment and a continuation of the modest increases in incomes, should stop sales or prices falling.

But one leading commentator, Ray Boulger of the mortgage brokers John Charcol, predicts some turbulence in the early months of 2016.

He reckons that some people will rush to purchase buy-to-let properties before the higher stamp duty rates take effect.

"Those people who want buy-to-let properties are clearly going to be incentivised to complete before 31 March," he says.

"Till then I think we will see some quite strong growth in prices, then I expect to see prices falling for the next few months as that element of demand is taken out of the market."