Scottish Budget: New 3% levy for buying second homes

- Published

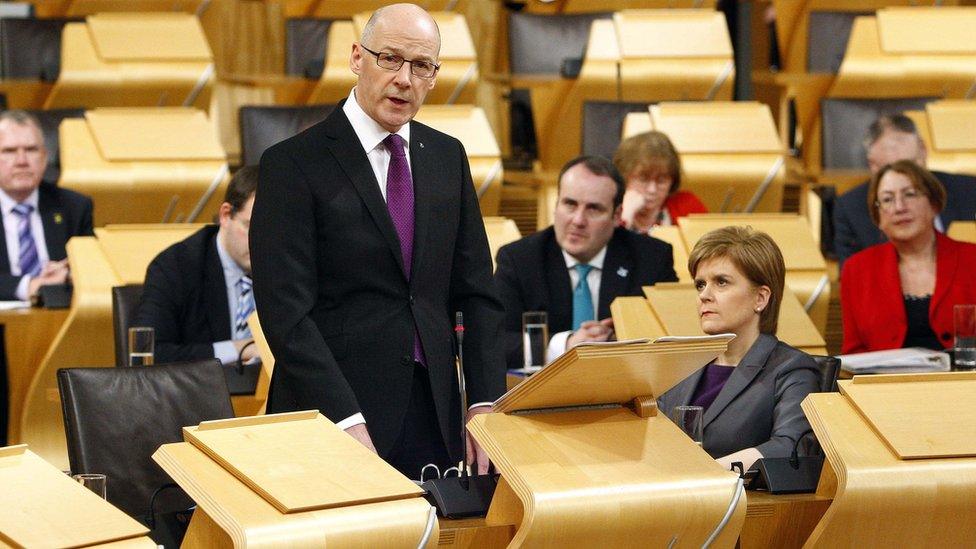

Scotland's Finance Secretary John Swinney has announced an extra charge for people buying second homes and buy-to-let landlords.

Delivering his budget, Mr Swinney said there would be an additional supplement of 3% of the purchase price of the property, on top of the existing Land and Buildings Transaction Tax (LBTT).

The move follows a similar announcement by the UK chancellor last month.

The Land and Buildings Transaction Tax (LBTT) replaced UK stamp duty in April.

According to the Scottish Fiscal Commission, the official watchdog of the Scottish government's tax and spending plans, the supplement on LBTT will affect between 8,500 and 12,500 transactions each year, and could raise between £19m and £27m.

It warned, however, that it is hard to forecast the impact in the first year, as sales may be brought forward to the current financial year to avoid the new tax.

The LBTT system, which raised £218m in its first seven months, uses a graduated tax rate, working in a similar way to income tax.

Under LBTT, properties bought for up to £145,000 do not attract any tax.

For sales between £145,000 and £250,000, a tax rate of 2% applies, with the introduction of a new rate of 5% between £250,001 and £325,000.

Between £325,001 and £750,000, the marginal rate is 10%, with a top rate of 12% applying to all transactions above £750,000.

Mr Swinney said the rates and thresholds for residential, non-residential and lease transactions will remain the same next year.

He said he would bring forward legislation on the new second home charge soon so that it could be in force by April 2016.

Property ladder

Mr Swinney told MSPs at Holyrood: "I am conscious of the issue of second homes.

"We need to ensure that the opportunities for first-time buyers to enter the market in Scotland are as strong as they possibly can be and we need to make certain that tax changes elsewhere in the United Kingdom do not make it harder for people to get on the property ladder.

"That is why I today announce my intention to introduce a supplement to LBTT for those purchasing an additional home for £40,000 or more.

"Such properties will be subject to a supplement of 3% of the total purchase price, payable in addition to the existing LBTT charge."

John Blackwood, chief executive of the Scottish Association of Landlords, said: "Landlords will be disappointed and frustrated by the decision by the finance secretary this afternoon to copy the policy of the Conservative Party at Westminster and punish those who choose to invest in the private rented sector (PRS) Scotland.

"The supplementary tax on the purchase of second homes will have a huge impact on the buy-to-let market and exacerbate an already serious shortage of properties in many areas.

"We firmly believe that the biggest losers from today's statement will be tenants who will now find it even harder to get the accommodation they want at a price they can afford."

Chartered Institute of Housing Scotland policy and practice officer Ashley Campbell said: "We welcome proposals to increase land and buildings transaction tax for second homes and buy-to-let properties but would like to see more details of where the additional revenue raised will be invested.

"Our preference would be for these funds to be re-invested towards increasing housing supply."

Bob Cherry from property consultancy CKD Galbraith, said: "Today's announcement regarding the introduction of a 3% surcharge on the full purchase price of all additional property from April next year will undoubtedly lead to a flurry of second home purchases and buy-to-let property sales before the end of March to beat the deadline.

"This new levy will have implications for current landlords looking to sell as well as act as yet another deterrent to would-be landlords thinking about the market as an investment opportunity.

"This measure, like the LBTT rises introduced earlier this year, is also a wealth tax on owners as buyers of buy-to-lets will seek to pass on the extra purchase costs by reducing the price they are prepared to pay."

- Published16 December 2015

- Published1 April 2015

- Published25 November 2015