Asia in 2016 - what does it hold?

- Published

- comments

China is adapting to a rate of economic growth that is being described as the country's "new normal"

It's been a year of reality checks for Asia's economies in 2015.

It was the year we clocked the following:

no country can grow at double digit growth forever (China)

you can't just dig stuff out of the ground and sell it for ludicrously high prices forever (end of the commodities super-cycle)

cheap US money doesn't last forever (Fed pushes rates up)

So, if 2015 was the year we were all jolted out of our heady highs - what does 2016 hold?

Here are my calls...

The great slowdown of China continues

Driving consumption, among other areas, will be a key focus for China's government

Official growth numbers will come in at 6.5%, the rate at which China's government has said is acceptable in the "new normal" for China, but real growth will much likely be far lower than that.

Most economic forecasts are coming in between 5.8% and 6.7%.

We've already seen reports indicating some provincial governments may have been inflating growth figures.

The continuing corruption clampdown will continue to squeeze regional budgets - and that's going to push spending and consumption down further.

Expect more monetary easing and fiscal easing - but these stimulus programmes are unlikely to boost growth that much. Driving consumption and developing the services sector will be a key focus for the government.

Remember this is all part of the Chinese government's plan - moving away from manufacturing-led growth to an economy that's more dependent on services and consumption.

But watch out for labour unrest as wages stagnate and more factory workers get laid off.

The elephant emerges, but slowly and not without a few stumbles

A key challenge for Prime Minister Modi is that his Bharatiya Janata Party doesn't have a majority in the parliament's upper house

India will be the standout performer in 2016, with growth forecast at more than 7.5%.

As a net oil importer, India will benefit from low oil prices - that will make it easier for the government to wean the gas-guzzling public off expensive fuel subsidies, and spend more of that money on big welfare programmes.

In theory, that should help boost consumption - a major driver of growth in India.

Also, higher wages for civil servants as a result of the Seventh Pay Commission's proposals should help to boost the spending power of India's middle classes and that will be positive for growth too.

But it's not all good news.

Economic reforms in India are necessary for its current growth to turn into a structural one.

The national sales tax needs to be passed, and reforms like these are key to increasing the growth rate.

The attempts to pass the GST (goods and services tax) constitutional amendment bill are still stuck in parliament over differences with the opposition Congress party.

Prime Minister Modi's Bharatiya Janata Party (BJP) doesn't have a majority in the parliament's upper house, so this will be a key challenge for him in 2016.

He also has to battle increasingly loud and credible accusations of intolerance in India, which even the central bank chief has pointed to as negative for an open and dynamic economy.

Japan - more of the same

Japan has a rapidly ageing population

Japanese companies should clock slow but steady growth in 2016.

A weaker Japanese yen will make exports more competitive, and as the US Fed continues to raise interest rates, the yen should become weaker.

The Fed's rate rises are predicated on a recovery in the US, which means more buyers for Japan's goods - so that's positive too.

Expect more monetary stimulus in 2016 as the Bank of Japan aims to boost the country's flagging economy ahead of an upper house election next year.

Prime Minister Shinzo Abe is under pressure to show that his reform agenda dubbed "Abenomics" is working.

But labour force issues will continue to dog growth.

Japan's population is shrinking and greying, which means the labour force is too.

Mr Abe has tried to push more women into the workforce with more female and family-friendly work policies in offices - but a male-dominated work culture is making that difficult.

South East Asia - not as bad as we thought, not as good as we hoped

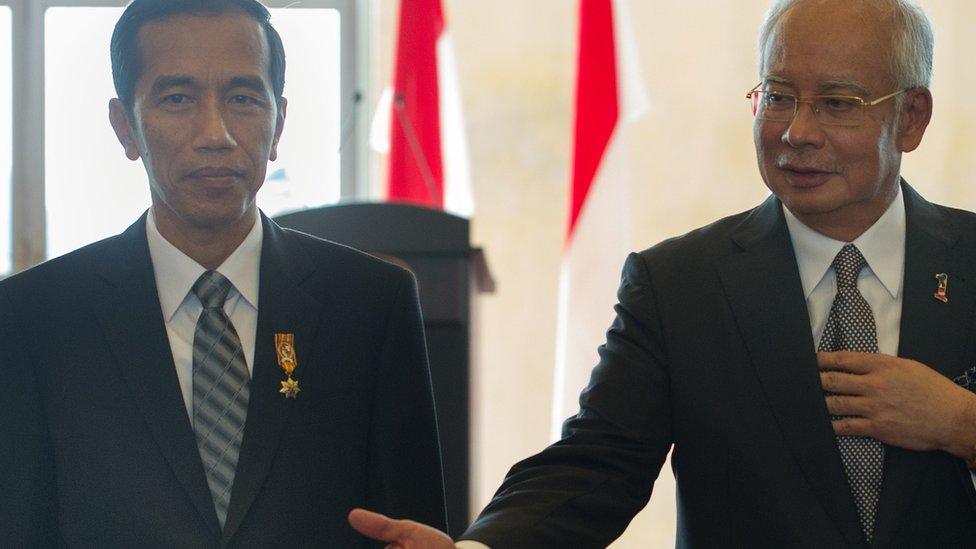

Indonesia's President Joko Widodo, left, and Malaysian Prime Minister Najib Razak are both suffering low approval rates

"Only when the tide goes out do you discover who's been swimming naked," is Warren Buffet's famous quote.

This couldn't be truer of some South East Asian economies which have spent the last decade benefiting from China's demand for their commodities - Indonesia and Malaysia, for example.

These countries should have used the last decade of growth to put in place economic reforms that could have helped them cope with the current slowdown.

But political interests outweighed economic ones, and that's now starting to pinch.

Malaysia and Indonesia are also at risk of further currency weakness, and capital outflows as the US Fed continues to hike interest rates.

Both Prime Minister Najib and President Joko Widodo are suffering from low approval ratings, and may move to protectionist policies to shore up their popularity with voters.

Those policies are unlikely to be sound economic decisions, so watch for more volatility in these markets in 2016.

These two leaders are also grappling with corruption scandals at home so they may well have their hands full trying to fight those fires.

But South East Asia could also see benefits from China's slowdown - as more factories move out of China to Cambodia, Vietnam and Myanmar.

The frontier economies are looking at growth of 6% to 7% next year, and in place to benefit from low-cost manufacturing. A young and relatively cheap workforce is poised to become the next big factory of the world.

Australia - the unlucky country?

Australia's new leader, Malcolm Turnbull, must navigate Australia out of the curse of the resource economy

Everyone's heard the phrase "Australia - the lucky country".

It's become a favourable nickname of sorts for the nation.

But the second half of that quote by Donald Horne is not as positive: "Australia is a lucky country run mainly by second-rate people who share its luck," he said.

"It lives on other people's ideas, and, although its ordinary people are adaptable, most of its leaders so lack curiosity about the events that surround them that they are often taken by surprise."

It would be unfair to put new Prime Minister Malcolm Turnbull into this category. After all he's just barely been in power for four months.

But he has to navigate Australia out of the curse of the resource economy.

Growth has slowed and mines are slashing jobs. Expect more mines to close.

Mr Turnbull has talked about the need to transition into a creative, innovative economy and has set up a 1bn Australian dollar ($723.2m; £487.5m) fund to boost growth in that area.

And while that may seem like a fair bit of money, a lot of technology firms say Australia's not the place to be raise cash or execute ideas.

Having said that, it's still a very nice place to live.

- Published22 December 2015

- Published16 December 2015

- Published16 December 2015

- Published15 December 2015