Volatile China markets calm down - for now

- Published

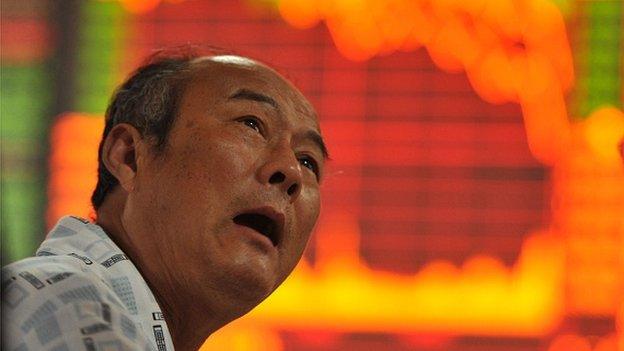

Small investors make up the bulk of the market in mainland China

Volatility is the word of the day - and perhaps of 2016 so far - at least when it comes to Asian markets.

Most of them opened lower on Tuesday in anticipation of a weaker start in China, but once Shanghai and Shenzhen recovered some of their losses, things calmed down across the region.

It certainly helped that regulators in China announced that Monday's "circuit breakers" - trading curbs that kick in when stock drops too far, too fast - were an attempt to calm markets and "protect investors".

China's security regulator also injected some $19.94bn (£13.5bn) into the money-market system, and said it might restrict share sales by major shareholders.

It appears authorities are trying to inject along with the money a sense that they are in control of the situation, monitoring things so they can step in again if it all goes pear-shaped.

On Monday, trading was halted as one index fell over 7% on weak manufacturing data

There is a precedent for this. The Chinese government put in place many measures after last year's crash, to stop shares from falling further.

They limited short-selling, threatened to arrest alleged market manipulators, ordered pension funds and large mutual funds to buy more stock, and imposed a six-month ban on large shareholders selling their stock.

That measure expires at the end of this week and there is speculation that smaller shareholders are selling their shares ahead of that, expecting further losses.

So markets are calmer - for now. But underlining Monday's falls was the continuing narrative that China's economy is slowing down.

That should not come as a surprise to anyone who has been paying attention, and it certainly should not come as a surprise to investors in China. What is under the spotlight though, is how authorities there manage China's "new normal".

- Published4 January 2016

- Published5 January 2016

- Published4 January 2016

- Published4 January 2016

- Published27 August 2015

- Published22 July 2015

- Published7 July 2015

- Published7 January 2016