Iran prepares to open the oil pumps

- Published

- comments

It is not the sexiest of titles. "Implementation day" refers to the date when Iran can start providing oil once again to the world markets.

But it is certainly one of the most important dates of the year for the global economy, alongside its major diplomatic and political significance.

Iran has the fourth-largest oil reserves in the world.

At one stage it was believed the implementation date would land at some point over the next six months as Iran moved to satisfy the International Atomic Energy Agency that its nuclear ambitions were purely civil.

Senior sources in the oil industry now believe "implementation day" will be much sooner.

One executive told me that plans were in place for January 27 after the IAEA cleared Iran's nuclear programme, external of having any offensive use.

John Kerry, the US Secretary of State, will front the announcement, the source said.

US oil exports

In terms of the energy market - and the price of petrol - Iran's re-entry is one of two important events that will mark 2016.

The other is the agreement that the US will start exporting oil, 40 years after the 1970s oil crisis led to a ban.

Both will add to an already over-supplied market.

Iran wants to increase production by as much as 2 million barrels a day from its present 2.8 million barrels.

By way of comparison, Saudi Arabia produces between 10 million and 11 million barrels a day.

And with Saudi Arabia signalling that it will maintain production in the face of Iran's return to the world stage - the kingdom does not want to lose market share to its arch-rival - there is scant evidence of upward pressure on the oil price.

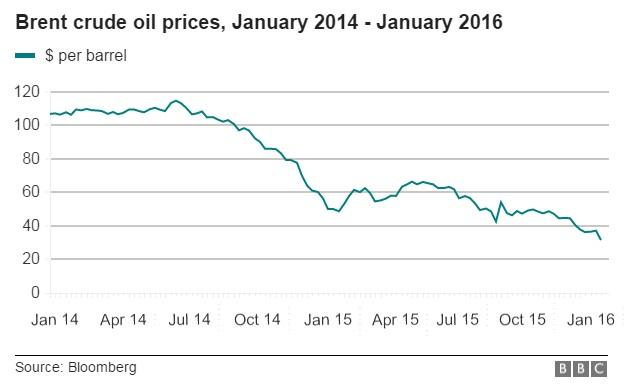

Brent Crude is languishing at just under $32 a barrel. It has fallen nearly 13% this week alone and by more than a third in the past year.

Such a sharp fall has changed the economics of oil production. One has only to read of the further job losses at BP's upstream business (that's the bit of the energy sector that explores and drills for oil) on Tuesday to see the effects. Another 4,000 jobs are to go at BP.

As Iran prepares to flex its oil producing muscles, the energy sector is braced for further downward pressure on the price of this vital global commodity.

- Published12 January 2016

- Published18 January 2016

- Published12 January 2016