Bank of England votes 8-1 to hold rates at 0.5%

- Published

UK interest rates have been left unchanged again at 0.5% by the Bank of England's rate-setters.

Eight of the nine rate-setters on the Monetary Policy Committee (MPC) voted for no change, with one voting for a rise.

The Bank rate has been at the record low of 0.5% since March 2009.

A number of economists have been pushing their expectations of the first UK interest rate rise from the end of 2016 into the start of 2017.

The Bank said: "All members agreed that, given the likely persistence of the headwinds weighing on the economy, when Bank rate does begin to rise, it is expected to do so only gradually and to a level lower than in recent cycles.

"This guidance is an expectation, not a promise."

Ian McCafferty, one of four external members of the MPC, has been voting for a rate rise for several months and had the same view at the latest meeting.

Inflation

The committee's minutes, external reveal a view that falling oil prices will mean any rise in inflation - which charts the cost of living - would be "slightly more gradual" in the near-term than forecast by the committee in November.

However, it expected inflation to increase to around the 2% target "once the persistent impact of lower energy and food prices, subdued world export prices and the past appreciation of sterling had dissipated". It added that inflation was likely to be at about 0.5% for several months this year.

The MPC also noted the fall in the value of the pound, which was partly attributed to actions by the European Central Bank.

"Since the start of 2016, however, some market contacts had additionally cited the forthcoming UK referendum regarding EU membership as a possible explanation for the depreciation of sterling," the minutes stated.

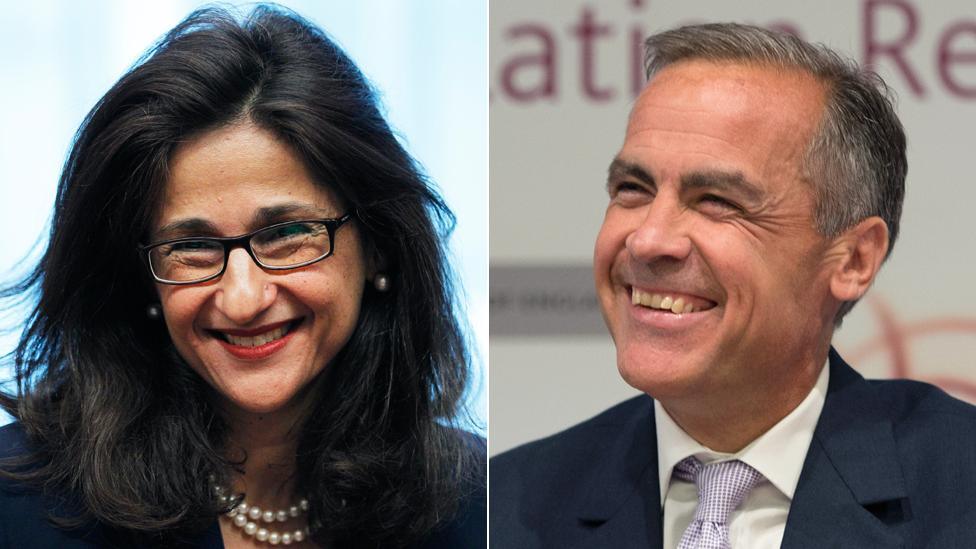

Analysis: Kamal Ahmed, BBC Economics Editor

The global risks are building.

Here is the MPC on the remarkable gyrations of the markets since the start of the New Year: "Recent volatility in financial markets has underlined the downside risks to global growth, primarily emanating from emerging markets."

And on confidence in the economy: "Business surveys imply that the near-term outlook for aggregate [economic] activity is slightly weaker."

And on the remarkable collapse of the oil price: "The 40% decline in oil prices means that the increase in inflation is now expected to be slightly more gradual in the near term."

It all makes for a rather gloomy soup. And some would argue pushes any interest rate rise into the relatively far future

Fragility

The decision to hold the Bank rate comes shortly after weak industrial output figures were released and estimates suggested UK economic growth had slowed.

Production fell 0.7% in November from October - the sharpest fall since early 2013, according to figures from the Office for National Statistics, external, released on Tuesday.

Also on Tuesday, the National Institute of Economic and Social Research (NIESR) predicted that UK economic growth slowed to 2.2% last year from 2.9% in 2014.

Meanwhile, the world economy remains in fragile condition, reflected by tumbling global markets last week after a run of poor economic data and interruptions to trading on Chinese stocks.

Last week, the Chancellor George Osborne warned the UK economy was facing "a dangerous cocktail of new threats" as a result of slow global growth and a drop in oil prices, which is a potential threat to the UK economy because of North Sea oil production.

The US Federal Reserve increased rates last month for the first time in nearly a decade, as the US economy expanded strongly last year.

Bank of England governor Mark Carney has already said the decision to raise rates in the US was "not decisive" for UK policymakers, stressing that any such move in the UK would be made according to UK economic conditions.

.

- Published14 January 2016

- Published13 January 2016

- Published14 January 2016

- Published7 January 2016

- Published10 September 2015