Iran: Business eyes new opportunities

- Published

It's only been a few days since UN sanctions against Iran were lifted but some firms have already announced plans to invest in the Iranian market.

Some companies have spent months plotting their return to a country rich in natural resources, with a large educated population and spectacular scenery.

European and Asian firms will get a head start, as US sanctions remain in place, making it extremely difficult for US firms to trade there.

There will be challenges for those who do take the plunge. Corruption is a big problem, commercial and labour laws are outdated and any legal issues could end up in Iranian courts - notorious for being slow.

But the potential for growth and profits will be hard to resist. We look at some of the more enticing opportunities.

Cars, trucks and buses

Daimler Trucks has wasted no time. It has already announced plans to restart sales and local production.

In partnership with Iran Khodro it will produce engines and and other parts. Daimler, which left Iran in 2010, says there is "huge demand for commercial vehicles, especially trucks".

Iran was the second biggest market for Peugeot-Citroen before it was forced to pull out in 2012. At its peak the company was selling 450,000 cars a year.

So the company is keen to get back into the market. Negotiations over a joint-venture to produce cars are "ongoing" according to Peugeot.

More immediately the company plans to open a showroom for its DS brand in Tehran along with a local partner.

But Peugeot can expect some competition. One analyst said that Volkswagen is considering a move into the Iranian market.

Car parts makers are also eyeing the opportunity, with tyre maker Continental thought to be looking at the market.

Analysts say that Tehran will be keen for overseas firms to transfer technical know-how to Iran and reinvest profits in the country. That could be a problem for firms who are worried about protecting their intellectual property, or want to be able to access profits.

Aviation

Airbus has already won an order for 114 aircraft from state carrier Iran Air. It could be the first in many new orders. One report in the Iranian press said the country could need almost 600 aircraft over the next decade.

However Airbus will face competition from Boeing, which is one of the few US firms which will be allowed to do business with Iran.

The US still has sanctions in place and the vast majority of US firms are still barred from operating in Iran.

Boeing is likely to win sales of its popular 737 narrow-body jets and bigger 777s for long haul flights.

However, at the moment, Boeing is being cautious: "There are many steps that need to be taken should we decide to sell airplanes to Iran's airlines. For now, we continue to assess the situation," the company said in a statement.

At the moment Tehran is the nation's hub for domestic and international flights.

Analysts say that other airports at other cities will have to be upgraded, including Iran's second biggest city Mashhad in the north-east, tourist destination Shiraz in the south-west and the important industrial city of Isfahan in central Iran.

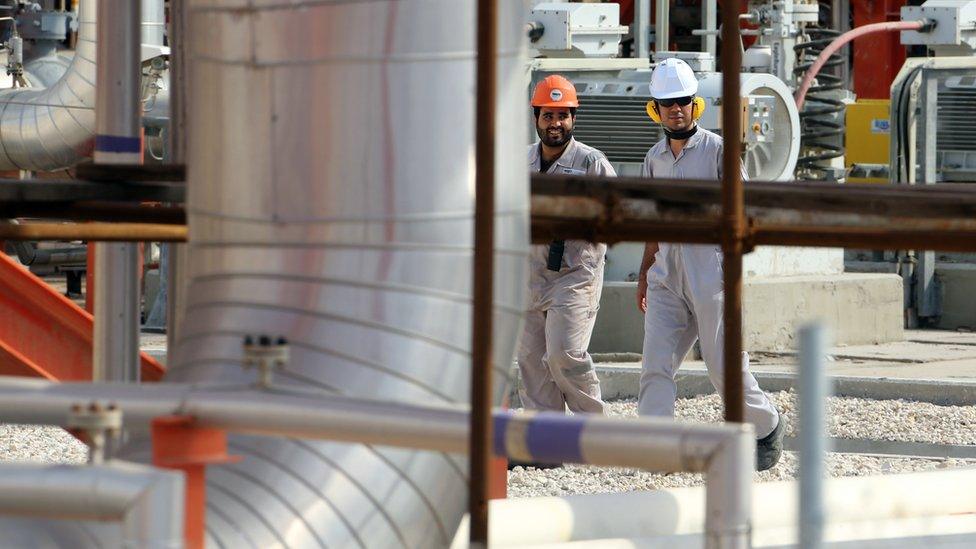

Oil

With the fourth biggest reserves of oil in the world, Iran is a potential bonanza for oil companies.

France's Total said that it is "eager" to return to work in Iran, where it has a long history.

Italy's Eni was one of the biggest buyers of Iranian oil before the sanctions hit. Its chief executive said that to become a major oil producer Iran would need $150bn of investment in its oil industry, which could take "four or five years".

Norway's Statoil is reported as saying it is "open to new opportunities" in Iran.

Anglo-Dutch giant Shell had an offshore oil project in Iran, but says it is "far too early" to say whether it will be investing again.

"We remain interested in exploring the role Shell can play in developing Iran's energy potential, within the boundaries of applicable laws," it said in a statement.

Not only does Iran have a lot of oil, it is also potentially cheap to exploit and that's important given the sharp fall in oil prices since 2014.

But due to a lack of investment, production has been falling. In 2015 it hit 2.9 million barrels a day, down from 3.7 million barrels a day in 2010, according to figures from Opec, external.

The Iranian government is also improving the investment model available to overseas firms, says Manouchehr Takin, an oil and energy consultant. He says we will find out more in late February when the Iranian government gives full details at a conference in London.

Gas

South Pars is the biggest gas field in the world, and a large part of it lies in Iranian waters. Like Iran's oil business, gas will need a lot of investment.

Gas is a slightly different proposition from oil, as it's more difficult to export.

Iran will have to decide whether to restart plans to develop liquefied natural gas (LNG), which can be shipped abroad or to build pipelines.

Iran had contracts with Shell, Spain's Repsol and France's Total to build three LNG plants but the projects were abandoned. It's not clear yet whether those plans will be revived.

However, German gas giant Linde has already expressed an interest in getting back into Iran's LNG sector.

In the pre-sanctions era there were plans to build pipelines to Europe, India, Syria and Turkey, but the projects were not completed.

Once again European and Asian firm will be keen to get into this promising sector.

Tourism

Back in October Iran's vice-president told the AP news agency that he was expecting a "tsunami" of tourists as a result of the lifting of sanctions.

With spectacular tourist attractions like the cities of Persepolis, Shiraz and Isfahan, Iran certainly has potential.

In 2014, the nation hosted over 5 million tourists, bringing in some $7.5bn in revenue, but Masoud Soltanifar told AP that Iran aims to attract 20 million tourists a year by 2025, generating £30bn a year.

"Wow that's a big number," said Tony Wheeler, reacting to that tourism target. Mr Wheeler founded the Lonely Planet travel guides and has visited Iran several times. He notes that Thailand, which has a well developed tourism industry, attracts 20 million tourists a year.

However, he points out, when Myanmar was opened to overseas investment, tourism numbers "jumped like crazy" and he thinks Iran could see a similar surge.

It is already an important destination for Shia pilgrims who account for a large proportion of visitors every year.

But according to travel expert Simon Calder, Iran is far from being a mainstream destination. Like other destinations in the Middle-East it is perceived as being dangerous and the lack of alcohol could put off some visitors.

A shortage of hotel beds is a problem, but international hotel chains are already looking to invest.

France's AccorHotels which owns the Novotel and Ibis brands opened two new hotels in Tehran. No doubt others will follow.

Mining and metals

Iran has significant deposits of zinc, copper, iron ore, silver and manganese. Although commodity prices have fallen, international firms are considering investing in the sector.

India's state-run aluminium firm Nalco is considering a $2bn investment to build a aluminium smelting plant. Others will no doubt be considering a move.

- Published23 November 2021

- Published17 January 2016