UK inflation rate rises to 11-month high in December

- Published

The UK's inflation rate rose to an 11-month high in December, with a sharp rise in air fares offsetting falling food and clothing prices.

The rate as measured by the Consumer Prices Index rose to 0.2%, from November's 0.1%, the Office for National Statistics (ONS) said., external

It is the first time in a year that the rate has exceeded 0.1%, and the rise is higher than economists had expected.

Air fares jumped 46% in December, the biggest rise for 13 years.

December typically sees a high monthly increase in air fares, due to the Christmas holidays, but the ONS said this jump was the highest since 2002.

But it warned that air prices were "highly variable" and said a November-to-December increase of more than 40% was not unusual.

Petrol prices, while lower than November, fell less than in the same period last year, so they also contributed to the rise in inflation, the ONS said.

This jump in transport costs was partially offset by a drop in alcohol, tobacco and food costs.

When will rates rise?

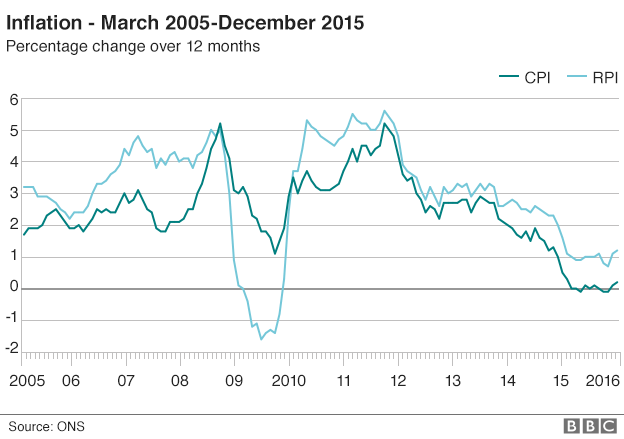

The Retail Prices Index, a separate measure that includes housing costs, grew by 1.2%, up from 1.1% in November.

Monthly inflation has been between -0.1% and 0.1% for the past 11 months, with low oil prices and a fiercely competitive environment for supermarkets keeping prices down for consumers.

For 2015 as a whole, consumer price inflation averaged 0%, its lowest level since comparable records began in 1950.

Latest minutes from the Bank of England's Monetary Policy Committee (MPC), which voted 8-1 to keep rates at their current historic 0.5% low, showed that members expect inflation to remain far below its 2% target for some time yet.

December's inflation figures will further dampen expectations of a rise in interest rates any time soon.

Most economists now believe that it could be the third quarter of this year, or even 2017, before there is any movement in interest rates.

"There aren't yet any signs which will worry the MPC. Inflation looks set to rise further over the coming months as sharp falls in petrol and food prices at the beginning of 2015 drop out of the calculation," said Scott Bowman, UK economist at Capital Economics.

"The MPC will be in no rush to push through the first rate hike."

Ben Brettell, senior economist at Hargreaves Lansdown, agreed, saying: "This continues the trend of inflation being at or very close to zero and places little pressure on the Bank of England to lift interest rates. Those hoping for higher rates on this side of the Atlantic shouldn't hold their breath."

- Published14 January 2016

- Published14 January 2016

- Published9 December 2015