Rolls-Royce shares climb 14% despite dividend cut

- Published

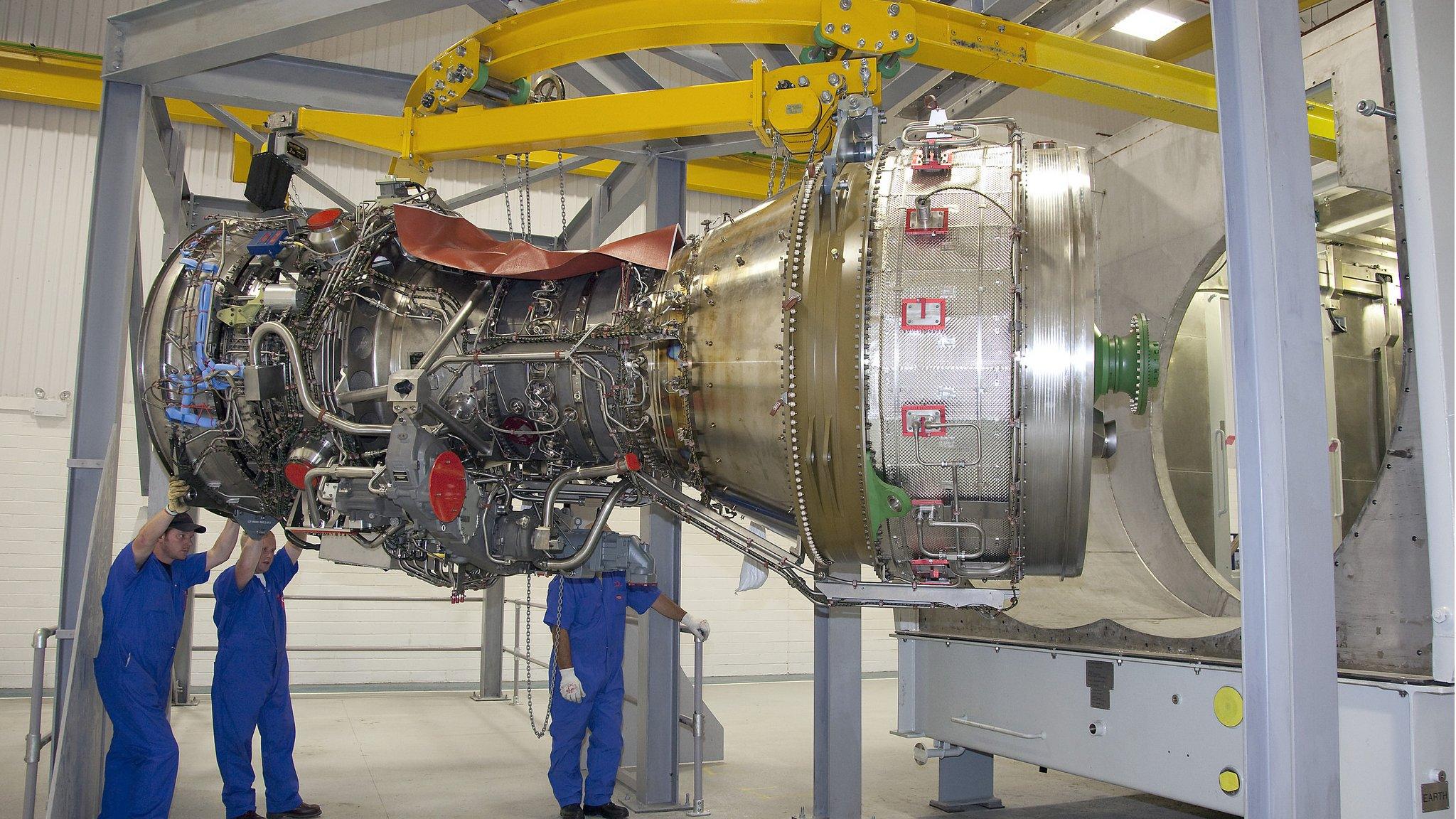

Aero engine giant Rolls-Royce's shares have risen to a gain of 14% despite a 50% dividend cut and profit at the low end of forecasts.

The company, which has issued a string of profit warnings in recent years, made £1.35bn before one-offs.

The chief executive said there would be further cost cuts on top of the £200m savings already planned.

Shares were buoyed by the prospect of further efficiencies and the fact that Rolls ruled out issuing more shares.

A rights issue of more shares would mean that the share of profits would be spread more thinly.

Russ Mould, investment director at AJ Bell, said in a note: "Investors breathed a sigh of relief that the group did not issue a further profit warning and that it only cut its dividend whereas many feared it might be scrapped."

Despite the gain in the share price, the biggest one-day move for more than 10 years, Rolls-Royce is trading at around half the level it reached last May.

The company said it had already made roughly 50% of those savings already announced.

Rolls-Royce employs more than 21,000 people in the UK, with more than 12,000 employed at its Derby aerospace engines and submarines division, and over 3,000 in Bristol.

Last year, the company announced 3,600 job cuts and warned that some of its 2,000 senior managers would depart.

Rolls also said it had cut the two top layers of management by 20% and planned further cuts.

It added that the initial exceptional restructuring charge for these changes would be £75m-100m this year.

'Accounting fog'

As well as its world-famous plane engines, the company also makes engines for the UK nuclear submarine fleet.

Its recent troubles have alarmed the government to the extent that the Business Minister, Anna Soubry, said in December that the government was "monitoring the situation carefully".

The next generation of nuclear submarines, due to be deployed by 2030, is being planned by the government.

Chief executive Warren East, who joined the company in July, has said an "accounting fog" had developed that had left investors unclear about its direction.

Mr East said: "In the context of challenging trading conditions, our overall performance for the year was in line with the expectations we set out in July 2015.

"It was a year of considerable change for Rolls-Royce: in our management, in some market conditions and in our near-term outlook."

He added that there were some positive notes, including the underlying growth of long-term markets and a growing order book.

To add to the company's problems, it is the subject of an investigation by the Serious Fraud Office.

Rolls said it was continuing to co-operate with the authorities in the UK, the US and elsewhere, but was unable to give any further details or a timescale for when the investigation would end.

- Published1 February 2016

- Published16 December 2015

- Published14 December 2015

- Published9 December 2015

- Published24 November 2015

- Published24 November 2015