British Gas profits jump by 31%

- Published

Centrica chief defends higher British Gas profits

Profits at British Gas have risen by 31% to £574m for the 12 months to 31 December as gas consumption increased.

The rise in operating profits compared with £439m for the previous year.

British Gas said, external gas usage rose by 5% despite the warmest December on record, as 2015 had more normal temperatures compared with a very mild 2014.

However, profits at its parent company, Centrica, fell by 12% to £1.46bn as wholesale gas prices fell sharply.

Energy suppliers have been under pressure to pass on savings to customers after significant falls in wholesale gas prices in the past year.

Centrica's chief executive, Iain Conn, stressed that the rise in profits at British Gas was not because of the fall in commodity prices and that the drop in wholesale costs had been passed on to customers.

"The reason the profits went up in 2015 versus 2014 actually is very simple - it's about the weather and about consumption," he told the BBC.

"We saw a very mild 2014 and we saw a more normal 2015 and therefore the amount of energy that our customers used went up and therefore the actual total profit went up."

He added that the wholesale costs were only part of the cost of a bill.

Analysis: John Moylan, Industry correspondent

With the energy sector in the midst of major competition probe, it's an awkward time for a big six supplier to be posting bumper results.

But British Gas says its profits are simply returning to more normal levels, having fallen back in 2014 due to warmer weather.

There's two main reasons why they've risen.

The first is that customers used 5% more gas.

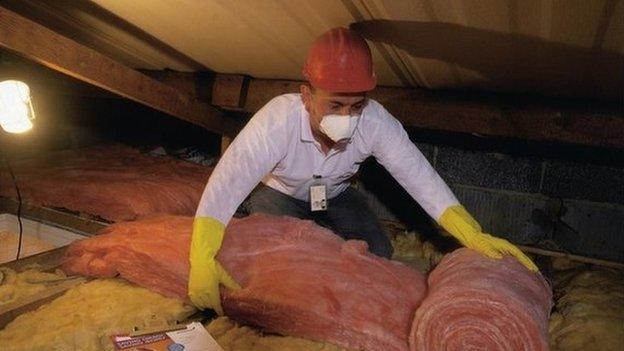

The second is that British Gas's costs - linked to the government's ECO energy efficiency programme - were lower compared to the previous year.

But Iain Conn, Centrica's boss, told me that falls in wholesale gas prices had been passed on in full.

And he added that if wholesale prices remain low, there may be room for further price reductions this year.

'Big issue'

The average annual British Gas profit has been £584m in recent years, Mr Conn said on a conference call.

Asked about the Brexit issue, he said that the UK was "better off inside" the European Union given the country's reliance on gas imports from the bloc and Norway.

That meant European gas prices were a "big issue" for the UK and it was difficult to see how Britain could influence EU energy policy by not being an EU member, he said.

Last week British Gas - the UK's largest energy supplier - said it was cutting gas prices by 5.1%, the last of the big six energy suppliers to do so.

E.On, EDF, SSE, Scottish Power and Npower have all cut gas prices by similar amounts.

The Competition and Markets Authority has been conducting a wide-ranging investigation into the UK's energy suppliers since last summer.

It estimates that consumers overpaid by £1.2bn a year between 2009 and 2013.

Electricity bills

Ann Robinson, director of consumer policy at uSwitch.com, said: "British Gas has cut standard gas prices three times in the last past year, but it should now go further and reduce electricity bills too."

However, Mr Conn said that the wholesale cost of electricity accounted for only 40% of customers' bills and that other costs, such as distribution and government levies continued to rise.

Last year British Gas made a profit of £55 per customer after tax, he said on a conference call, which was in the middle of its £42 to £65 average range.

David Hunter, energy analyst at Schneider Electric, said the higher profits for British Gas would put the company under more pressure.

"With prices slashed by only 5%, standard tariffs are barely more competitive than they were, and still a long way off the fall in wholesale prices. With these tariffs still up to £450 a year more expensive than the best deals, consumers are being left out of pocket," he said.

As well as selling energy through British Gas, Centrica is also a major producer of natural gas and oil. Following the slide in prices for natural resources, the company is reducing its exploration and production activities.

Steve Clayton, head of equity research at Hargreaves Lansdown, said: "Centrica invested £9bn in its upstream gas and power operations between 2007 and 2014. This left the group very exposed to falling oil and gas prices."

Shares rise

Centrica has written down the value of its oil and gas assets and power stations by £2.4bn.

Those charges contributed to a statutory operating loss of £857m, although that was lower than the £1.137bn for 2014.

Centrica shares, which have fallen by about a quarter in the past 12 months, closed up 6.85%, making the stock the biggest riser on the FTSE 100.

The company confirmed that the full-year dividend would be 12p a share, down from 13.5p for 2014, in a blow to its millions of shareholders.

Earlier this month, British Gas announced 500 job cuts, mostly in its energy efficiency business.

- Published18 February 2016

- Published11 February 2016

- Published2 February 2016