Pound hits lowest level against dollar since 2009

- Published

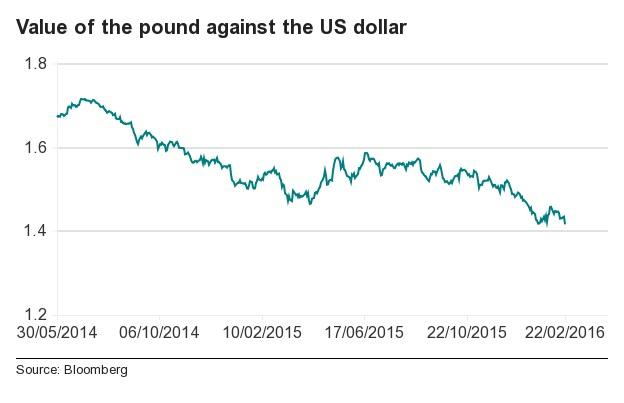

The pound hit its lowest level against the dollar in almost seven years on concerns about a possible UK exit from the European Union.

At one stage it was down as much as 2.4% at $1.4058, its lowest level since March 2009, before later recovering.

The move follows London Mayor Boris Johnson joining the campaign to leave the EU after Prime Minister David Cameron set a June referendum date.

The steep fall adds to losses made by the pound over recent months.

At 16:00 GMT the pound was trading at $1.4135, down 1.4% from the previous close.

'Uncertainty'

So far this year, fears of a British exit from the EU - dubbed 'Brexit' - have already pushed the pound down by more than 4% against the US dollar.

Analysts said that was likely to continue to direct sentiment until the vote.

"Today's weakness appears to reflect an increased probability of Brexit after political reaction to the new deal on EU membership was more split than the PM would have hoped," said Sam Hill, senior UK economist at RBC Capital Markets.

If the pound finishes at its lows for the day, it will be the biggest one-day loss since the Bank of England cut interest rates to 0.5% in 2009 and started its economic stimulus programme known as quantitative easing.

Analysis: Kamal Ahmed, BBC economics editor

To an extent sterling's weedy day is down to markets "pricing in" the chance of Britain leaving the EU.

In the short term at least, many market participants believe a "Brexit" would lead to a weaker currency as worries about Britain's £229bn annual trade with the EU and the possibility of new trade barriers heave into view.

There are other factors at play.

The dollar has had a strong recent run against the euro and the Swiss franc as well as sterling.

That's down to the Federal Reserve's decision to raise interest rates in December and signal that it may do again during 2016.

Confidence in the US economy may not be boundless, but it is stronger than confidence in the eurozone.

At the same time the European Central Bank and the Bank of England have been sending out very doveish messages on interest rate rises.

Against the euro, the pound is down 1% to €1.2802. Against the yen, the pound has slumped to 160.075 yen, its lowest since late 2013.

"I don't think investors are saying Brexit is good or bad, but it's the uncertainty," said Simon Smith, chief economist at FxPro.

The pound has already dropped more than 17% against the dollar in the last 18 months, partly due to the outlook for UK interest rates.

Whereas the US raised rates last year, Bank of England governor Mark Carney has ruled out such a rise for now.

As a result sterling is seen as less attractive for investors, continuing to fall from the $1.7165 peak seen on 1 July, 2014.

A weak pound helps exporters by making British goods cheaper on international markets.

It also makes the UK a better value destination for tourists.

However, a weaker pound makes imports more expensive, possibly hurting consumers and businesses that rely on foreign goods.

Credit risks

Meanwhile, ratings agency Moody's said: "The economic costs of a decision to leave the EU would outweigh the economic benefits."

Investment would suffer due to political uncertainty and exports would decline unless a new trade deal was struck with the EU, the credit agency said, external.

Moody's said it would consider downgrading the UK's credit rating - which affects how expensive it is for the government to borrow money - if the country voted to leave the EU.

However, another credit agency Fitch said Brexit would be "only moderately negative" if trade deals were secured.

David Cameron announced on Saturday that the EU referendum would be held on 23 June after he came back from Brussels with a renegotiation of Britain's EU membership.

The intervention by Boris Johnson is being seen as a significant blow to Mr Cameron's campaign to remain in the EU.

Several other senior Conservatives - including Justice Secretary Michael Gove - have already said they would join the Out campaign.

- Published22 February 2016

- Published22 February 2016

- Published20 February 2016

- Published19 January 2016