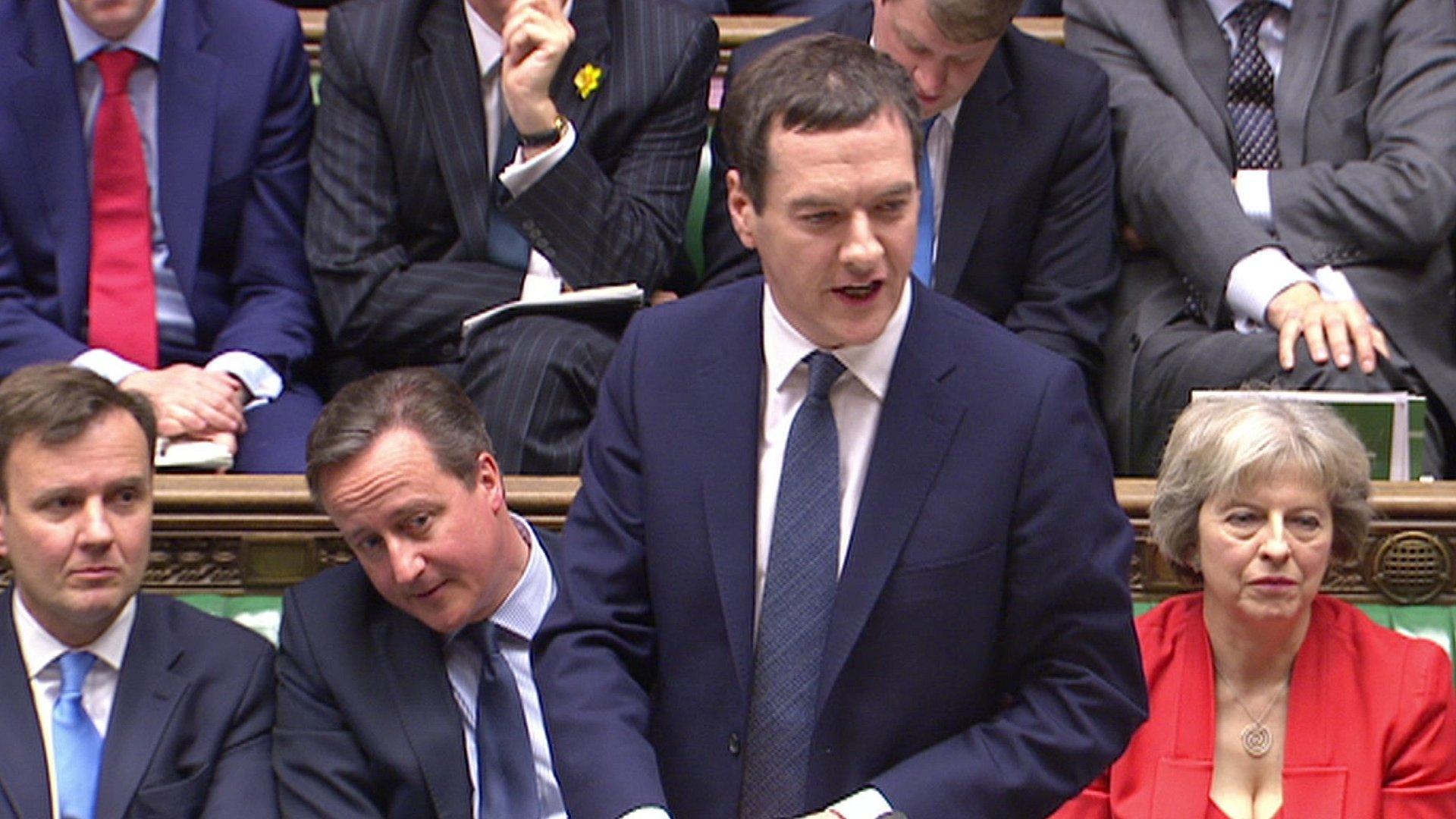

How will Chancellor George Osborne reach his surplus?

- Published

Slower economic growth has meant Chancellor George Osborne has rethought how he will meet his target to spend less money than he brings in by 2020.

The Office for Budget Responsibility now sees 2016 growth of 2%, down from the 2.4% expected in November.

That is the effect of what he describes as a "dangerous cocktail" of global economic risks and slower economic growth than was predicted.

It means a cut of nearly £30bn to close the gap in the last year of the decade.

In 2019-20, the government plans a surplus of £10.4bn.

In the year before, it is a deficit of £21.4bn. How will he pull this off?

'Shuffling' the numbers

According to the chancellor's numbers, nearly £10bn of the swing comes from a change of heart in how large companies will pay tax.

The government had wanted companies to start paying their tax in the year they earn profits. That plan has been put on hold for two years. The effect is a lot less tax paid in the financial year to 2019 - almost £4bn less - and almost £6bn more in the year to 2020.

This £10bn change is part of what OBR chief Robert Chote referred to as "shuffling" money around.

Another £3.5bn comes from cuts in government departments, this being the "50p in every £100 the government spends" Mr Osborne unveiled on Sunday. But he doesn't know where the cuts will come yet.

"There will be an efficiency review to inform future spending decisions," the Treasury said. The review will report in 2018.

The government will bring forward infrastructure spending, which means just less than £1bn more spending in the 2019 year and more than £1.5bn less spending in the 2020 financial year, a £2.5bn difference.

Economic 'deterioration'

It will cut £2bn in spending for public service pensions.

Most of the remainder of the gap is formed of cuts already planned by the chancellor.

"He's reacting to a deterioration" in the economic environment, according to Ian Stewart, chief economist at Deloitte. Mr Osborne is betting that the economy "will be in a better position to take the spending cuts than it is now", he said.

Mr Osborne is increasing spending in places, or cutting his potential income. A longer school day and breakfast clubs will cost £350m in the 2020 year, while bigger tax-free savings allowances will cost £590m.

Budget figures show a tougher economic environment meant 2020 would have seen a £3.3bn deficit without Mr Osborne making more cuts

- Published16 March 2016

- Published16 March 2016