Sugar tax surprise in Budget - but growth forecasts cut

- Published

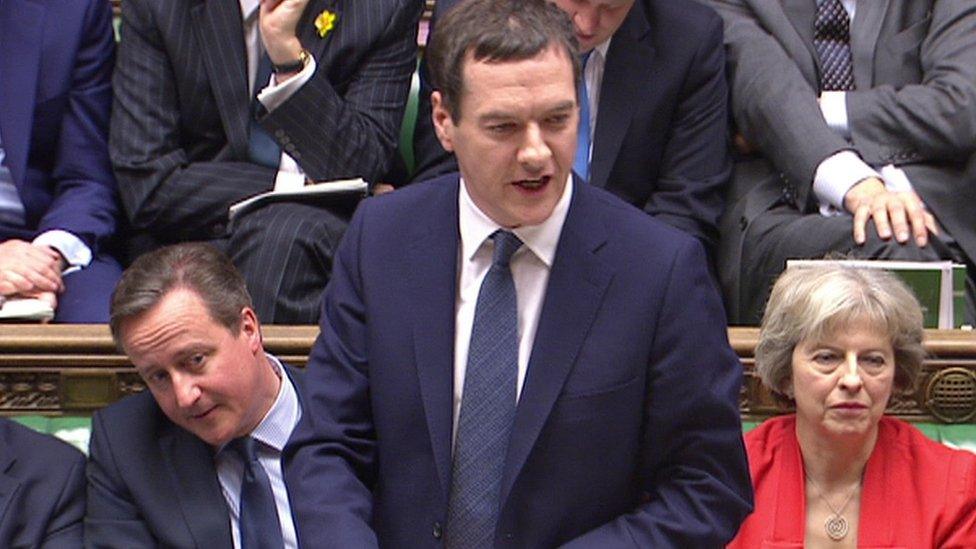

The chancellor opened his 2016 Budget with comments about the UK economy

George Osborne has unveiled a tax on sugary drinks in a wide ranging Budget dominated by gloomier growth forecasts.

The chancellor blamed the slowdown on a "dangerous cocktail" of global risks and said the UK had to "act now so we don't have to pay later".

He announced an extra £3.5bn in spending cuts - and sparked controversy by warning of the risks of EU exit.

But Labour contrasted a lowering of corporation tax with cuts to disability payments.

Key Budget announcements include:

Growth forecast cut for the next five years and £3.5bn in extra public spending cuts by 2020

Mr Osborne has missed his target of cutting debt as a share of GDP

A 2% increase in tax on cigarettes and 3% on rolling tobacco from 18:00 GMT, but beer and cider duty will be frozen as will the levy on whisky and other spirits

Plans for a longer school day in England

The rate at which workers start paying the top rate tax is to be raised from £42,385 to £45,000, with the tax-free personal allowance raised to £11,500 and corporation tax to be cut to 17% by April 2020

On savings, the ISA limit will be increased to £20,000 a year for all savers, and lifetime ISAs with a 25% bonus will be introduced for young people

An extra £700m for flood defences - to be paid with a 0.5 percentage point increase on the tax on insurance premiums

The higher rate of Capital Gains Tax is being cut from 28% to 20%

The £530m raised by a tax on the sugar content of soft drinks - the equivalent of about 18-24p per litre, the government says - will be spent on primary school sports in England, with the devolved administrations in Scotland, Wales and Northern Ireland free to decide how to spend their share.

Mr Osborne's sugar tax announcement sparked a big fall in the share price of soft drinks makers but it was welcomed by TV chef Jamie Oliver, who has been campaigning for such a move.

Sugar tax in focus

Jamie Oliver hails "a big moment in child health"

The tax will be levied on the volume of the sugar-sweetened drinks companies produce or import.

The Office for Budget Responsibility says it could result in a "pretty substantial price rise" on products - as much as 80% on, for example, a two-litre bottle of own-brand cola.

There will be two bands - one for total sugar content above 5 grams per 100 millilitres; a second, higher band for the most sugary drinks with more than 8 grams per 100 millilitres, with the levels yet to be set.

Sugar in fizzy drinks

35g

The amount of sugar in a 330ml can of Coca-Cola (7 teaspoons)

30g

The recommended max. intake of sugar per day for those aged 11+

-

£520m The amount George Osborne expects the sugar tax to raise

Examples of drinks which would currently fall under the higher rate of the sugar tax include full-strength Coca-Cola and Pepsi, Lucozade Energy and Irn-Bru, the Treasury said. The lower rate would catch drinks such as Dr Pepper, Fanta, Sprite, Schweppes Indian tonic water and alcohol-free shandy.

BBC health editor Hugh Pym said the tax had come as "a bolt from the blue" - particularly as Downing Street had opposed the idea last autumn. It was attacked at the time by some Conservative MPs as "nannystate-ism".

In his biggest Parliamentary test to date, Labour leader Jeremy Corbyn delivered the Opposition's response, describing Mr Osborne's Budget as "the culmination of six years of his failures" which had "unfairness at its core".

The Labour leader said the financial proposals failed on productivity, investment and in tackling inequality - and gave tax cuts to the wealthy while disabled people lost more than £1bn.

Jeremy Corbyn: Osborne's Budget is culmination of "six years of his failures"

But he welcomed Mr Osborne's sugar tax, which will be introduced in two years' time and will not apply to fruit juices or milk-based drinks.

Announcing the move, Mr Osborne said: "I am not prepared to look back at my time here in this Parliament, doing this job and say to my children's generation: 'I'm sorry - we knew there was a problem with sugary drinks. We knew it caused disease. But we ducked the difficult decisions and we did nothing'."

BBC experts analyse the Budget

Mr Osborne said the UK was still on course to clear its deficit by 2019/20 thanks to the extra spending cuts.

But in a move that has angered Conservative colleagues who want the UK to leave the EU, he cited the Office for Budget Responsibility's view that the UK would be "safer, stronger and more secure" if it remains in.

Some of the key announcements from George Osborne's 2016 Budget

Tory MP and Leave campaigner David Davis said: "The real risks for Britain lie in remaining within the EU."

Mr Osborne's package includes a £1.5bn plan to turn all state schools into academies.

A Budget day tradition: George Osborne posed with his Treasury team before the speech

David Cameron seemed keen to see Jeremy Corbyn's reaction to a point from his chancellor

In other Budget announcements, Mr Osborne committed £300m for transport projects, although almost half of the money committed was announced in the Autumn Statement.

The lower growth forecast from 2.4% to 2% in 2016 was driven by a reduction in the OBR's productivity forecasts.

The OBR also said the government was going to breach its own welfare cap in every remaining year of this Parliament.

The additional spending is mainly caused by more people than expected being eligible for disability benefits, with the Personal Independence Payment (PIP) scheme costing £3bn more than expected in July.

Cuts aimed at saving £1.3bn were announced last week.

There will be new action to tackle overseas retailers who store goods in Britain and sell them online without paying VAT - and new tax free allowances for "micro entrepreneurs" who rent their homes or sell services through the internet.

Reforms to business rates will mean 6,000 small businesses pay no rates and 250,000 have their rates cuts from April 2017, said Mr Osborne.

He announced a major overhaul of the North Sea tax regime aimed at helping the UK's oil and gas industry, effectively abolishing the Petroleum Revenue Tax.

The SNP's deputy leader Stewart Hosie welcomed the move - but criticised the overall Budget package, saying Mr Osborne had "failed to tackle the debt, the deficit and the borrowing as he promised" and urging him to abandon austerity and invest more in growth.

- Published16 March 2016

- Published16 March 2016

- Published16 March 2016

- Published15 March 2016