New state pension system is underway

- Published

An overhauled state pension - being paid to new, rather than existing pensioners - has begun, with some set to gain while others lose out.

The government's long-term aim is simplification, stripping away extras such as the second state pension.

It will also become cheaper, in time, for the government with many of those in their 20s and 30s receiving less than they would under the old system.

But in the short-term, the self-employed particularly will benefit.

A Department for Work and Pensions (DWP) spokeswoman said: "Millions stand to gain from the changes to the state pension, including women and the self-employed who so often lost out in the past.

"The new state pension, external will provide a sustainable system for future generations who will also benefit from workplace pension savings throughout their careers."

However, the independent Institute for Fiscal Studies (IFS) said that the new single tier, or flat-rate, element of the new system may have been overstated, leading to the risk of "disillusionment" from new pensioners.

"The aim is to replace the complex mess of existing rules with a new, far simpler system that rewards a wide range of contributions - whether that be paid employment or caring for children - in exactly the same way," said Rowena Crawford, of the IFS.

"We estimate that women will gain on average £5.20 per week in additional state pension income at the state pension age, and those who have been self-employed for at least 10 years will gain an average of £7.50 per week.

"But continued complexity is unavoidable in the short-run. There is a considerable risk of disillusionment as people start claiming pension incomes this year."

She said that some would receive a "nasty surprise" when they realised they would receive less than the advertised "flat-rate" of £155.65 a week.

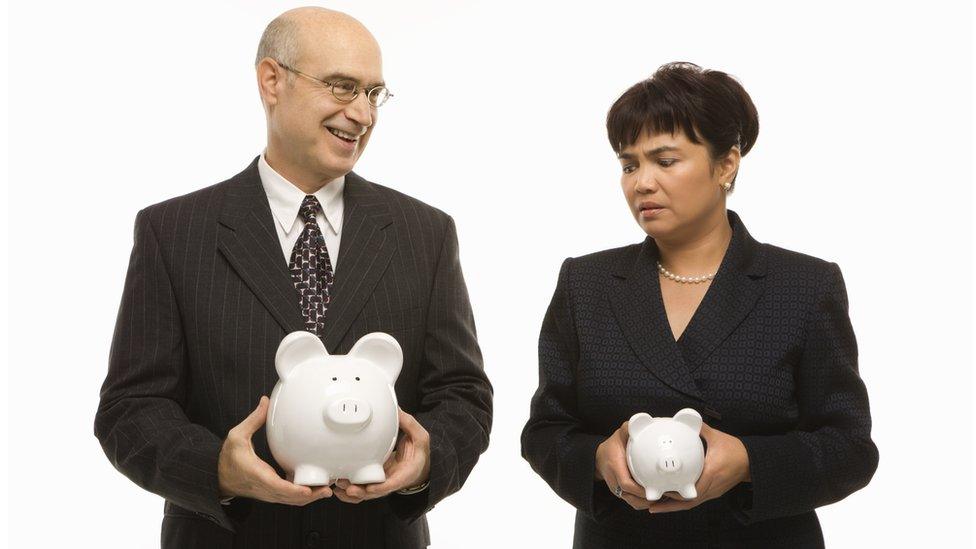

Winners and losers

For more information about whether you are a winner or a loser under the new system, click here.

Complex rules

The basic state pension, which is still being paid to existing pensioners, is worth about £120 a week, plus top-ups such as the state second pension for those who qualify.

The new state pension will be paid to men born after 6 April 1951 and women born after 6 April 1953.

To qualify for any state pension under the new system, individuals will need to have 10 years of National Insurance contributions. To receive the full amount, of £155.65, they will need to have 35 qualifying years.

Some, primarily public sector workers, will receive less than the full amount if they were contracted out of the state second pension. In practical terms, this meant they paid less in National Insurance contributions, but more into their workplace pension scheme.

As changes to the state pension come into place, who will financially benefit, and who will be worse off?

The most significant change in the long-term is the abolition of the state second pension.

The effect, as revealed by BBC News earlier in the week, is that 11.4 million younger workers will get less out of the new system than they would have done had the old system carried on, according to the Pensions Policy Institute.

By 2050, about half of retirees will get a higher pay-out, with half getting a lower pay-out.

Assuming a pension age of 70 by then, in general, people born before 1980 can, on average, expect to do better out of the new system, but those born after that date are likely to fare worse.