Why the top 10 tax havens don't include Panama

- Published

The sign in front of the building that houses the law firm Mossack Fonseca

The huge leak of documents from the Panamanian law firm Mossack Fonseca has revealed how tax havens are used to hide wealth and has focused the world's attention on the Central American nation.

The Panama Papers revelations have prompted the country to create an international panel to help improve transparency in its offshore financial industry.

But international organisations which investigate financial secrecy warn that Panama is not even in the top 10 countries with the least financial transparency.

They say that rich Europeans and North Americans can easily hide their money much closer to home. And this may explain why so few US residents have so far been implicated in the Panama scandal.

'Dirty money'

Ramon Fonseca, co-founder of the company at the centre of the Panama Papers leak, says that the focus on his company and country is unfair

The co-founder of Mossack Fonseca, Ramon Fonseca, accuses richer countries of hypocrisy.

"I assure you there is more dirty money in New York, Miami and London than there is in Panama," he told the New York Times.

But is he right?

The Tax Justice Network, an independent organisation which analyses international tax and financial regulation has created a list that ranks countries according to the strength of their financial regulation and the volume of their transactions.

The top ten for financial secrecy

Switzerland

Hong Kong

USA

Singapore

The Cayman Islands

Luxembourg

Lebanon

Germany

Bahrain

United Arab Emirates

It's notable that Panama does not even make the top ten

"There is a double standard: many developed countries host or support jurisdictions where there is an absence of financial transparency," says Alex Cobham of Tax Justice Network.

Switzerland leads the ranking with its almost impenetrable tradition of secrecy in banking, even if - under international pressure - it has recently made some concessions towards identifying the owners of accounts linked to international tax evasion investigations.

Hong Kong: Mossack Fonseca's busiest office

Hong Kong was a British colony until 1997 but is now administered by China

Hong Kong follows hot on Switzerland's heels in the ranking. The former British colony, now a special administrative region of China, is of "great concern", according to the Tax Justice Network.

The Panama Papers reveal that nearly one third of Mossack Fonseca's business came from its offices in Hong Kong and China - making China the firm's biggest market and Hong Kong the company's busiest office.

Hong Kong allows so-called bearer shares, which facilitate the movement of funds without knowing to whom the money belongs.

USA: Keeping US money at home

The US state of Delaware has almost one firm for each resident

Within US borders and just a stone's throw from the White House, the east coast state of Delaware is home to around 945,000 firms, which equates to almost one for each resident.

Delaware is one of four US states - the others are Nevada, Arizona and Wyoming - that have been criticised for their lax financial regulation. Many of the firms are suspected of being "ghost companies".

Transparency International, an anti-corruption campaigning movement, describes the state as a "transnational crime haven".

British Overseas Territories - sunny places for shady people?

Ugland House in the Cayman Islands is the registered office for 18,000 companies

President Obama told a debate in New Hampshire in 2008 about the case of Ugland House, a building in the Cayman Islands which he said hosted 12,000 companies.

"That's either the biggest building or the biggest tax scam on record," the President said. Ugland House's own website, external now says the building is the registered office of 18,000 companies.

Although the Cayman Islands are self-governing, they are a British Overseas Territory.

The Tax Justice Network's Alex Cobham suggests that if such dependencies are included in the British ranking, it would place the UK at the very top of the list.

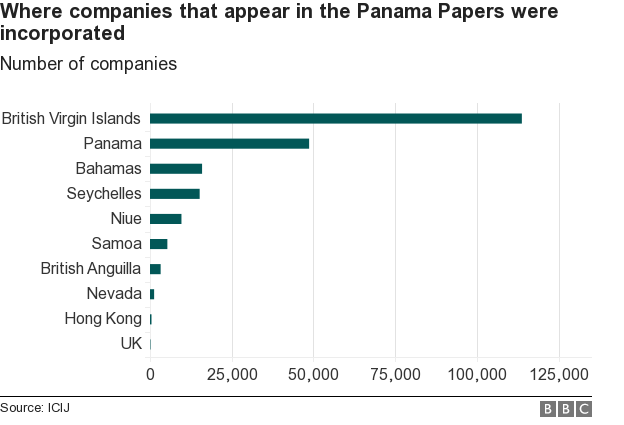

Another UK Overseas Territory - the British Virgin Islands - features strongly in the Panama Papers. More than twice as many companies involved in the leak are registered there than in Panama.

Closing the loopholes

Panama is not the only country which has promised to take action to improve its financial transparency.

The leaders of the G8 major economies agreed new measures to clamp down on money launderers, illegal tax evaders and corporate tax avoiders at a summit in 2013.

The summit communique urged countries to "fight the scourge of tax evasion".

Developed countries may have their work cut out for them, however.

Jason Hickel of the London School of Economics estimates that tax havens collectively hide a sixth of the world's total private wealth.