Barclays profits drop by a quarter

- Published

Barclays has reported a 25% drop in profits for the first quarter of the year, dragged down by the performance of divisions it plans to sell off.

Pre-tax profit for the first three months of the year was £793m, down from £1.1bn for the same period last year.

The bank , externalsaid its so-called non-core divisions lost £815m.

Barclays warned last month that its first quarter would be weaker than last year due to turbulent market conditions and a "particularly strong" March 2015.

Barclays chief executive Jes Staley said the bank had made "good early progress" against its cost cutting and restructuring strategy, which it announced last month.

In March, Barclays said it would split itself into two main core divisions - Barclays UK and Barclays Corporate and International - to meet new banking regulations, which are aimed at preventing ordinary customers suffering from decisions made by investment bankers in the event of another financial crisis.

Profits at these two divisions rose 18%.

But losses at its non-core division, which contains a range of business lines including its European retail operations and some of its Asian banking operations, widened to £815m from £310m a year ago.

The bank plans to have sold off its entire non-core division by the end of next year.

Barclays boss Jes Staley said the group's core business was performing well

Revenues at its investment bank fell 31% in the quarter, but Mr Staley, who took the helm in December, said the bank had outperformed rivals.

"We think we've picked up significant market share so we're pleased by that.

"We're not satisfied by the level of profitability we have in our corporate and investment bank, but we are encouraged by our relative performance in the first quarter," he said.

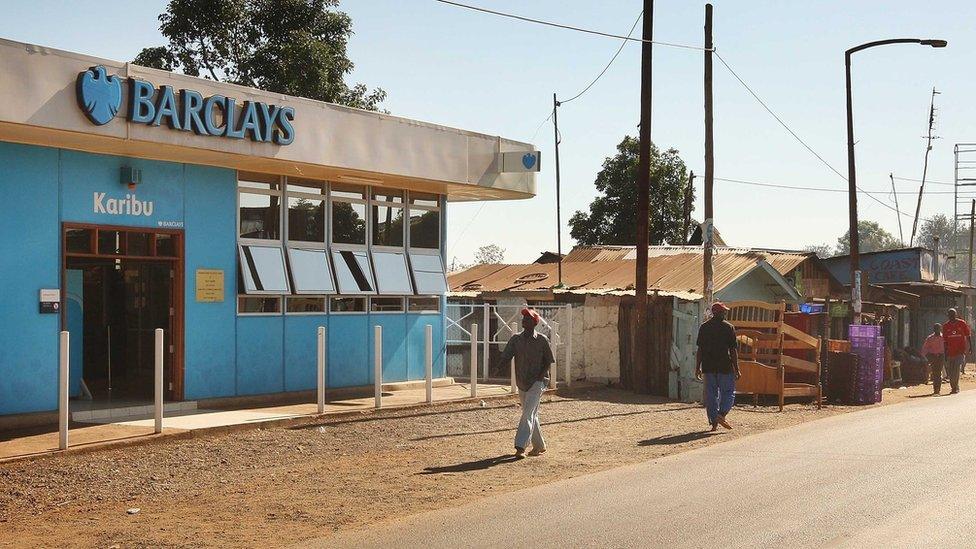

The bank also said last month that it would offload most of its stake in its Africa business. In its latest statement, Barclays said it was "continuing to explore opportunities" to reduce its share in the Africa business.

Barclays said it was continuing to explore opportunities to reduce its share in its African business

'Showing promise'

Mr Staley insisted the group's core business was performing well "despite a challenging market environment".

"We continue to target cost reductions in the group and we are on track to meet our 2016 guidance," he added.

Barclays also warned it was "cautious" ahead of the EU referendum vote on 23 June.

It said there had been little improvement so far in the performance of its investment banking division in the second quarter, but said it was "too early" to make any specific comment on its overall performance for the quarter.

Richard Hunter, head of research at Wilson King Investment Management, said the results showed "the potential of a newly streamlined Barclays".

"Stripping out the non-core business, performance at both UK and Corporate & International is showing promise, with the latter being rather less impacted than expected by the volatility of global markets in the first quarter," he added.

Santander results

Separately, Spanish banking giant Banco Santander, the eurozone's biggest bank, also reported a fall in profits on Wednesday.

The bank said, external profit dropped 5% to €1.6bn (£1.2bn) in the first three months of the year, mainly due to a fall in the Brazilian Real and sterling. The bank said excluding the impact of exchanging all its earnings into euros, its profits would have risen 8%.

Banco Santander makes about a fifth of its profit in Brazil, its second-biggest market after the UK.

Despite the profit fall, group chairman Ana Botín said the bank's performance was better-than-expected and "gives us confidence that we will continue to deliver".

In the UK, Santander's pre-tax profits rose 13% to £532m in the first quarter of the year, up from £470m a year earlier.

- Published1 March 2016

- Published1 March 2016

- Published21 January 2016