UK house price growth slows in April, says Nationwide

- Published

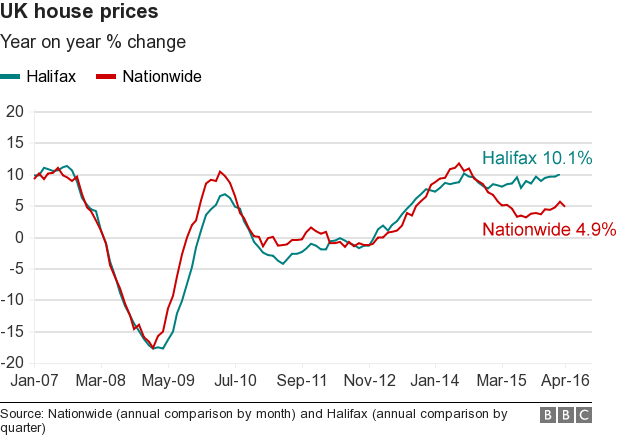

UK house price growth slowed in April, following the surge of buying in March, according to the Nationwide Building Society.

The annual pace of house price growth slowed to 4.9% in April, compared with 5.7% in the previous month.

In April alone, house prices rose by just 0.2%, the lowest monthly increase since last November.

Meanwhile a survey of surveyors has suggested that demand for commercial property has slumped to a record low.

The study - for the Royal Institution of Chartered Surveyors (Rics) - concluded that international investors have been put off by the possibility of the UK's exit from the European Union.

'Temporary boost'

Nationwide said April's slowdown in house price rises came after the number of property sales in March hit a record high, when landlords rushed to beat an increase in stamp duty.

There were 165,400 transactions during the month, according to HM Revenue and Customs (HMRC), higher than the previous peak of 149,000 in January 2007.

"It may be that the surge in house purchase activity resulting from the increase in stamp duty on second homes from 1 April provided a temporary boost to prices in March," said Robert Gardner, Nationwide's chief economist.

Nationwide's figures, external show that the price of the average house or flat in the UK increased to a new record high of £202,436.

"House purchase activity is likely to fall in the months ahead given the number of purchasers that brought forward transactions," said Mr Gardner.

"The recovery thereafter may also be fairly gradual, especially in the BTL [Buy-To-Let] sector, where a wealth of other policy changes, such as the reduction in tax relief for landlords from 2017 are likely to exert an ongoing drag."

Commercial property

The Rics survey indicated that demand from foreign investors for UK commercial property is now at its lowest level since it started keeping records three years ago.

Uncertainty about the EU referendum was cited by 38% of Rics members as the reason for that lack of interest.

"There is no doubt that since the EU referendum became a certainty following the general election last May, we have seen a decline in interest from overseas investors in UK commercial property," said Rics chief economist Simon Rubinsohn.

"At least in the short-term, we know that international retailers and service providers are finding the UK market less attractive."

Of the surveyors questioned, 43% said that a UK exit from the EU would have a negative impact on the commercial property sector, while 6% said it would be beneficial.