Third bankruptcy of BHS buyer revealed

- Published

Dominic Chappell, whose consortium bought the failed retailer BHS last year, has been declared bankrupt three times, it has been claimed.

It had been known that Mr Chappell was made bankrupt in 2005, following a dispute with an estate agent, and again in 2009 after a failed property scheme.

However, he was also made bankrupt in 1992, at the age of 25, the Sunday Times reported.

BHS collapsed into administration last month.

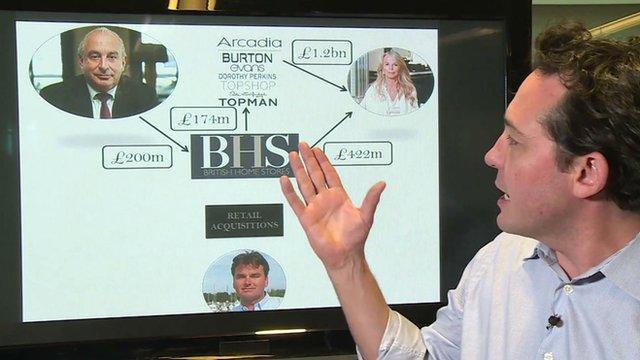

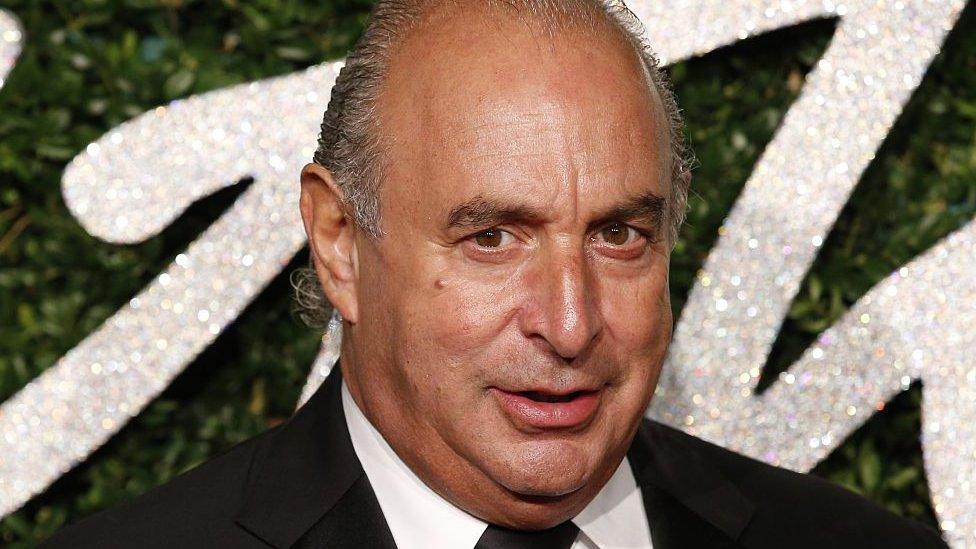

Mr Chappell's Retail Acquisitions vehicle bought BHS from Sir Philip Green for £1. The retailer's pension fund, which has 20,000 members, has a deficit of £571m and Sir Philip has agreed to answer questions from MPs next month about the failure of BHS.

The bankruptcy order was handed down in Slough county court on 3 June 1992, with a notice in The London Gazette - the UK's official public record - stating Mr Chappell's occupation as "car salesman".

It is not known why the order was brought.

The Sunday Times reported, external that Mr Chappell initially claimed the bankruptcy was "100%" untrue. When shown the notice from The London Gazette he responded: "It was annulled or dissolved, or whatever they do. It definitely didn't stand. I can't even remember about it, to be honest."

However, the Insolvency Service had no record of the bankruptcy being annulled, the paper reported.

Mr Chappell told the BBC that the 1992 bankruptcy had been annulled but he had not had sufficient time to obtain the relevant court documents after being contacted late on Friday afternoon by the Sunday Times.

He described media coverage of the BHS collapse as a "witch hunt".

Meanwhile, former City minister Lord Myners has told Sir Philip to "calm down" after the retail tycoon called for Frank Field, chairman of the Commons Work and Pensions Committee, to step down.

Mr Field had said that Sir Philip's knighthood should be removed if he did not repay £571m to BHS's pension fund.

The Work and Pensions and the Business committees are conducting a joint investigation into the collapse of BHS and Mr Field has recruited Lord Myners as an advisor.

Sir Philip Green sold BHS last year for £1

Lord Myners was chairman of Marks & Spencer in 2004 when Sir Philip made an unsuccessful bid to take over the retailer.

"My advice to Sir Philip is to calm down and understand that the select committee is an opportunity to explain. If he thinks he has been vilified, he can respond there on the record," he told the Sunday Telegraph, external.

The joint investigation begins on Monday with evidence from the Pension Protection Fund and the Pensions Regulator.

- Published6 May 2016

- Published6 May 2016

- Published6 May 2016