Revaluation delay 'made BHS miss out on £15m saving'

- Published

BHS could have saved more than £15m last year if there had not been a delay in the revaluation of business rates, according to new research.

It says business rates at 90% of BHS stores would have been cut, had the last revaluation gone ahead as planned.

Business rates are a tax based on property values, usually reviewed every five years.

Rates were revalued in England and Wales in 2010, but the government postponed the next review until 2017.

Colliers International, the commercial real estate agency and consultancy, said that with many of the valuations completed at the height of the property boom, many retailers have been paying higher rates than rents in parts of the UK.

Colliers believes BHS could have saved more than £15m per year - or £75m for the five-year business rates period - had the revaluation continued as planned.

Nail in the coffin?

John Webber, head of rating at Colliers International, said it was clear that business rates were a major factor in the stricken retailer's demise.

He said: "The government decision to delay the business rates revaluation in 2015 certainly had an impact on BHS. It's hard to know whether it was one of the final nails in the coffin, but clearly a £75m saving is a significant amount of money."

He added that regional rates had been kept unfairly high for too long. He said: "By delaying the revaluation, Middlesbrough has been forced to pay for Mayfair for far too long in terms of business rates."

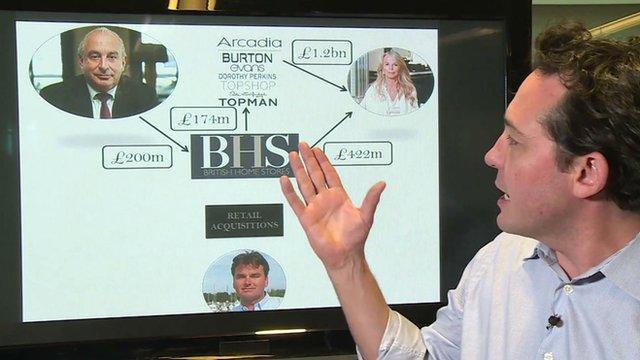

BHS collapsed into administration two weeks ago with debts of £1.3bn.

It was sold for £1 by Sir Philip Green, the owner of Arcadia, 13 months ago.

BHS effectively ran out of cash after its new owners failed to secure more than £100m of funding for a turnaround plan. It also had a huge pension deficit to service.

The administrator Duff & Phelps has set a deadline of 17:00 on Tuesday for interested parties to submit their offers. They are thought to include Sports Direct and Ikea.

- Published6 May 2016

- Published8 May 2016

- Published9 May 2016