UK house prices accelerated in March, as lending hit nine-year high

- Published

House price inflation across the UK jumped to 9% in March, as landlords rushed to beat stamp duty changes, official figures show.

The Office for National Statistics (ONS) said, external the figure was up from 7.6% in the year to February.

Separate figures showed the amount of money borrowed for home loans in March was the highest for nearly nine years.

The Council of Mortgage Lenders (CML) said, external £13.8bn was lent during the month, 59% more than in February.

The figure was the highest for any month since August 2007.

Landlords and buyers of second homes have had to pay an extra 3% in stamp duty since the start of April.

"While the increases are substantial, these supercharged levels of activity are likely to be temporary, and will fall back over the summer months," said Paul Smee, the director general of the CML.

Landlords borrowed £7.1bn in March, an 87% increase on February.

Wages

The ONS figures show that UK house prices have increased five times faster than wages since 2011, according to the Resolution Foundation, which campaigns to improve living standards.

Its analysis of the ONS data shows that house prices have increased by 36% over the past five years.

Average weekly earnings have gone up by just 7% over the same period, it said.

The think-tank said the growth gap between wages and house prices was even more pronounced in London and the South East.

But even in Scotland and the North, house prices have risen at twice the rate of wages.

However the ONS data shows that prices in Scotland fell by 6.1% in the year to March 2016.

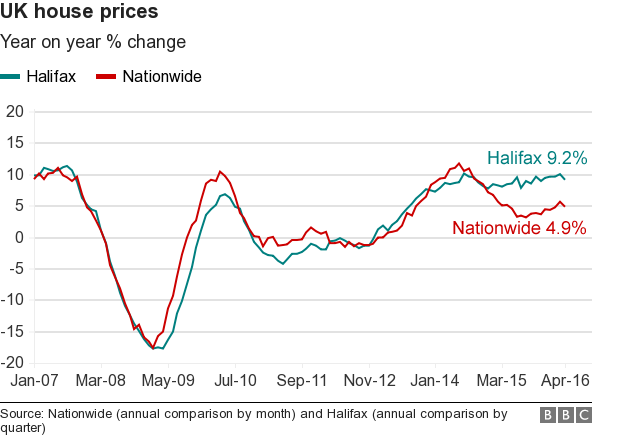

Recent surveys by both the Halifax and Nationwide have suggested that house price growth has already cooled since the stamp duty changes came into effect.

The ONS said house price growth in March was particularly driven by London, where the cost of a house or flat rose by 13% over the year.

In its last survey using the current methodology, the ONS said the average cost of a home in the UK reached £292,000 in March.

- Published13 May 2016

- Published9 May 2016