Brexit poses 'major risk' to global growth, warns Bank of Japan chief

- Published

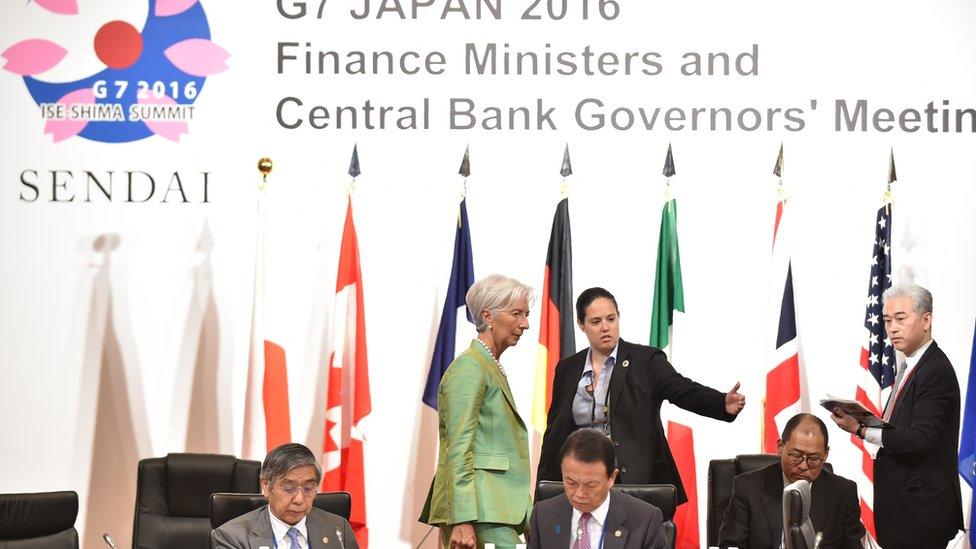

Bank of Japan governor Haruhiko Kuroda says a Brexit vote could be 'quite serious'

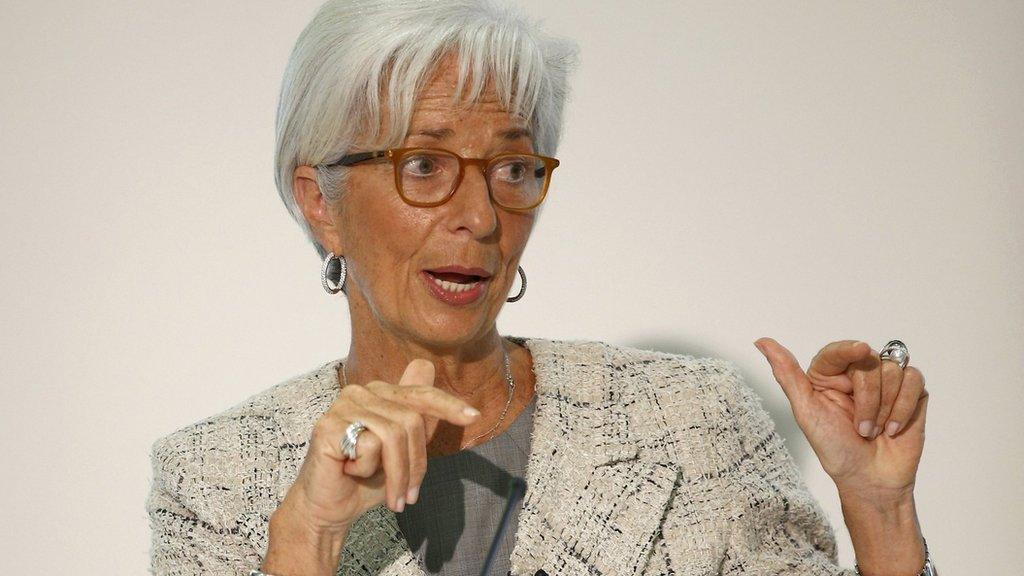

Haruhiko Kuroda, governor of the Bank of Japan, says the most serious risk facing the global economy was the possibility of the UK voting to leave the European Union.

In an interview ahead of the Group of Seven Leaders meeting in Japan this week, Mr Kuroda made the remarks when I asked him whether China, Brexit, or the US Federal Reserve raising interest rates was the biggest threat to global economic stability.

"It is for the British people to decide whether or not to exit from the European Union," he said, but added: "This could be potentially quite serious. If Brexit is agreed, it would have a significant and serious impact on the global economy."

Mr Kuroda also said Brexit would have an impact on Japan's economy as well as emerging economies.

In recent months, as the deadline for the UK to vote on whether to leave the EU gets closer, calls by the global community against a Brexit vote have become louder.

The United States, the International Monetary Fund and the World Bank have all raised concerns about the damage a vote in favour of Brexit could do to confidence and investor sentiment, which they say are already at delicate levels.

But those in favour of Brexit have said that these statements are alarmist, and are an attempt to influence the British public.

'Clear impact'

Meanwhile, Mr Kuroda defended his negative interest rate policy - so controversial when he first implemented it in January of this year - and said it will eventually have an effect on the real economy.

"I don't say it will take one year or two years, or something like that," he said. "It will have a clear impact on the economy soon."

Significantly Mr Kuroda said he is also willing to loosen monetary policy further - in other words, lower interest rates even further below zero - if he feels it is necessary and if inflation fails to the 2% target Japan has set.

He was criticised for introducing the policy in January. At the time, many felt Mr Kuroda had lowered interest rates to below zero was because he was trying to weaken the yen to help Japanese companies sell their goods overseas and increase profits at home. The Bank of Japan has consistently denied this.

Currencies were a hot topic at the G7 finance ministers meeting in Sendai this weekend. The US reiterated its view that countries should refrain from competitive currency devaluation.

The US has put Japan and China on a currency watch-list, but Mr Kuroda dismissed accusations that Japan is a currency manipulator. He told me that the yen has strengthened by 10% in recent months, although stopped short of saying that Japan will not intervene in the currency markets to weaken the currency, saying that was not a decision for the central bank to make.

Currencies will be on the agenda when leaders of the club of rich nations sit down for talks later this week. They will also discuss how to address the issue of stagnating global growth. Some countries, such as Japan, want to continue to use monetary policy to help stimulate economic growth. But Germany and the UK believe in austerity and fiscal discipline and have criticised the addiction to cheap money.

Mr Kuroda weighed in on the role of central banks in the fight to boost global growth. He said that there are still tools available to central banks, and that they have not yet run out of ammunition. "Monetary policy has been making positive impact in the economy. I don't think for Japan, or the ECB, at this stage that monetary policy has reached the limit. We still have enough room to further these monetary conditions."

Watch the full interview with Haruhiko Kuroda on BBC World's Talking Business on Friday 27 May.

- Published13 May 2016

- Published12 May 2016

- Published30 December 2020