Tata Steel: Government warned over pension cut plan

- Published

The government has been warned that a plan to cut pension benefits to help save Tata Steel's UK operations could take ministers down a "dangerous path".

Ex-pensions minister Steve Webb urged caution over "rushed changes" he said could have implications for workers "well beyond the steel industry".

A £485m pension deficit has been deterring potential buyers of Tata Steel's UK business.

A consultation, external on the pension scheme's future has been launched by ministers.

It includes a "full range of options that consider whether and how the scheme could be separated from the existing sponsoring employer and whether it will be necessary to reduce the benefits within the scheme," the Department for Work and Pensions said in a statement.

One option is to base the scheme's annual increase on the Consumer Prices Index (CPI) inflation measure, which is usually below the Retail Prices Index (RPI) measure currently used.

The plan has been supported by some union leaders and the British Steel Pension scheme.

'Pension security risk'

In 2011 private sector pension schemes were given more freedom to move to the CPI measure, if their rules allowed it.

Tata Steel is looking to sell its loss-making UK business. It has had seven expressions of interest and a shortlist is expected soon.

Former Lib Dem pensions minister Steve Webb said: "The government is going down a very dangerous path.

"Everyone has huge sympathy for steel workers and for efforts to protect jobs, but rushed changes to pension rules risk driving a coach and horses through the pension security of hundreds of thousands of workers well beyond the steel industry."

India's Tata is still considering bids for its UK steel business

There has been a suggestion that the new rules would stipulate that a company could only change their pension liabilities in an emergency. But, speaking to the BBC, Mr Webb said the term emergency was "ill-defined" and that companies could create them artificially in order to reduce their pension payouts.

"Once there's a loophole that says you can walk away from promises you've made. Other [companies] could walk away," he said, adding that he thought there could also be legal challenges.

'More generous'

However, the trustees of the British Steel Pension Scheme welcomed the move, saying it was better than the alternative, which would see the scheme fall into the Pension Protection Fund (PPF).

"Although this [government move] would entail future pension increases being cut back from their current levels, benefits would be more generous than those provided by the PPF for the vast majority of Scheme members," said Allan Johnston, chairman of the British Steel Pension Scheme.

But Mark Turner of the Unite union cautioned that he wanted to see the detail.

"We don't want to make changes if they're going to be detrimental to the rest of industry," he told the BBC.

In total the British Steel pension scheme has 130,000 members, one of the largest defined benefit schemes in the country.

Further details are expected when Business Secretary Sajid Javid makes a statement later in the House of Commons.

Analysis: Simon Jack, BBC business editor

The pension fund and its deficit have been a source of unease for the current owners Tata and a deal-breaker for any would-be buyers.

Reducing its burden will make a sale easier and may even convince Tata to hang on to its UK steel business.

Any such change would be very controversial as it would set what some would see as a dangerous precedent.

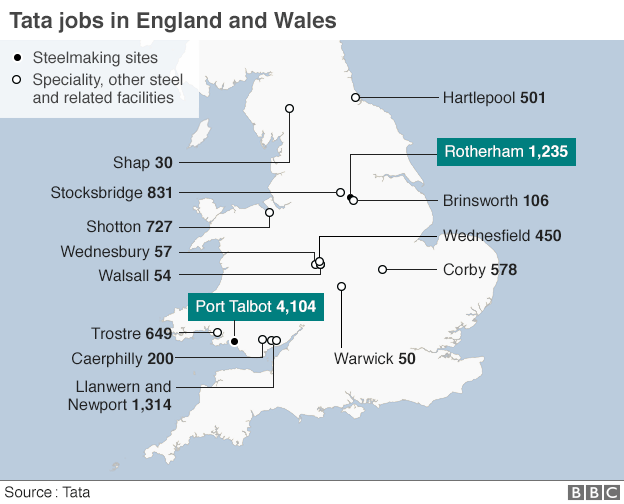

The move is evidence of the business secretary's sense of urgency to resolve an industrial crisis which has put 10,000 steel workers' jobs in imminent danger.

The BBC understands that union leaders have accepted that this proposal is a better deal than seeing the pension scheme shunted into the lifeboat of the Pensions Protection Fund, which can see some members lose 10% of their payout immediately and see lower increments in future years.

Who are the potential bidders?

Owen Smith, the shadow work and pensions secretary, said steel workers' pensions "must be protected".

"If these reports are accurate, the secretary of state for work and pensions should come to the House to explain precisely what is being proposed, including how current and future steel pensioners will be affected and what precedents might be set by any changes to hard-won pension protection legislation," he added.

- Published25 May 2016

- Published28 April 2016