How steel workers' pensions could be hit

- Published

The government wants to reduce pensions payable to 130,000 current and former steel workers, to make Tata's Port Talbot operations more attractive to a buyer.

Many of those worked in the industry in the days of Corus, or even British Steel.

There are several options on the table, but under the plan being backed by the trustees, the government has warned that all of those workers would face "a substantial loss" in their pensions.

However, it says the proposal under consideration is better than if the scheme collapsed, and had to be taken over by the pensions lifeboat, the Pension Protection Fund (PPF).

It has also made it clear this would be a one-off arrangement, and the changes would not be extended to other schemes.

So how much can workers expect to lose over their lifetime?

CPI v RPI

The trustees' preferred option involves making a special exception for the British Steel Pension Fund, by allowing it to index future payment up-ratings by the Consumer Prices Index (CPI), rather than the Retail Prices Index (RPI).

In the first instance that would affect deferred members - people no longer working for Tata but who are not yet claiming a pension - as well as those who have already retired.

But those still working would be hit the worst, as they would face lower increases for the longest period.

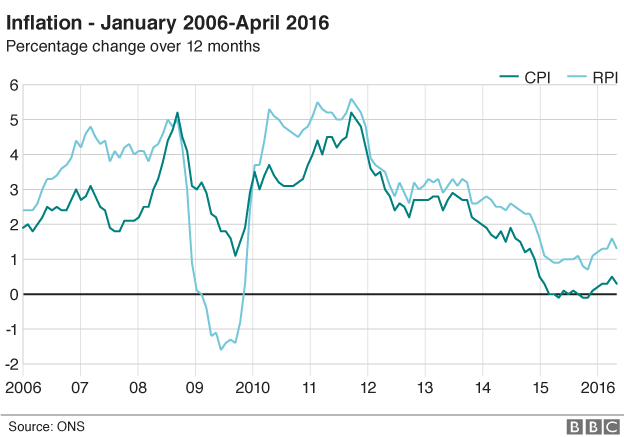

RPI is usually significantly higher than CPI, although as the chart below shows, that is not always the case.

Unlike CPI, RPI includes mortgage interest payments. As a result it fell below CPI in 2009 and 2010, when UK house prices collapsed, and interest rates were cut to a record low.

'17% reduction'

Nevertheless, economists expect RPI to outpace CPI over the next ten years by between 0.75% and 1% every year.

Indeed this month CPI was just 0.3%, while RPI was 1.3% - illustrating a typical gap between the two measures.

Nevertheless CPI is unlikely to remain so low in the longer term.

So, assuming it were to return to its 2% target, while RPI retains its 1% margin, how much less could steel workers expect from their pension?

Take a steel worker who retires today on a pension of £100 a week.

Under the existing pension scheme, he or she could expect that to grow to £181 a week after 20 years.

Under the new scheme, up-rated by CPI, he could only expect £148 a week.

That would amount to £32 less - or a reduction of 17% in his or her pension.

Pension Protection Fund

Nevertheless the government has insisted that steel workers would be better off under its new plan than they would be if the scheme was absorbed into the PPF.

The PPF already uses CPI anyway.

On top of that, it says that 50,000 current workers would be saved from the extra 10% reduction in their pensions that they could expect within the PPF.

70,000 workers who are mostly retired would see little difference.