Premier League finances enter new era, says Deloitte

- Published

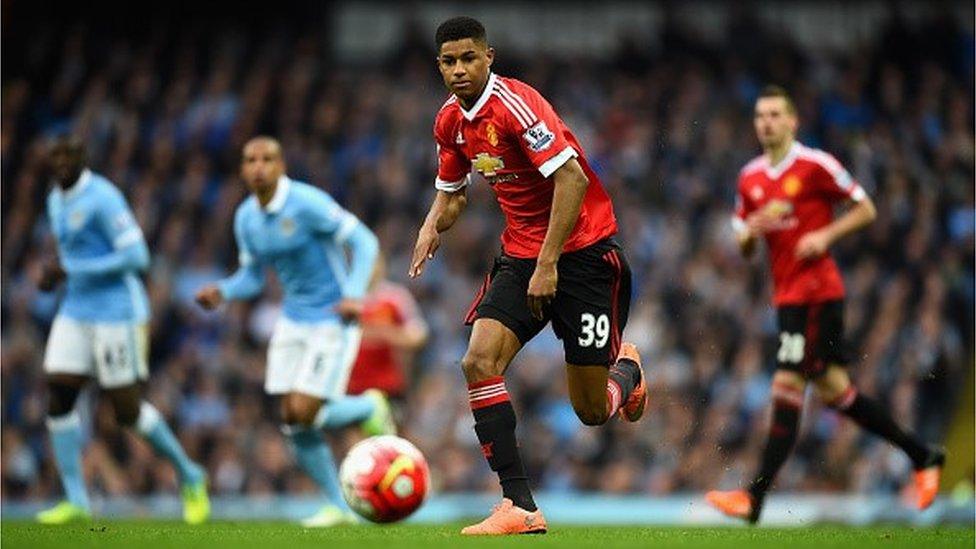

Premier League wage costs are rising, but not to unsustainable levels, Deloitte says

Increasingly large TV deals are helping English Premier League clubs to enter "a new era of sustained financial performance", according to Deloitte.

It says the current TV deals saw Premier League clubs generate £3.3bn record revenues in 2014-15, up by 3%.

Top flight clubs also recorded a second straight year of pre-tax profits in 2014-15, for the first time since 1999.

With more lucrative TV deals from 2016, Deloitte says clubs are "looking at at least three more years of big growth".

'Turned the corner'

Launching its 25th Annual Review of Football Finance, Dan Jones from the business consultancy's Sport Business Group said: "What we are seeing is a continuation of club profitability, it is certainly not a one-off.

English football's booming balance sheets

"We feel Premier League clubs have turned the corner, and are entering a new era of sustained profitability. Clubs are now attractive propositions to investors, and not merely as vanity projects."

He said increased profitability meant that top flight English clubs could compete with overseas teams in order to buy up the best players in the world, and still have money left in reserve.

From 2016-17 clubs will receive even more cash from broadcasters, with Sky and BT Sport paying a record £5.136bn (up from £3.018bn in 2013-16) for live Premier League TV rights for three seasons.

Broadcasting revenues are at the heart of Premier League clubs' profitability

"When the enhanced new broadcast deals commence in the 2016-17 season, operating profits could rise as high as £1bn," Mr Jones said.

He also said that it was encouraging to see that much of this new-found TV wealth was being spent by clubs not only on players, but also on improving stadia and infrastructure.

Wage costs

"The pace of football's financial growth in two and a half decades is staggering," said Mr Jones, referring to the foundation of the Premier League in 1992.

"By half-time of the second televised Premier League game next year, more broadcast revenue will have been generated than during the whole of the First Division season 25 years ago."

Football match day income accounts for about one-fifth of Premier League revenues

He added: "The impact of the Premier League's broadcast deal is clear to see. For the first time, the Premier League leads the football world in all three key revenue categories - commercial, match day and broadcast - and this is driving sustainable profitability.

Although the wages/revenue ratio has increased for the Premier League clubs, Mr Jones does not see this as cause for concern.

"Wage costs grew at a faster rate than revenues in 2014-15 and as a result the division's wages/revenue ratio rose from 58% to 61%," he said.

"However, this represents the second lowest level since 2004-05 and is 10 percentage points lower than in 2012-13.

"In fact, in the last two years, only 30% of revenue increases have been consumed by wage growth, whereas in the five years to 2012-13 this figure was 99%."

Premier League highlights 2014-15

Broadcast rights deals saw Premier League clubs enjoy the second-highest level of both operating profits (£546m) and pre-tax profits (£121m) in 2014-15

A total of 17 Premier League clubs recorded an operating profit; 14 recorded a pre-tax profit

Clubs' wage costs increased by 7% to exceed £2bn for the first time

Clubs' revenues were more than €2bn (£1.5bn) higher than the next highest earning league, Germany's Bundesliga

Premier League matchday revenues now account for about one-fifth of club revenues

Clubs' combined gross spending to acquire players was a record-high of £1.1bn

Clubs' net debt remained at £2.4bn with interest-free soft loans, usually from owners, accounting for 75% of the total

European leagues

The 92 clubs in the English Premier League and Football League generated more than £4bn in revenues for the first time in 2014-15, a new record.

Clubs are giving more money in tax to the UK government than before

Meanwhile, the UK government's tax take from the top 92 professional football clubs in 2014-15 was roughly £1.5bn, up from £1.4bn the previous season.

Deloitte's review of football finance also found that combined revenue for the "big five" European leagues (England, Germany, Spain, Italy, and France) rose 6% to a record €12bn (£9.2bn) in 2014-15.

While the Premier League, Bundesliga and Spain's La Liga were profitable, Italy's Serie A and France's Ligue 1 generated combined operating losses.

'Unsustainable'

In England's second tier, the Championship, combined revenues grew 12% to £548m in 2014-15, exceeding £500m for the first time.

"Wage costs rose by 4% to £541m which, despite a reduction in the wages/revenue ratio from 106% in 2013-14 to 99%, means clubs spent almost as much on wages as they generated in revenue," said Deloitte.

Celtic failed to qualify for the group stages of the Champions League in 2014-15 season

"This remains an unsustainable level of spending without the support of owner funding. This resulted in operating losses of £225m and a combined pre-tax loss of £191m."

In Scotland, Celtic's failure to qualify for the group stages of the Champions League contributed to a fall in Premiership clubs' aggregate revenues of 9%, or some £13m.

However, the Glasgow club still accounted for 50% of all revenues in the division, as they lifted the title for a fourth successive year.

Deloitte said a new deal to market the international (non EEA - European Economic Area) TV rights meant Scottish football was now being shown in more than 100 countries.