Con-artists widen impersonation act to target fraud victims

- Published

Fraudsters are mimicking a wider range of organisations - rather than only banks - in a bid to steal personal details via scam emails.

The number of fake banking websites detected by an anti-fraud group has fallen to its lowest level since 2006.

Financial Fraud Action (FFA) said that 16,462 fake bank websites were detected last year, compared with a peak of 256,641 in 2012.

It warned that fraudsters were claiming to be the taxman or retailers instead.

Tricks

Millions of spam emails are sent each year, aiming to convince people to click on a link that will send them to a fake website.

FFA said these emails usually claimed the recipient needed to "update" or "verify" a password, and then urged the victims to click on a link from the email which directed them to the bogus bank website.

Information entered on the bogus website or form was then captured by the criminals for their own fraudulent purposes, it said.

The number of cases rose steadily before a huge spike in 2012.

Katy Worobec, director of Financial Fraud Action UK, said: "Banks have worked hard to tackle the problem of phishing emails. However, intelligence suggests that fraudsters are still using phishing emails to steal people's personal and financial details by claiming to be other organisations such as government departments, utility companies, technology companies or major retailers.

"It remains vital to be wary of any unsolicited emails asking for your information."

Advice

FFA suggested that users should be wary of unsolicited emails that are not addressed to a full name, but instead have a vague greeting such as "Dear customer", emails that request personal information such as username, password or bank details, or messages that have addresses which do not match the actual website of the organisation.

Users should never visit a website from a link in an email and then enter personal details, it added.

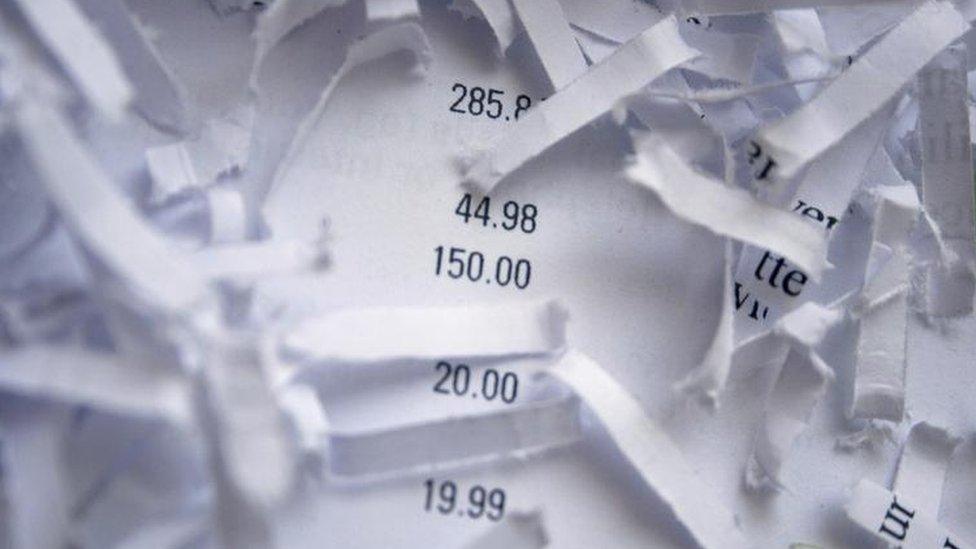

Fraudsters have found increasingly sophisticated ways of conning people with bank transfers or identity theft.

In April, BBC News revealed how more than 5,000 people were conned into sending payments they expected to make for genuine invoices into criminals' accounts, leaving the genuine recipient unpaid.

The number of cases of the scam - also known as "mandate" or "invoice" fraud - is up 71% on the previous year.