BHS collapse 'fuels public distrust of business'

- Published

A business leader has accused the former owners of BHS of "lamentable failures", saying its collapse has fuelled public distrust of UK plc.

Simon Walker, head of the Institute of Directors (IoD), told the BBC that Sir Philip Green had a moral responsibility to the retailer's staff.

The IoD normally promotes the cause of business, but Mr Walker said there were still many unanswered questions.

Sir Philip is due to give his side of the story to MPs later this month.

It was announced on Thursday that the department store will be wound down with the loss of up to 11,000 jobs after efforts to find a buyer failed.

BHS, sold by Sir Philip last year for £1 to former racing driver Dominic Chappell, went into administration in April.

'Lamentable failure'

Mr Walker told the BBC's Today programme that the collapse of BHS "has the potential to be deeply damaging to the reputation of British business".

He said: "We spend a lot of time agonising about the loss of trust in the business community, and I think we can see why this is. I think there is a lamentable failure of behaviour and there are a lot of questions that need to be asked."

Asked if he could defend Sir Philip's handling of the company, Mr Walker replied: "No, I can't."

Sir Philip, he said, has "moral responsibilities" over the demise of the firm and plight of the pension scheme.

The billionaire owner of the Arcadia retail empire has been accused of taking money out of BHS while the pension fund sank deep into deficit.

The BBC's Keith Doyle reports: "Great sadness and shock for the staff"

Mr Walker said: "You can't just get yourself off the hook by selling a business to someone who's been bankrupt three times and is a former racing driver with no retail experience."

He acknowledged that "BHS was probably going to fail anyway", but added: "It's the manner of its failure and the fact that it ends up dumping huge liabilities on to the taxpayer that is a problem, and it is the lack of due diligence in selling it (to Mr Chappell)... something's wrong".

Two Commons select committees are holding hearings into the demise of BHS, and Sir Philip, Mr Chappell and other directors are due to give evidence later this month.

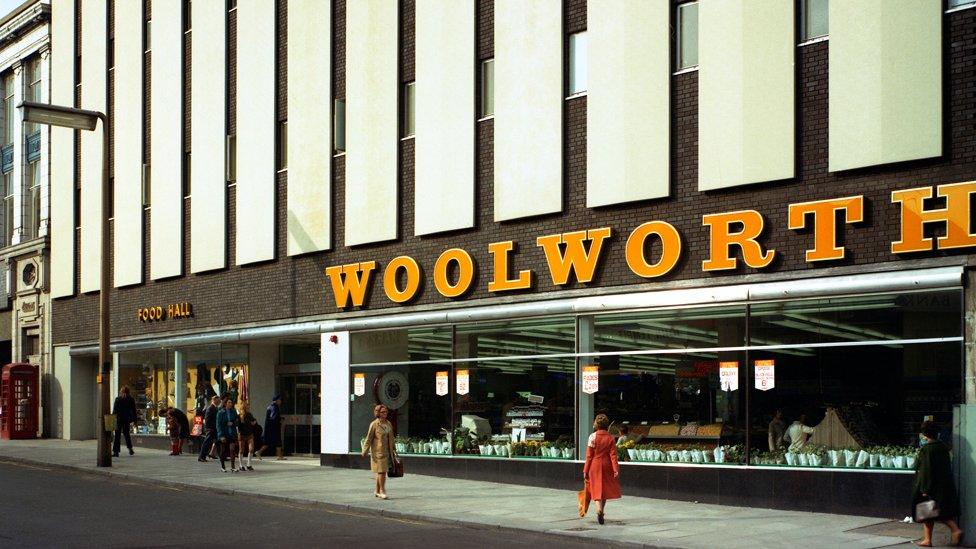

Sir Philip said on Thursday that he was "saddened and disappointed" by the biggest retail collapse since Woolworths in 2008.

A spokesman said the owner of the Topshop chain had hoped to see the company sold as a going concern.

Arcadia advisers have previously said that the business was sold to a company, not an individual, and that they were presented with a credible business plan.

'Seismic shifts'

BHS's administrators Duff & Phelps said on Thursday that they had failed to find a buyer and that all 163 stores would be holding closing sales over the coming weeks.

The jobs of 8,000 members of staff are likely to go, while a further 3,000 jobs of non-BHS employees who work in the stores may also be at risk.

John Hannett, of the retail union Usdaw, said there were "serious questions about how we got to this position".

He told the BBC: "There are serious questions about the pension deficit, serious questions about why they [Duff & Phelps] were not able to find a successful business owner when we know a number [of potential buyers] expressed an interest. So we need to unravel how we got to this situation."

Duff & Phelps blamed "seismic shifts" in the retail sector for the collapse of the chain.

Analysis: Ed Curwen, BBC Analysis & Research

When BHS ran out of money it was taken over by administrators. Their job is to get the best possible outcome for the creditors - anyone it owes money too.

This covers everything from the big banks that loaned money, to suppliers, employees, shareholders and the taxman. Where they all rank is established by law.

At the front of the queue are the secured creditors: Arcadia Group, Sir Philip Green's retail empire, is owed about £35m. Barclays bank and two investment firms are owed around £89m.

They will all get paid off before the unsecured creditors. That includes the taxman, who was owed about £6m in unpaid VAT and taxes, suppliers to BHS, owed about £40m between them as of late February, and any redundancy payments owed to BHS employees.

Unsecured creditors will share in a dividend of many millions of pounds, it is understood. Even so, that sum will still be spread fairly thinly.

Hilco Retail Services has been appointed to assist in the process of winding down the BHS store network.

Hopes of rescuing the store chain had rested on a late offer from a company led by retailer Greg Tufnell and reportedly backed by Portuguese money.

Other bidders who failed to convince the administrators included a consortium led by Matalan founder John Hargreaves, as well as separate offers from Sports Direct's Mike Ashley and Poundstretcher boss Aziz Tayub.

- Published3 June 2016

- Published2 June 2016

- Published2 June 2016

- Published2 June 2016

- Published2 June 2016

- Published1 May 2016