Sterling falls after polls suggest growing Brexit support

- Published

Some analysts expect a sharp fall in the value of sterling in the event of a vote to leave the EU

The pound has weakened after new polls suggested an increased chance of a vote in the referendum to leave the European Union.

Sterling did subsequently recover some of the losses.

But there is certainly a view that the currency would decline if Britain were to decide to leave.

Some analysts expect the fall in the value of sterling in the event of a Brexit vote would be very sharp .

Economic performance

The concern reflects the view held by many - though by no means all - economists that leaving the EU would undermine the UK's economic performance.

There would be a period of uncertainty about access to the EU market for British exporters while new arrangements were negotiated. The ultimate result could be that it would be harder to sell to the EU market. It is argued that foreign investment could be hit by the uncertainty.

This would be going on at a time when the UK has a large deficit in what is called "the current account deficit" - which is trade in goods and services plus some international financial transactions.

The deficit has to be financed by loans and foreign investment in financial assets. Unease about the economic outlook could mean that foreign investors would only provide the finance for the deficit if sterling were cheaper.

There is of course another view, reflected by Economists for Brexit, external that the UK would prosper outside the EU.

For the short term, however, it is more likely to be the majority view that moves markets and sterling in particular.

Simon Jack explains how the pound and the EU referendum are connected

Our reporting on the currency markets usually focuses on what's called the spot rates, the exchange rate that an investor pays to buy currency immediately.

Currency options

But they can also buy options, which are rights to buy or sell a currency (or other types of financial asset) in the future at a price fixed in advance. It's a way of getting insurance against a move in the exchange rate. If the move you are worried about doesn't happen you don't exercise the option. So you are insured, but you have had to pay for it.

That part of the market suggests that investors do think a leave vote would weaken sterling. That was the message that the Bank of England governor Mark Carney gave to a parliamentary committee, external back in March, in rather technical language:

"We have seen a marked increase in implied volatility in the options market around the date of the referendum, once the date became known, and the skews in the option market, in other words the purchase of downside protection if the pound was going to depreciate, had gone up quite sharply."

In other words, more investors were buying insurance for the time of the referendum against a fall in the pound than a rise.

The Bank also says, external that about half the decline in sterling since November is due to news related to the referendum.

Here's another sign.

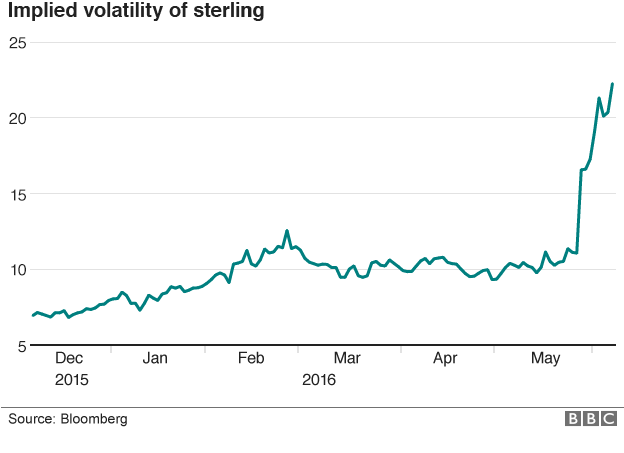

The financial news service Bloomberg calculates what it calls "implied volatility" from the options market. It shows a marked increase for the pound against the dollar as the referendum approaches.

Other influences

John Redwood, the Conservative MP and Brexit supporter, looks at the sterling issue rather differently. He wrote in his blog, external: "The pound fell from over $2 in 2008 to $1.4 in 2009 when we were firmly committed to the EU, so we know other influences can generate large sterling movements."

And it must be said that Mark Carney fully recognises other factors have influenced sterling in recent months.

On the current account issue, Mr Redwood argues that the immediate impact would be beneficial:, external

"The first round effect is to improve the balance of payments by [one] fifth as we cancel the payments we have to make to the rest of the EU which we do not get back."

Pro-Brexit Conservative MP John Redwood argues that "other influences" can generate large sterling movements

The leading Brexit campaigner Boris Johnson also rejects the concerns about the impact on the pound from a leave vote: "The pound will go where it will over the short term. But, believe me, in the long term you can look forward to fantastic success for this country… I think the pound's value will depend entirely on the strength of the UK economy."

It's also worth pointing out that a weaker pound now could be helpful to the British economy. It improves the competitiveness of British industry. It makes imported goods more expensive boosting inflation.

Normally that would be unwelcome, but not at a time when inflation is well below the Bank of England's target.

- Published6 June 2016

- Published12 May 2016

- Published28 April 2016

- Published17 April 2016