Will sterling sink if the UK votes for Brexit?

- Published

Simon Jack explains how the pound and the EU referendum are connected

The pound hit a three-week low on Monday before recovering slightly, after polls found growing support for a vote to leave the EU.

But what would happen to the value of sterling in the event of a vote for Brexit on 23 June?

According to Paul Hollingsworth, UK economist at Capital Economics, a vote to leave the EU could cause the value of sterling to fall between 10% and 20%.

The severity of the fall would be determined by what the opinion polls say over the next few weeks, he argued.

"If we see more of a shift towards Leave then clearly we could see some of that depreciation come before the vote [rather] than after it," Mr Hollingsworth said.

"However, if polls lean towards Remain and we still vote to leave, then there would be more of a shock factor, and that could hit the pound hard."

Meanwhile, Mike Amey, a managing director at Pimco, the world's largest bond fund, said the fall would be more like 5% to 10%.

What about in the following weeks and months?

Any recovery of sterling would depend on various factors. On the upside we could see the political rhetoric around Brexit change following the vote, and this might have a positive impact.

"I can't imagine the prime minister would say, 'This result is all doom and gloom,'" Mr Hollingsworth says.

A leadership contest following a vote for Brexit could cause market uncertainty, say economists

That said, some have speculated David Cameron might have to resign in the wake of a Brexit vote. This would result in a Tory leadership contest and more political uncertainty, which could affect sterling.

It was not clear how long the process of leaving the EU would take.

"The negotiations could take two years or much longer, so it could potentially weigh on the economy for a number of years," says Mr Hollingsworth.

"However, it may not be as bad as some have said, because during the negotiations we would still have free trade and the free movement of people… We wouldn't wake up on the 24th and find ourselves outside the EU."

How is the Bank of England preparing for the vote?

The Bank of England cannot comment on the impact of a potential Brexit as it is now in "purdah" - the period leading up to a vote during which government departments and public bodies refrain from making new announcements.

However, the Bank has said it would inject money into the banking system to compensate for shortages following the referendum.

In terms of monetary policy following a potential Brexit vote, inflation and a weakening economy could be big challenges for the central bank.

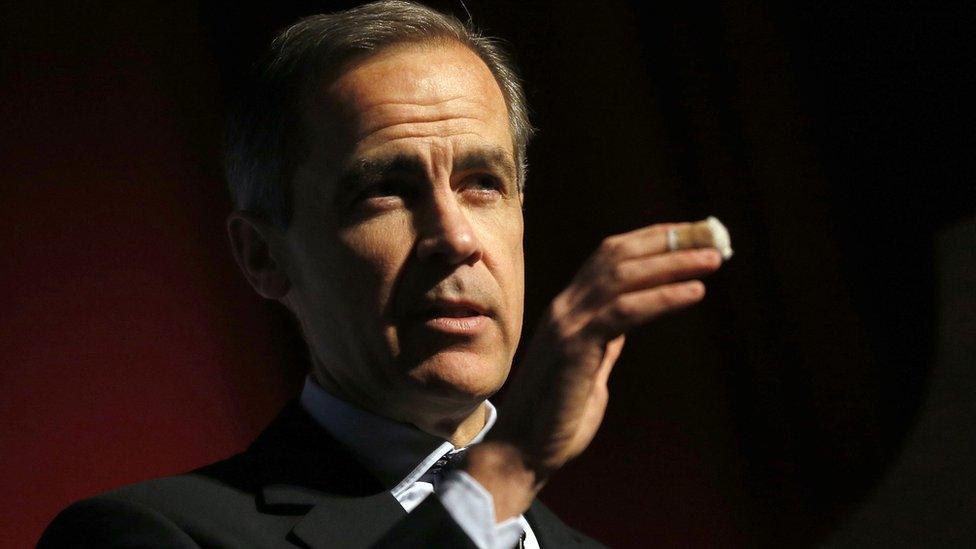

The Bank of England's Mark Carney has promised to protect the banking system following the vote

In response, some say it could keep interest rates on hold or cut them closer to zero.

But Pimco's Mr Amey believes the Bank would not go as far as introducing a negative rate, as we have seen in some countries.

"If they felt they needed to support economic growth more forcefully then they would re-engage in quantitative easing," he says.

How is the City preparing?

With bated breath, it appears.

Brokerage ETX Capital, for example, plans to keep traders overnight to monitor the markets and handle trades.

"The result is going to be announced at an awkward time, in the middle of the night," said Joe Rundell, head of trading at ETX. "And we expect that whatever the result there will be significant movements on the FTSE 100, the sterling markets and in gold."

Some traders could face a busy night shift

If the country votes to leave it could be the firm's busiest night of the year, he added.

"We are making contingency plans for a 40% move on the sterling market if there is a Brexit. It's not likely, but these sorts of things can happen."

JPMorgan Chase, RBS and Morgan Stanley are among other banks planning to have traders at their desks overnight as well, according to a Bloomberg report.

What about UK government bonds?

Some have argued that increased economic uncertainty following a vote to leave would trigger a sell-off in UK government bonds, or gilts.

But Mr Amey argues that gilts would rally, "largely because the market would expect an interest rate cut by the Bank of England and the UK financial markets would need a risk-free security to turn to.

"So if there was some volatility in other assets the gilt market would be sensitive to that and perform strongly."

- Published6 June 2016