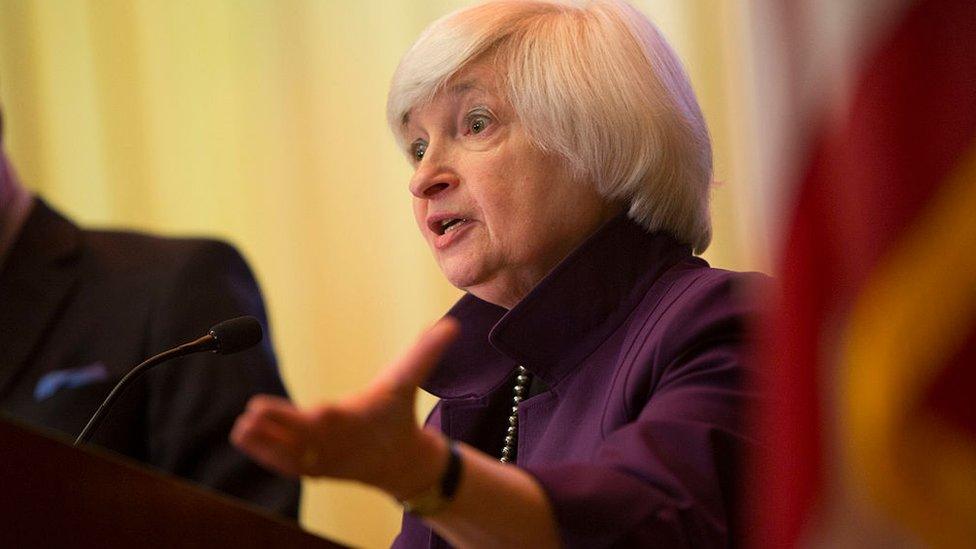

Janet Yellen warns of Brexit hit to US economy

- Published

Federal Reserve chair Janet Yellen said a UK vote to leave the European Union could have "significant economic repercussions".

In a speech on Monday, she said a Brexit was one factor that the central bank would consider when deciding whether to raise interest rates.

The Fed next meets on 14-15 June.

Ms Yellen said "positive economic forces have outweighed the negative" - her strongest indication yet that the Fed will raise rates this summer.

"If incoming data are consistent with labour market conditions strengthening and inflation making progress toward our 2% objective, as I expect, further gradual increases in the federal funds rate are likely to be appropriate," she said.

The Fed raised interest rates by 0.25 percentage points for the first time in nine years last December and has left them unchanged since.

It had been widely expected to raise interest rates over the summer, but poor job creation figures for May diminished those expectations.

The US labour market added just 38,000 jobs last month - the fewest since September 2010.

Ms Yellen said the May job data was disappointing, but that it was outweighed by mostly positive trends.

"I see good reasons to expect that the positive forces supporting employment growth and higher inflation will continue to outweigh the negative ones. As a result, I expect the economic expansion to continue, with the labour market improving further and GDP growing moderately," she said.

Brexit effects

If the Fed does not increase interest rates at its upcoming meeting, its next opportunity will come in July. That meeting will be held after the EU referendum on 23 June - giving the Fed an opportunity to assess the vote's impact on global markets.

Some economists have warned that a Brexit could adversely impact the US economy.

In her speech the Fed chair said: "A UK vote to exit the European Union could have significant economic repercussions."

She stressed that investors' "appetite for risk" could change quickly and that a UK exit from the EU would be likely to affect market sentiment.

Ms Yellen's remarks echo comments from other economists about the impact of a Brexit on the US economy.

On Friday Lael Brainard, a member of the Fed's board of governors, suggested that a Brexit could have a "significant adverse reaction" to the US market.

"Because international financial markets are tightly linked, an adverse reaction in European financial markets could affect US financial markets, and, through them, real activity in the United States," Ms Brainard said.

Change of direction

In a speech on 27 May, Ms Yellen said she expected a rate rise to be appropriate "in the coming months".

But the Fed chair has also previously called on the Fed's rate-setting Open Market Committee to "proceed cautiously" with any rate rise given the impact it could have on both the US and global markets.

A slew of economic data released in May appeared to signal that the US economy was growing strong enough to handle a rate rise. Consumer spending, core inflation and housing prices all had reported increases.

- Published3 June 2016

- Published27 May 2016

- Published10 May 2016