MSCI rejects China again from its emerging market index

- Published

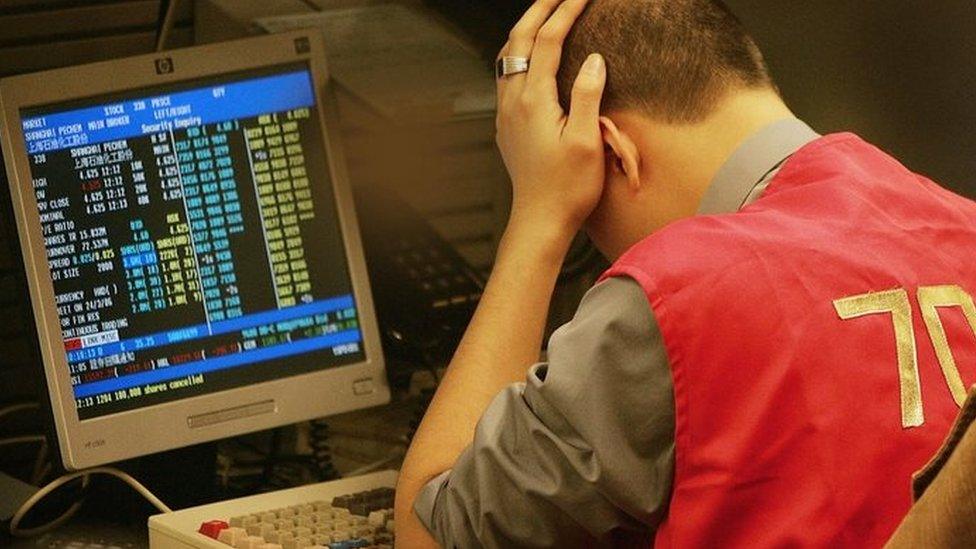

US stock index provider, MSCI, has again delayed the inclusion of China's mainland domestic shares in its emerging markets index.

Inclusion on the index would have been a major step forward for Beijing as it attempts to open up its financial markets and attract foreign capital.

Regulation worries and accessibility for global investors were some of the reasons behind MSCI's decision. , external

MSCI is world's biggest stock index provider.

China has in recent months increased its efforts to reform its often volatile stock market, but MSCI said global investors were looking for more.

"International institutional investors clearly indicated that they would like to see further improvements in the accessibility of the China A shares market before its inclusion in the MSCI Emerging Markets Index," Remy Briand, global head of research at MSCI, said.

'A long term story'

Beijing has in recent months introduced significant improvements in the accessibility of the China A shares market for global investors, MSCI said on Tuesday

The index provider said on Tuesday that China's authorities had demonstrated "a clear commitment", external in bringing accessibility of their A shares market closer to international standards.

It also said it was looking forward to the "continuation of policy momentum in addressing the remaining accessibility issues."

However, analysts said they were not particularly surprised by MSCI's decision.

"It really was fifty-fifty regarding the inclusion," Catherine Yeung from Fidelity Investment told the BBC.

"What's important to note is that while we have seen some significant improvements in terms of how foreign investors access domestic Chinese stocks, [but regarding] the criteria that was set last year, a lot of it still needs to be fulfilled," she said.

Ms Yeung said what was very interesting was that MSCI said the inclusion of A shares could occur within the next year "outside of the normal review period which falls every June".

"So if we see further developments in terms of regulation, in terms of how we access the market as investors from a foreigner perspective, then indeed we could see inclusion," she said.

"But don't forget, it's likely to be a partial inclusion, let's say 5%, and inclusions do take years to actually be implemented.

"So this is very much a long-term story."

- Published14 June 2016

- Published15 June 2016

- Published10 June 2015